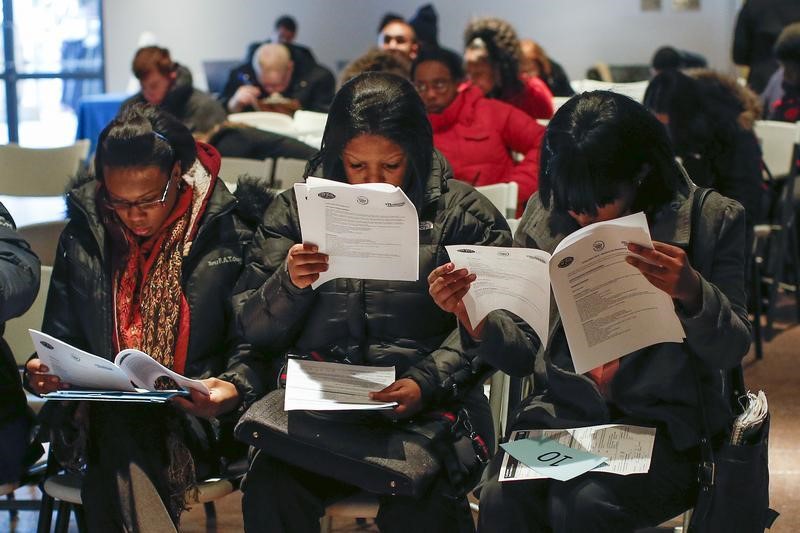

Investing.com - The number of people who filed for unemployment assistance in the U.S. rose more than expected last week, but remained in territory usually associated with a firming labor market, official data showed on Thursday.

In a report, the U.S. Department of Labor said the number of individuals filing for initial jobless benefits in the week ending December 4 increased by 13,000 to a seasonally adjusted 282,000 from the previous week’s total of 269,000. Analysts expected jobless claims to hold steady at 269,000 last week.

First-time jobless claims have held below the 300,000-level for 39 consecutive weeks, which is usually associated with a firming labor market.

Continuing jobless claims in the week ended November 28 inched up to 2.243 million from 2.161 million in the preceding week. Analysts had expected continuing claims to dip to 2.152 million.

The four-week moving average was 270,750, an increase of 1,500 from the previous week's 269,250. The monthly average is seen as a more accurate gauge of labor trends because it reduces volatility in the week-to-week data.

EUR/USD was trading at 1.0948 from around 1.0949 ahead of the release of the data, GBP/USD was at 1.5137 from 1.5139 earlier, while USD/JPY was at 121.45 from 121.44 earlier.

The US dollar index, which tracks the greenback against a basket of six major rivals, was at 97.81, compared to 97.80 ahead of the report.

Meanwhile, U.S. stock futures pointed to a higher open. The Dow futures pointed to a gain of 28 points, or 0.16%, the S&P 500 futures indicated a rise 6 points, or 0.28%, while the Nasdaq 100 futures increased 14 points, or 0.29%.

Elsewhere, in the commodities market, gold futures traded at $1,072.10 a troy ounce, compared to $1,071.50 ahead of the data, while crude oil traded at $36.83 a barrel from $36.73 earlier.