Benzinga - To gain an edge, this is what you need to know today.

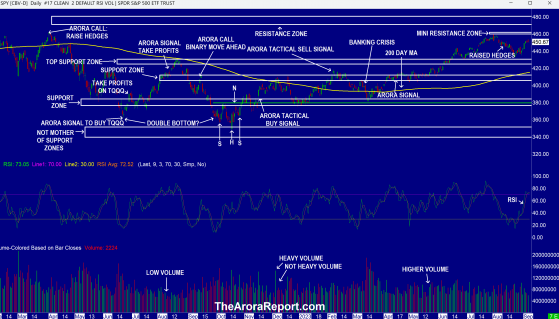

Weak Seasonality Please click here for a chart of SPDR S&P 500 ETF Trust (ARCA:SPY) which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- The chart shows that the stock market is below the mini resistance zone. The mini resistance zone shown on the chart is a magnet for traders.

- RSI on the chart shows that after the late August rally, momentum is waning.

- September is seasonally weak. However, bulls have a good argument – in years when S&P 500 is up more than 10% going into September, September tends to be positive.

- October is often the most volatile month of the year. Most crashes have occurred in October.

- In The Arora Report analysis, seasonality is one of the many factors that investors need to consider. The most important factor in September will be market mechanics. As of this writing, market mechanics are positive for the month, but market mechanics can quickly change.

- Understanding market mechanics can give you an edge. There are several podcasts in Arora Ambassador Club on market mechanics.

- In addition to seasonality, here are the other important factors:

- The AI frenzy fever was on the verge of breaking in mid-August, but then it picked up steam again. What happens to the AI frenzy in September will come down to the news.

- The consumer has been excessively spending, but low to mid income consumers are likely to start running into cash flow issues in the September/October timeframe and may start spending less.

- Economic data, especially inflation data, will be very important

- The next Fed meeting is scheduled for September 19 and 20. In The Arora Report analysis, what the Fed does will come down to the economic data that is released between now and the Fed meeting.

- ARM (NASDAQ: ARM) IPO is ahead. ARM IP is licensed by all major smartphone manufacturers, including Apple Inc (NASDAQ: AAPL). ARM is trying to position itself as an AI company. NVIDIA Corp (NASDAQ: NVDA) is a licensee of ARM. As a full disclosure, there is a buy signal on ARM in ZYX Buy.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

China Caixin Services PMI came at 51.8 vs. 53.6 consensus.

In The Arora Report analysis, based on the recent data, China will likely miss its 5% growth target unless the government starts a major stimulus program. So far, President Xi seems to be reluctant to start a new major stimulus program due to debt issues that are plaguing local governments in China.

Magnificent Seven Money Flows In the early trade, money flows are negative in Apple Inc (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), Alphabet Inc Class C (NASDAQ: GOOG), Meta Platforms Inc (NASDAQ: META), Microsoft Corp (NASDAQ: MSFT), NVIDIA Corp (NASDAQ: NVDA), and Tesla Inc (NASDAQ: TSLA).

In the early trade, money flows are negative in SPDR S&P 500 ETF Trust and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is