Good Morning Everyone!

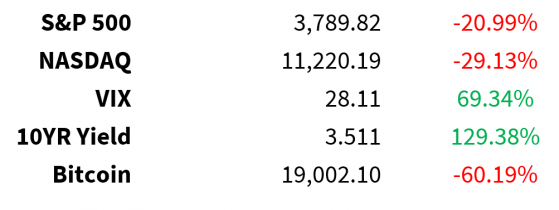

Prices as of 4 pm EST, 9/21/22; % YTD

MARKET UPDATE Fed lifted interest rates by expected 75bps

- Third consecutive 75bps hike

- Powell signaled more to come

- Comments more hawkish than expected

- “The chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive, or restrictive for longer”

- Current: 3.00-3.25%

-

Median forecast has rates hitting 4.4% by end of 2022, 4.6% in 2023

- 75bps in November followed by 50bps in December?

- New Dot Plot:

Bond Market reaction

- Yields on US Treasury bonds jumped on the Fed’s decision

-

Highest yields since

- US2Y - October 2007 (>4%)

- US10Y - February 2011

- US30Y - April 2013

- Yields reaction:

US Q2 Current Account - deficit narrows

- -$251.1 billion vs. -$260.6 billion expected (prev. -$282.5 billion)

- Consensus -$260.6 billion

Initial jobless claims - labor market still strong

- 213k vs 218k expected (prev. 208k)

10 am EST - Conference Board Leading Economic Index (LEI)

- Current data point to already elevated recession risks:

Crude $83

- Prices dropped on Putin’s mobilization announcement

- US inventory levels - gasoline and distillate stocks remain below their 5-year ranges:

- The streak of declining US gasoline prices has ended after 98 days:

Earnings

- Accenture (NYSE: NYSE:ACN)

- Darden Restaurants (NYSE: DRI)

- FactSet (NYSE: FDS)

- Manchester United (NYSE: MANU)

CRYPTO UPDATE Stablecoin regulations: US vs. EU

-

In the US, new bill would criminalize creation/issuance of algorithmic stablecoins (think Terra (CRYPTO: LUNC))

- Panel could vote as early as this week

- Some existing stablecoins concerned, uncertain if they fall in this category

-

In the EU, new draft of the markets in crypto-assets (MiCA) regulation removes limitations on stablecoins

- Major win for stablecoin advocates

- Leaves door open for regulations on DeFi and NFTs

Lockstep: Bitcoin and S&P 500

- 60-day correlation between BTC (CRYPTO: BTC) and S&P 500 futures hit 0.72 this week

- Just shy of May record

MEME OF THE DAY

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga