By Jason Hovet and Jan Lopatka

PRAGUE (Reuters) - Czech and Chinese companies signed deals on Wednesday including the acquisition of a Czech-Slovak financial group and the creation of a 5 billion euro investment fund, capping a state visit by Chinese President Xi Jinping.

The Czech presidential office said investments in both directions could total 10.9 billion euros (8.6 billion pounds) by 2020, mostly via vehicles seeking to invest in the Czech economy.

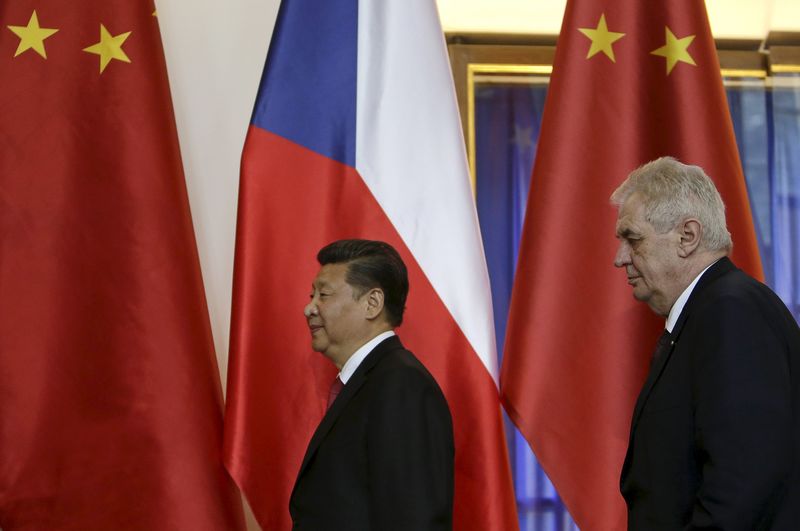

Czech President Milos Zeman has pushed since his election in 2013 for closer ties with China and Russia rather than with European Union and NATO allies.

Deals included an acquisition by the closely-held CEFC China Energy of an additional 40 percent in Czech-Slovak J&T Finance Group SE (JTFG), raising its stake in the mid-sized player on the two banking markets to 50 percent, JTFG said.

JTFG and China's Pang An Bank <000001.SZ> also plan a 5 billion euro fund to invest in unspecified financial, energy and industrial assets.

Zeman and Xi signed a strategic partnership agreement on Tuesday. China has such deals with about 15 European countries.

CEZ, the majority state-owned Czech electricity company, signed a deal in which its subsidiary Skoda Praha and China's Pinggao <600312.SS> will develop energy projects in Europe and Asia. Total investment could be in the tens of billions of crowns, CEZ said.

So far, Chinese investments in the Czech Republic have lagged those in other European markets and consisted mainly of acquisitions last year by CEFC, whose ownership details have not been made public. CEFC chairman Ye Jianming has been given the post of an adviser to Zeman.

With CEFC raising its stake in JTFG, now majority-owned by two Slovak businessmen, CEFC will get access to the Czech banking market as well as Russia, Croatia and Slovakia, a euro zone country where JTFG owns bank Postova Banka.

JTFG said CEFC will pay 980 million euros for the 50 percent stake, subject to regulatory approval by institutions including the Czech National Bank and the European Central Bank.

JTFG also signed a framework deal with privately-held China Development Bank to set up an 800 million fund. CEFC and Hengfeng Bank Company bought Czech metallurgic firm ZDAS and agreed to set up a 1.1 billion euro fund for other industrial investments.

The biggest Czech exporter, Skoda Auto, and its parent group Volkswagen (DE:VOWG_p) agreed a five-year plan worth 2 billion euros with China's SAIC Motor Corporation to expand Skoda's model range in China.

Czech aircraft maker Aircraft Industries signed a 111 million euro deal for the sale of 20 planes.