Benzinga - To gain an edge, this is what you need to know today.

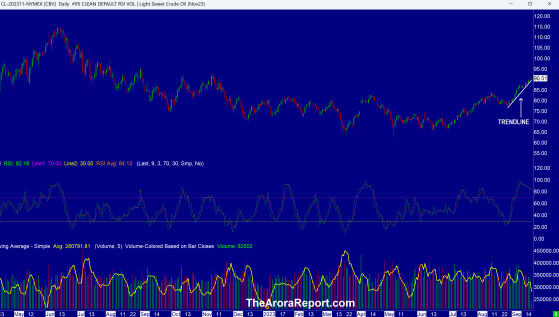

Difficult Fight Against Inflation Please click here for a chart of oil futures that represent West Texas Intermediate.

Note the following:

- The chart is of West Texas Intermediate crude (WTI). WTI, as tracked by the United States Oil Fund ETF (ARCA:USO) is the standard for the U.S. Brent crude. Brent is trading about $3 above WTI. $100 price for Brent is the magnet for traders.

- The chart shows a steep trendline.

- The main reason for the rise in oil price shown on the chart is that Saudi Arabia, in cooperation with Russia and other OPEC+ members, have successfully reduced the supply.

- The latest government stimulus in China may increase demand for oil in China. This is adding to the bullishness.

- Resilient U.S. economic data and American consumers’ willingness to spend is adding to the upward pressure on oil. In the past when gasoline prices rose, consumers would cut back on other discretionary purchases. However, this time is proving to be different so far. Rising gas prices are not having a negative impact on other discretionary purchases by American consumers. The American consumer has become used to excessive spending. Right now, lower income consumers can still borrow and higher income consumers still have savings.

- Also contributing to higher oil prices is general risk-on sentiment generated by higher stock prices and house prices holding up in spite of higher interest rates.

- The fear is that Saudi Arabia and Russia may want to tighten the screws on the West by trying to run up oil prices to $120 - $130.

- For more guidance, refer to world renown oil ratings from The Arora Report. You can see the oil ratings from the top menu in the Real Time Feeds. These ratings are based on the following:

- Geopolitics

- Sentiment

- Fund Flows

- Supply

- Demand

- Inventories

- Positioning

- Technicals

- Risk Appetite

- Economic Indicators

- Currencies

- FOMC, Bank of England, and Bank of Japan meetings are ahead this week.

- Rising oil prices are making the job of fighting inflation difficult for the Fed and the Bank of England.

- Japan imports almost all of the oil it uses. Rising oil prices may force the Bank of Japan to change its loose monetary policy. In The Arora Report analysis, if the Bank of Japan changes its loose monetary policy, it will have a negative impact on stocks in the U.S. The reason is that there is a lot of money that has been borrowed in Japan at low interest rates and then invested in the U.S. stock market.

- A concern is also developing about a potential government shutdown.

- On the positive side, early indications are that preorders for iPhone 15 are better than expected. This is good news because Apple Inc (NASDAQ: AAPL) is the largest stock and carries heavy weight in the indexes.

- After the successful IPO of Arm Holdings PLC - ADR (NASDAQ: ARM), excitement is building for IPOs of Instacart (NASDAQ: CART) and Klaviyo Inc. (NASDAQ: KVYO). As a full disclosure, ZYX Buy from The Arora Report has signals on both CART and KVYO.

- Saudi Arabia and Turkey are vying for the next Tesla Inc (NASDAQ: TSLA) factory. Saudi Arabia is sweetening the deal with an offer of rights to purchase particular EV metals. Elon Musk is also scheduled to meet with the Israeli Prime Minister on Monday. Musk had previously indicated that the location for the next Tesla factory would be chosen by the end of the year.

- In The Arora Report analysis, Saudi Arabia and other oil rich Middle Eastern countries are using their oil riches to expand into growing areas such as EVs and AI. We are considering continuous coverage of Saudi Arabia and other Middle Eastern countries in ZYX Emerging by The Arora Report.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

Magnificent Seven Money Flows In the early trade, money flows are positive in Apple and Alphabet Inc Class C (NASDAQ: GOOG).

In the early trade, money flows are negative in Amazon.com, Inc. (NASDAQ: AMZN), NVIDIA Corp (NASDAQ: NVDA), Microsoft Corp (NASDAQ: MSFT), Meta Platforms Inc (NASDAQ: META), and Tesla.

In the early trade, money flows are mixed in SPDR S&P 500 ETF Trust (ARCA:SPY) and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is