WATERVILLE, ME (Reuters) - The Federal Reserve would not want to raise interest rates if U.S. inflation showed no sign of rising, though it would take a grimmer economic picture to prompt the central bank to cut rates, a top Fed official said on Tuesday.

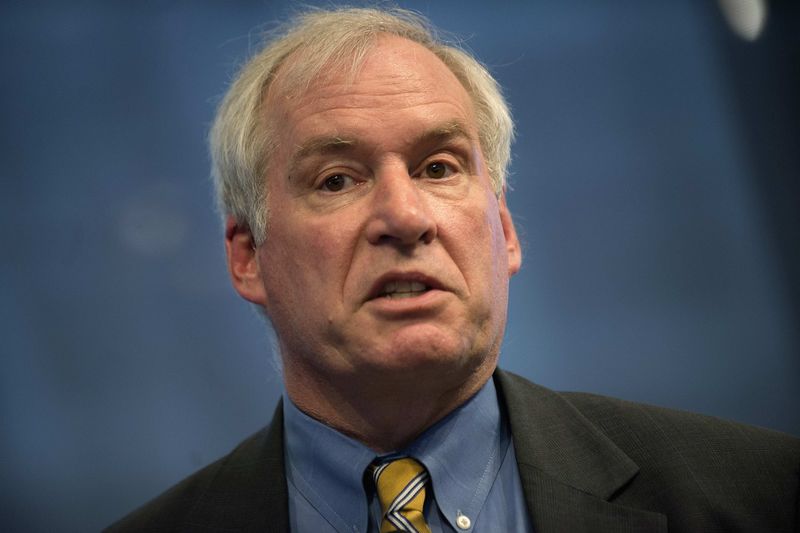

"If we see no progress on inflation at all, there would be no rush to be raising rates," Boston Fed President Eric Rosengren told students at Colby College.

"In order to ease further we'd have to see that we're not getting the forecasts of 2 percent growth at all," he said. "We'd probably have to see a situation where we'd be concerned that the unemployment rate would be rising rather than falling ... and a significant weakening in labour markets."