By Jonathan and Cable

LONDON, Dec 14 (Reuters) - - Euro zone business ended the year on a weak note, expanding at the slowest pace in over four years as new order growth all but dried up, hurt by trade tensions and violent protests in France, a survey showed on Friday.

The downbeat figures come a day after the European Central Bank decided to end its lavish asset-buying scheme but otherwise kept policy broadly unchanged, promising protracted stimulus for an economy struggling with an unexpected slowdown and political turmoil.

IHS Markit's Flash Composite Purchasing Managers' Index slumped to 51.3, its weakest since November 2014, from a final November reading of 52.7, well below even the most pessimistic forecast in a Reuters poll where the median expectation was for a modest rise to 52.8.

"It's a relatively gloomy picture to end the year on. It's clear the underlying rate of growth has slowed further, and it is broad-based across manufacturing and services," said Chris Williamson, chief business economist at IHS Markit.

Williamson said the PMI indicated the bloc's economy would expand 0.2-0.3 percent this quarter - and probably towards the lower end - slower than the 0.4 percent predicted in a Reuters poll this week. [ECB/INT]

Suggesting there won't be much of a pick up when 2019 begins, an index measuring new business fell to a four-year low of 50.7 from November's 52.3, skating closer to the 50 level that separates growth from contraction.

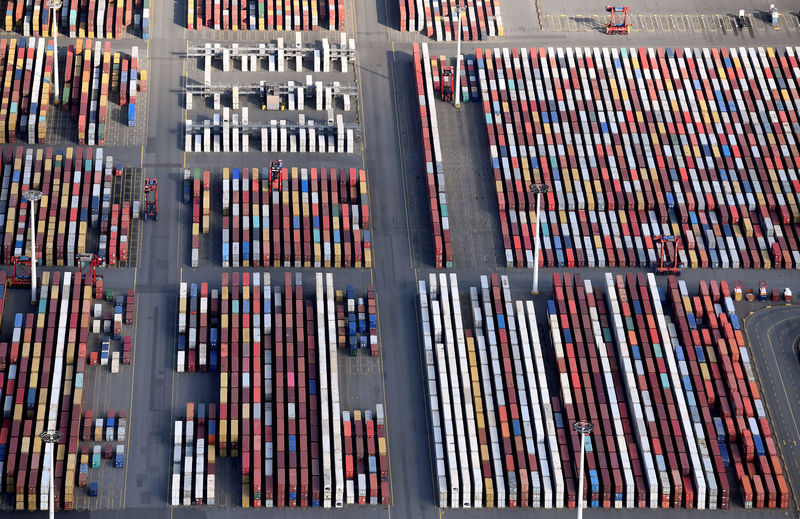

New export business, which includes trade between member countries, contracted for a third month.

A PMI for the bloc's dominant service industry sank to 51.4 from November's 53.4, well below even the lowest forecast in a Reuters poll for 53.5.

Slowing growth came despite service firms increasing their prices at the weakest rate in seven months. The output price index fell to 52.4 from 52.8.

Manufacturing growth also unexpectedly slowed. The factory PMI fell to 51.4 from 51.8 in November, missing the 51.9 predicted in a Reuters poll and its lowest reading since February 2016.

An index measuring output, which feeds into the composite PMI, nudged up to 51.0 from 50.7. The November reading was the lowest since mid-2013.

But with orders falling and backlogs of work being run down, optimism waned among factory managers. The future output index dropped to a six-year low of 56.0 from 56.3.

"There isn't much to pin hopes of faster growth on," Williamson said.