(Bloomberg) -- Limbo—that’s where to find Wall Street when it comes to cryptocurrencies.

Squeamish from the start about pursuing profits in one of the darker corners of finance, established firms this year slowed their already halting efforts to make a business out of Bitcoin mania. While none has thrown in the towel, and some continue to develop a trading infrastructure, most flinched as the value of virtual coins collapsed.

Take Goldman Sachs Group Inc (NYSE:GS)., which sought to position itself at the cutting edge of digital assets that skeptics see mainly as a domain of day traders and anarchists. Progress has been so slow as to be barely noticeable, according to people familiar with its crypto business. Many in the industry now say it was quixotic to have expected last year’s frenzy to translate into a Wall Street crypto offering.

“The market had unrealistic expectations that Goldman or any of its peers could suddenly start a Bitcoin trading business,” said Daniel H. Gallancy, chief executive officer of New York-based SolidX Partners, which hopes to launch a Bitcoin ETF in the U.S. "That was top-of-the-market-hype thinking."

Goldman remains a focal point for expectations of an establishment embrace of crypto. The firm was among the first on Wall Street to clear Bitcoin futures and people familiar with the matter said last year it was preparing a trading desk—the bank even provided its bankers to the New York Times for an interview on its plans. After considering a custody service for crypto funds, the firm invested in custodian BitGo Holdings Inc. It’s also offering derivatives on Bitcoin called non-deliverable forwards.

The bank has yet to offer trading of crypto and has gained little traction for its NDF product, having signing up just 20 clients, according to people familiar with the matter. Justin Schmidt, who was hired to head its digital-asset business, said at an industry conference last month that regulators are limiting what he can do. Still, Goldman plans to add a digital-assets specialist to its prime brokerage division, the person said.

With regulators offering little clear guidance on how they will classify the broad universe of tokens—as commodities, securities or something else—banks and investment firms are treading cautiously. Criminal and regulatory probes aren’t helping either.

Even after the plunge that erased $700 billion from the value of crypto assets, believers are sticking to their script

Morgan Stanley (NYSE:MS), which hired Andrew Peel as its head of digital assets earlier in the year, has been technically prepared to offer swaps tracking Bitcoin futures since at least September, yet thus far has not traded a single contract, according a person familiar with the matter. A person with knowledge of the business said in September the contracts would be launched once there is proven institutional client demand.

Meanwhile, Citigroup Inc (NYSE:C). has not traded any of the products it designed for cryptocurrencies within existing regulatory structures, according to a separate person with knowledge of its business. The so-called digital asset receipts enable trading by proxy without direct ownership of the underlying coins, a person with knowledge of the plans said in September.

In London, Barclays (LON:BARC) Plc, which has sounded out client interest on a cryptocurrency trading desk, is almost back to square one. Earlier in the year the British bank appointed two former oil traders—Chris Tyrer and Matthieu Jobbe Duval—to explore the business. Tyrer, who led the digital-assets project, left in September, while Jobbe Duval followed two months later, according to people familiar with the matter. Barclays currently has no plans for a crypto trading desk, according to a spokesman.

Officials for Citigroup and Morgan Stanley declined to comment on their cryptocurrency businesses. For its part, Goldman’s “primary focus is thoughtfully and safely serving our clients’ needs,” said spokesman Patrick Lenihan in New York.

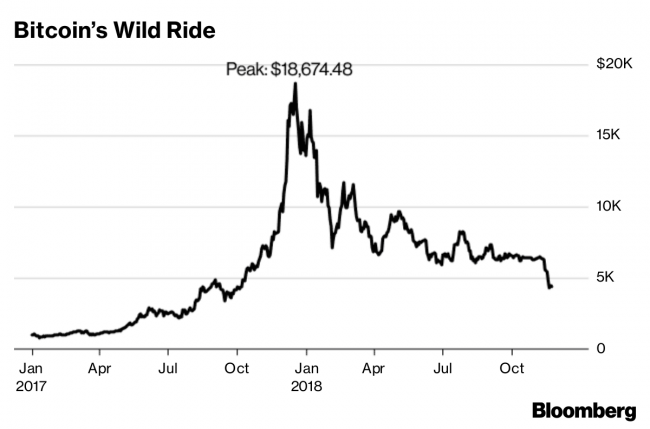

Even after the staggering sell-off in digital assets in 2018—a year after Bitcoin came in touching distance of $20,000 it now trades at around $4,000—crypto pros see signs institutions are getting ready to jump back in if they need to.

“The more important story is all the infrastructure that’s being built now to enable institutional trading,” according to Ben Sebley, a former Credit Suisse (SIX:CSGN) Group AG trader who is now head of brokerage at crypto boutique NKB Group.

Intercontinental Exchange Inc., owner of the New York Stock Exchange, said in August it had created a suite of services to enable consumers and institutions to buy, sell, store and spend digital assets. Meanwhile, Fidelity Investments said in October it’s preparing a new business to manage digital assets for hedge funds, family offices and trading firms. Another encouraging sign for the bulls came the same month in the form of Yale University’s investment in a crypto fund.

Even after the plunge that erased $700 billion from the value of crypto assets, believers are sticking to their script.

“It appears as if progress is coming to a halt, yet nothing could be further from the truth,” said Eugene Ng, a former Deutsche Bank AG (DE:DBKGn) trader in Singapore who has set up crypto hedge fund Circuit Capital. “The bear market is going to allow many of these institutions to build the proper foundations without rushing to build-out infrastructure without adequate testing for fear of missing out on a gold rush.”