Proactive Investors - UK house prices have dropped again on an annual basis, and rising mortgage rates could put more pressure on the market in the months to come, according to latest figures.

Nationwide reported that the average price of houses sold in May were 3.4% lower than a year ago, down from the 2.7% fall recorded in April.

In May, prices slipped by 0.1% on a seasonally-adjusted basis, partly reversing April’s surprise 0.4% rise.

The average price was £260,736 in May, Nationwide said, which sees the market coming under pressure in the months ahead.

“Headwinds to the housing market look set to strengthen in the near term,” said Robert Gardner, Nationwide's Chief Economist.

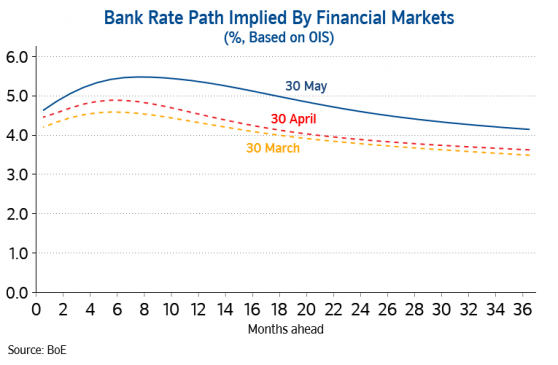

"Investors’ expectations for the future path of Bank Rate increased noticeably in late May, suggesting it could peak at c5.5%, well above the c4.5% peak that was priced in around late March,” he pointed out, adding rates are also projected to "remain higher for longer.”

“Nevertheless, in our view a relatively soft landing remains the most likely outcome since labour market conditions remain solid and household balance sheets appear in relatively good shape," he continued.

Martin Beck, Chief Economic Advisor to the EY ITEM Club, feels: “The main headwind facing the housing market - rising mortgage rates - is set to build.”

He noted around 2.5mln more owner-occupiers will be exposed to higher mortgage rates during 2023 as fixed-rate deals are renegotiated.

“The EY ITEM Club thinks it is very likely the Bank of England will raise interest rates again this month, and possibly again later in the summer.”

But he thinks although house prices are likely to continue drifting down, a major correction will be avoided.