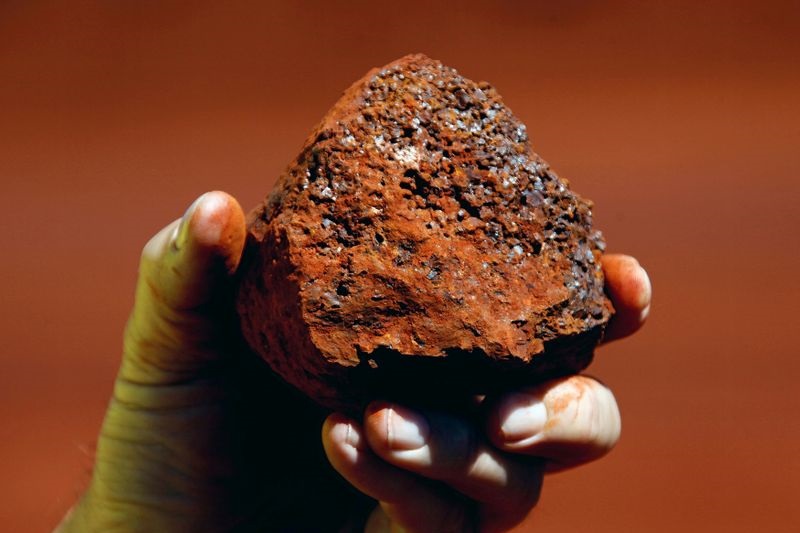

UBS noted that the price of iron ore has seen a week-over-week increase to approximately $118 per ton. This upward movement comes despite indicators suggesting a softness in the fundamental aspects of the market. Iron ore port inventories have remained broadly flat, diverging from the usual seasonal trends.

The expected seasonal surge in demand has been described as modest, which is reflected in the China Iron and Steel Association's (CISA) pig iron production figures for the first ten days of April and the MySteel blast furnace utilization rates.

Iron ore supply, on the other hand, has shown an uptick. Shipments from traditional markets have risen by 4% year-to-date. This increase includes a notable performance from Brazil. While raw material costs have decreased, steel margins have improved, although this comes in the context of lower steel prices. Meanwhile, finished steel net exports from China reached record highs in March.

The market's response to these mixed signals includes a small net long position on the Dalian Commodity Exchange. Despite the price increase and varied market signals, UBS maintains a neutral stance on major mining companies such as Rio Tinto (NYSE:RIO), BHP Group (NYSE:BHP), and Vale.

UBS estimates that the spot free cash flow (FCF) yield for BHP is around 8%, while Rio Tinto and Vale's yields are approximately 10% and 14%, respectively. These figures are part of UBS's interactive model assessments for the companies.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.