- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

There Have Never Been Fewer US Homes For Sale

There Have Never Been Fewer US Homes For Sale

There Have Never Been Fewer US Homes For Sale

Benzinga - The Bank of England delivers surprise half-point rate hike to 5%, the highest in 15 years.

They say the risks to inflation are “skewed significantly to the upside”.

Market

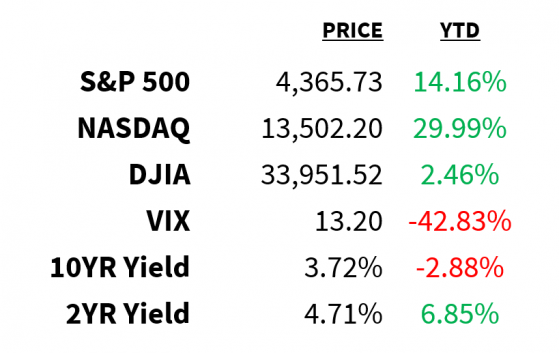

Prices as of 4 pm EST, 6/21/23

Macro Jerome Powell will make his way back to Capitol Hill this morning for a second round of grilling in front of the House Financial Services Committee.

- Yesterday he defended the Fed’s decision to skip a rate hike last week as “prudent”.

- He also signaled that the pause was likely to be temporary.

- He compared the move to a driver slowing down after pulling off the highway to avoid missing their destination.

- “The process of getting inflation back down to 2% has a long way to go.”

President Joe Biden called Xi Jinping a “dictator” at an event yesterday.

- Biden implied Xi was unaware that the US shot down an alleged Chinese spy balloon in February because he didn’t know it was there.

- Xi wasn’t happy about that, calling the comments a “provocation”.

- This comes just one day after US Secretary of State Blinken’s trip to China to ease tensions with the country.

According to Redfin, there were fewer homes for sale in May than any other month…ever.

- The number of homes for sale in the US experienced its first decline since April 2022, falling 7.1% YoY in May.

- Compared to pre-pandemic levels (May 2019), there are 38.6% fewer homes for sale.

- Home prices are also declining by less: the median sale price was down 3.1% YoY in May compared to April’s 4.2% drop.

Redfin

Stocks The Federal Trade Commission (FTC) sued Amazon yesterday for “deceptive” practices and violating consumer protection laws.

- The regulator claims the company misled consumers into signing up for its Prime subscription program using “manipulative” tactics.

- It says it used “dark patterns” to steer users into enrolling without their consent and made it difficult for them to cancel.

- This is the third case brought on by the FTC against Amazon in the last month.

After a quiet year of “soul searching”, SoftBank’s Masayoshi Son is back and on the offensive.

- And it’s all thanks to ChatGPT: Son says the tool—which he has been using every day extensively—has revived his spirits and revitalized his passion for technology.

- As such, SoftBank is positioning itself to be at the forefront of the AI revolution.

- After nearly 3 years of asset sales and cash hoarding, the firm has more than $35 billion in cash to help get it there.

Goldman strategist David Kostin offered 5 reasons why investors should hedge the S&P 500 today:

- Put-call skew shows investors are positioned upside.

- Narrow market rallies are typically followed by sharper drawdowns than normal (chart).

- Elevated equity valuations.

- The optimistic economic growth outlook is already priced in.

- Positioning is no longer a tailwind.

Goldman Sachs

Energy US energy companies have cut domestic O&G drilling activity to the lowest since April 2022.

- Those cuts are expected to continue amid weak oil prices.

- Meanwhile, stockpiles of crude oil at the Cushing, OK storage hub have risen for 8 straight weeks.

- They are now at their highest level in 2 years.

Earnings Yesterday’s highlights:

KB Home (NYSE: KBH): $1.94 EPS (vs. $1.33 expected), $1.77 billion in sales (vs. $1.43B expected).

- The company improved demand in the quarter with net orders increasing 84% and cancellations improving on a sequential basis.

- Guided full-year revenue of $5.8 to $6.2 billion, above analysts’ estimates of $5.67 billion.

What we’re watching today:

- Accenture (NYSE: ACN)

- Darden Restaurants (NYSE: DRI)

- FactSet Research (NYSE: FDS)

- Commercial Metals Company (NYSE: CMC)

- GMS Inc (NYSE: GMS)

- Methode Electronics (NYSE: MEI)

Top Headlines

- Mortgage demand: Despite a 3rd straight drop in interest rates, weekly mortgage demand remained flat.

- BTFD: Retail investors bought a record $1.5 billion worth of single stocks in the week ending Tuesday.

- Uber cuts: Uber is laying off 200 recruiters which represent 35% of its recruiting team but just 1% of total staff.

- WFH: The number of work-from-home job openings is beginning to roll over.

- Pharma suit: A pharmaceutical trade group is suing the US government over Medicare drug price negotiation plans.

- Project S: TikTok is launching “Project S”, an online shopping initiative called Trendy Beat to compete with Shein and Amazon.

- Wall Street pay: Lawyers on Wall Street are now outearning investment bankers.

- Mopping up: A new Fed paper suggests the Federal Reserve and European Central Bank will mop up as much as 90% of the money they pumped into banks over the last decade.

Crypto

Prices as of 4 pm EST, 6/21/23

- BTC options: Bitcoin (CRYPTO: BTC) options volume jumped to a 3-month high yesterday with $3.3 billion worth of contracts changing hands.

- Stablecoins: Jerome Powell said yesterday that stablecoins are a form of money and require robust federal regulation.

- Unusual defense: Coinbase employed an unusual legal strategy by filing amicus briefs in other crypto-related lawsuits to shape court rulings in its own case against the SEC.

- Mining ban: Venezuela’s temporary ban on crypto mining is having long-lasting effects on the country’s crypto industry.

- Bitcoin ETF: Valkyrie Funds is hopping on the spot Bitcoin ETF bandwagon with a new filing of its own.

Deals

- Semis fab: Intel will sell a 20% stake in IMS Nanofabrication to Bain Capital at a $4.3 billion valuation.

- Retail IPO: Secondhand retailer Savers Value Village is seeking a $2.7 billion valuation for its US IPO.

- Canadian sports: Larry Tanenbaum is selling a portion of his stake in Maple Leaf Sports & Entertainment at a $8 billion valuation.

- SVB VC: SVB Financial Group is exploring options for its venture capital arm, SVB Capital.

- Private > public: There are more companies going private than there are companies going public this year.

Meme Of The Day

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Related Articles

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.