Proactive Investors - Bitcoin (BTC) has continued to show signs of consolidation around the US$28,000 price point in a promising sign that the impressive gains netted during the recent bout of financial turmoil could prove sticky.

BTC/USDT gained close to 2% over the weekend after closing 3% lower on Friday. At the time of writing, the pair had fallen back 0.7% to US$27,750.

The past few weeks have been pretty chaotic, not just for crypto but for the broader financial sector, with numerous banking collapses in the US and Credit Suisse’s takeover by rival UBS.

Interest rate hikes across the UK, EU and US have also sown uncertainty, but evidently things have started to calm down in the markets.

To that end, the safe-haven rally we’ve seen on physical gold and bitcoin should be expected to level out too.

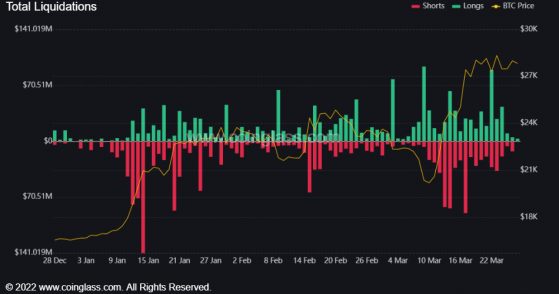

A marked decline in long and short futures liquidations seems to attest to this point- on Sunday, combined liquidations totalled US$18mln compared to US$100mln-plus at the height of the turmoil.

Bitcoin might see some downward pricing pressure depending on the level of profit taking, though buying support around 27k per Binance’s order book could act as a bottleneck.

Tensions between Coinbase (NASDAQ:COIN) and the US Securities and Exchange Commission (SEC) shouldn’t be ignored either.

The Nasdaq-listed cryptocurrency exchange received a Wells Notice from the regulator on Thursday last week, typically a sign of an impending enforcement action.

Bitcoin products are not likely to be impacted by any enforcement, but it could provide an added layer of uncertainty in the markets regardless.

Bitcoin’s risk-on rally levels out – Source: currency.com

Ethereum (ETH) added around 1.3% over the weekend but has since ceded most of those gains this Monday morning. The ETH/USDT pair is currently trading at US$1,750

In the altcoin space

Ripple (XRP) remains elevated above the rest of the top-20 altcoin set, and is now over 20% higher week on week.

The payment token’s stellar performance coincides with renewed hopes of a major win the long-running SEC vs. Ripple Labs dispute over unregistered securities.

Ripple president Monica Long told CNBC last week that she is “very hopeful” about achieving a win; that simple statement was evidently enough to galvanise the XRP bulls.

Litecoin (LTC), which has a similar profile to XRP as a payment token, has also surged by over 10% in the past seven days.

Top overnight movers among the top-100 club include ssv.network (SSV), Rocket Pool (RPL) and Neo (NEO).

Global cryptocurrency market capitalisation added 0.3% to US$1.16tn overnight, while total value locked in the decentralised finance (Defi) space remained unchanged at US$49.1bn.