Marcus Sotiriou, Analyst at the UK based digital asset broker GlobalBlock

After a slump across all risk-on assets due to Russia invading Ukraine, global markets recovered remarkably yesterday. $143 million of Bitcoin (CRYPTO: BTC) short positions were liquidated over the course of 12 hours as bulls took control. It appears that the invasion was a ‘sell the rumour, buy the news’ event, where risk-on assets were bought aggressively as it was confirmed that Russia were indeed invading. The market dislikes uncertainty so as soon as we had some clarity of the long-lasting crisis, buyers stepped in.

Donations increased dramatically to the Ukrainian army yesterday, particularly in the form of Bitcoin. Blockchain analytics firm Elliptic confirmed that almost $400,000 in Bitcoin was donated over a 12-hour period to Come Back Alive, a Ukrainian NGO providing support to Ukraine’s armed forces. This comes after Ukraine made Bitcoin and crypto legal last week.

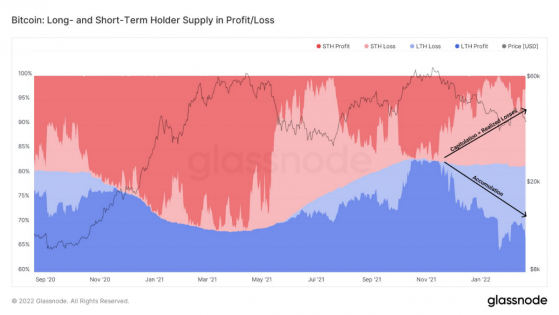

On-chain metrics suggest that long-term investors remain unphased. Data from Glassnode shows that short-term holders are supplying the market whilst long-term holders are accumulating. This is shown by ‘STH (short-term holder) Loss’ increasing, whilst ‘LTH (long-term holder) loss has been decreasing.

Last Friday, the Canadian Purpose Bitcoin spot ETF saw the biggest inflow since February 2021, as almost 1.2k Bitcoin was added in just one day. Their AUM (Assets Under Management) is now at a new all-time-high of 32.26k Bitcoin. This gives further confluence to institutions (generally long-term holders) buying Bitcoin in this region.

More ETFs (Exchange Traded Funds) are expected to roll out soon, as Kookmin Bank is preparing to become the first bank in South Korea to offer crypto investment products to retail investors. KB Financial Group is South Korea’s largest firm by net profit, and, according to research platform Macrotrends, they had about $520 billion in total assets as of September 2021.

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga