Proactive Investors - Bitcoin was trading flat this morning after bouncing off a 12-day low on Sunday.

The benchmark cryptocurrency, which has been on a rip in 2024 due to large-scale inflows into spot-bitcoin exchange-traded funds, was under selling pressure at the end of last week amid a bout of profit taking.

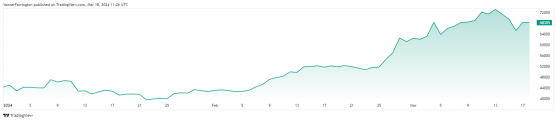

It hit an all-time high of nearly $74,000 on Thursday before falling as low as $64,780 in weekend trades.

But in a sign of resilience, bitcoin recovered nearly 5% of these losses yesterday, bringing the BTC/USD pair back to $68,300 by the end of the session.

As of 11.30am this morning (UK time), the pair was slightly lower at $68,255.

Despite the short-term volatility, Standard Chartered (LON:STAN) recently raised its bitcoin year-end forecast to $150,000, with highs of $250,000 predicted.

Standard Chartered analysts wrote: "We think the gold analogy – in terms of both ETF impact and the optimal portfolio mix – remains a good starting point for estimating the ‘correct’ BTC price level medium-term.

"If ETF inflows reach our mid-point estimate of $75 billion, and/or if reserve managers buy BTC, we see a good chance of an overshoot to the $250,000 level at some stage in 2025."

On the Ethereum (ETH) front, the second-largest cryptocurrency remains over 10% lower week on week against bitcoin’s 4.5% dip.

In the broader altcoin space, Solana (SOL) has pulled ahead by adding a third to its token price over the past seven days, while Avalanche (AVAX) and Toncoin (TON) have also added over 30%.

Memecoins Shiba Inu (SHIB) and Dogecoin (DOGE) extended their losses by around 16% each.

Global cryptocurrency market capitalisation currently stands at $2.58 trillion, with bitcoin dominance at 53.6%.