(Reuters) - Earnings of large U.S. banks would be hit by 1-6 percent this year if Britons vote in favour of leaving the European Union next week, according to brokerage Keefe, Bruyette & Woods (KBW).

Britain's exit could increase costs and weaken capital market activity, hurting banks such as Goldman Sachs Group Inc (N:GS), Morgan Stanley (N:MS), JPMorgan Chase & Co (N:JPM), Citigroup Inc (N:C) and Bank of America Corp (N:BAC), KBW analyst Brian Kleinhanzl wrote in a note on Thursday.

Morgan Stanley and Goldman Sachs, with large exposure to the capital markets, are expected to be the worst hit, Kleinhanzl said.

"Banks may have a two-year transition period and they could experience both revenue and expense headwinds during the transition," he wrote.

For 2017, the impact on these banks' earnings per share would be 2-9 percent, he said.

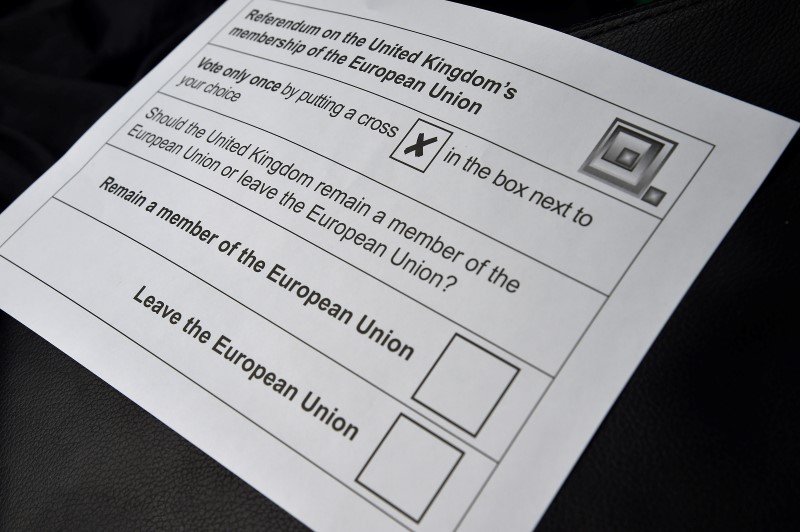

U.S. mortgage lender Wells Fargo & Co (N:WFC) is likely to be least impacted by a "yes" vote on June 23, the brokerage said.

However, in the longer term, the impact of Brexit is expected to be "a wash for U.S. universal banks," Kleinhanzl said.