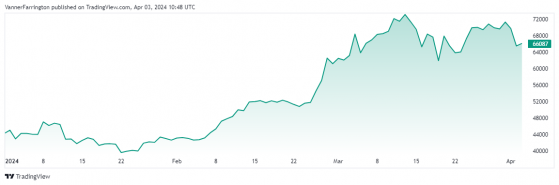

Proactive Investors - Bitcoin dropped more than 9% in the first two trading sessions of April after meandering along the $70,000 line in the latter stages of March.

Yesterday was particularly brutal, with the BTC/USD pair plummeting 6% to close the session below $64,500.

Though this morning offered some respite, with bitcoin climbing back to the $66,359 mark, the world’s largest cryptocurrency still faces a few headwinds worth considering.

The US dollar index (DXY) just hit a six-week high as US investors started to price in fewer interest rate cuts from the Federal Reserve this year.

Swap markets suggested 0.69 percentage points worth of cuts by December, a more hawkish outlook compared to the 0.75 ppt implied by the Fed’s outlook.

Markets are likely to support the greenback in the near term to reflect this higher-for-longer outlook.

Spot-bitcoin exchange-traded funds also chalked up $85.7 million worth of cash outflows on Monday, reversing nearly a week’s worth of inflows prior.

Farside data shows that inflows returned yesterday, albeit at a softer $40 million.

Despite the recent bearishness, bitcoin is still in a strong position year to date, having added over 55%.

Ethereum also saw a sell off over the past two days to the tune of 12%, though has managed to claw back some losses today. The ETH/USD pair is currently swapping for $33,14, around 7% lower week on week.

In the broader altcoin space, BNB, Ripple (XRP), Cardano (ADA) and Avalanche (AVAX) are all on the week-on-week red, while Solana (SOL) has added around one percentage point.

Global cryptocurrency market capitalisation currently stands at $2.51 trillion, with bitcoin dominance at a flat 52%.