Benzinga - Good Morning Everyone!

Berkshire Hathaway’s Charlie Munger was asked about long-term valuations: “I don't worry about it too much, because I will be dead."

At least he’s being honest.

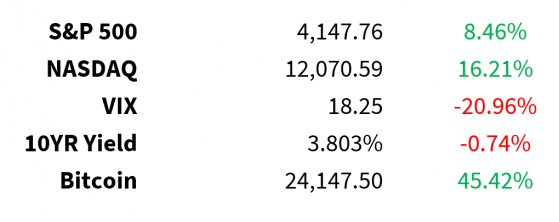

Prices as of 4 pm EST, 2/15/23; % YTD

MARKET UPDATE Retail sales

- +3% vs. 1.8% expected

- All categories showed growth MoM and YoY

-

Restaurants and bars +7.2% MoM, +24% YoY

- Rotation from goods to services still underway

- Data says: consumer still strong

Industrial & Manufacturing production

-

Industrial production unch MoM

- +0.8% YoY

- Slowest growth since February 2021

-

-9.9% monthly drop in Utilities (chart below)

- Largest drop ever

-

Manufacturing production +1% MoM

- Best print since February 2022

Homebuilder sentiment

- Rose by 7 points (most since mid-2020)

- At 5-month high

- Sales expectations jumped to highest since July

- Optimism over prospective buyer traffic

Today's data:

-

8:30:

-

PPI MoM: 0.7% vs. 0.4% est

- Biggest gain in 7 months

-

Largest increase in goods (+1.2%) since June

- +6.2% surge in gasoline cost

- Core PPI MoM: 0.5% vs. 0.3% est

- Building Permits MoM: +0.1% (prev -1%)

- Housing Starts MoM: -4.5% (prev -3.4%)

-

Initial Jobless Claims: 194k vs. 200k est

- Remains close to 9-month low from January

- Labor market: still tight

-

Philly Fed Manufacturing: -24.3 vs. -7.4 est

- Lowest reading since May 2020

- 6th straight month of contraction

-

PPI MoM: 0.7% vs. 0.4% est

-

Fed talk

- 8:45 - Mester

- 1:30 - Bullard

- 4:00 - Cook

- 6:00 - Mester

Crude

-

IEA lifts oil demand by 2 mbpd in 2023

- China makes up 900k bpd

-

Record 101.9 mpbd

- +100k bpd from prev forecast

Tesla (NASDAQ: TSLA)

-

Autopilot workers announced unionization campaign Tuesday

- Yesterday Tesla fired dozens of them

-

Charlie Munger on Tesla/BYD (Chinese competitor):

- “BYD is so much ahead of Tesla in China ... it’s almost ridiculous”

Cisco Systems (NASDAQ: CSCO)

- Beat top & bottom lines

- Demand for tech infrastructure stronger than expected

-

Highest sales forecast in years

- +9.8% for 2023

Zillow (NASDAQ: Z)

- Beat top & bottom lines

- Driven by core advertising

- Developing “super app” for housing

- Partnering with Opendoor (NASDAQ: OPEN) to reach home sellers

Earnings

- Hasbro (NASDAQ: HAS)

- Datadog (NASDAQ: DDOG)

- Crox (NASDAQ: CROX)

- DraftKings (NASDAQ: DKNG)

- Paramount Global (NASDAQ: PARA)

- Cenovus Energy (NYSE: CVE)

- PBF Energy (NYSE: PBF)

- NRG Energy (NYSE: NRG)

- Watsco (NYSE: WSO)

- Hyatt Hotels (NYSE: H)

- Pool Corp (NASDAQ: POOL)

- Southern Company (NYSE: SO)

- Zebra Tech (NASDAQ: ZBRA)

- EPAM Systems (NYSE: EPAM)

- Reliance Steel (NYSE: RS)

CRYPTO UPDATE Bitcoin (CRYPTO: BTC) hits 6-month high

- Highest since August

- Closing in on $25,000

- +11% last 24 hours

- Squeeze? Short-sellers closed out $64.5 million in bets yesterday

Court reveals identities of SBF guarantors

- Check out thread for details:

The two people who paid the former FTX CEO’s bail are:© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.Larry Kramer (left) - former dean of Stanford Law School.

Andreas Paepcke (right) - a Senior Research Scientist at Stanford. pic.twitter.com/ZnPB9n95x9

— Genevieve Roch-Decter, CFA (@GRDecter) February 15, 2023

Read the original article on Benzinga