By Suzanne Barlyn and Nikhil Subba

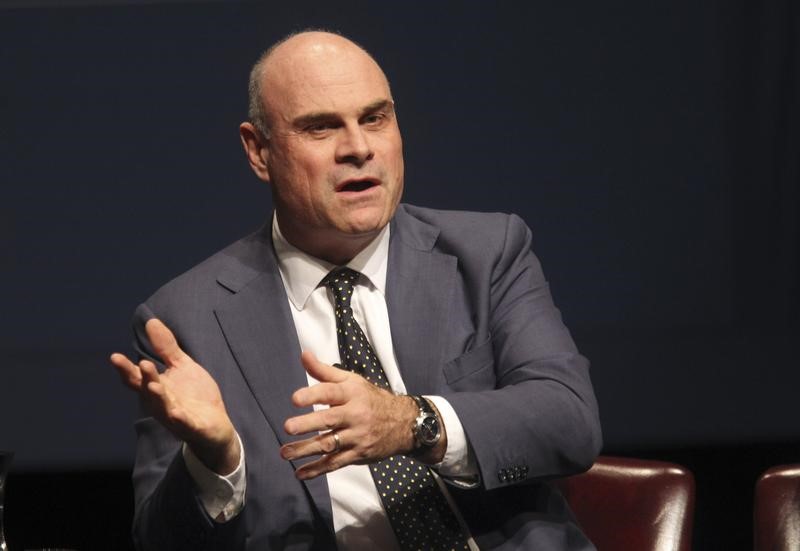

(Reuters) - American International Group Inc (N:AIG) said on Thursday its Chief Executive Peter Hancock will step down, a decision he made after poor financial performance frustrated shareholders and the insurer's board of directors.

Hancock, 58, will remain as CEO until a successor is named. In a joint statement, neither he nor Chairman Douglas Steenland gave any clues as to who might replace him.

"Without wholehearted shareholder support for my continued leadership, a protracted period of uncertainty could undermine the progress we have made and damage the interests of our policyholders, employees, regulators, debtholders, and shareholders," Hancock said.

Billionaire activist investor Carl Icahn, who is AIG's fourth-largest investor, cheered Hancock's departure: "We fully support the actions taken today by the board of AIG," he tweeted.

AIG's shares were down 0.4 percent to $63.21 on Thursday at the close of trading in New York. The stock trades at less than 85 percent of the stated value of AIG's assets.

When Icahn first began acquiring his stake in 2015, he advocated splitting up AIG into three parts. The insurer instead embarked on a two-year turnaround plan developed by Hancock, which intended to return $25 billion to shareholders. Last year, AIG returned a total of $13.1 billion of capital to shareholders, the company said.

The board is still committed to that plan, Steenland said.

According to AIG's 2016 proxy filing, Hancock could receive an exit package of $20.4 million or $31.5 million, depending on whether the board determines his reason for leaving was "good."

EXTERNAL POSSIBILITIES

Many longtime AIG executives who would have been obvious internal candidates for CEO have left since Hancock took the helm in 2014. Analysts have floated several names of external possibilities since AIG stunned Wall Street with a surprisingly wide fourth-quarter loss on Feb. 14.

Among them are John Doyle, who spent decades at AIG before leaving to oversee the brokerage business at insurer Marsh & McLennan.

Brian Duperreault, who oversaw the turnaround of Marsh & McLennan after the 2008 financial crisis and is now CEO of Hamilton Insurance Group is also a possibility, as is Daniel Glaser, the current CEO of Marsh & McLennan, and Constantine Iordanou, CEO of insurer Arch Capital Group Ltd.

These executives either declined to comment or could not immediately be reached.

Several AIG board members also have insurance industry leadership experience.

What is important, analysts said, is that the next CEO has a firm grasp on AIG's troubles in property and casualty insurance which have weighed heavily on results.

"We've seen a few examples in the insurance world of similarly large organizations that were similarly distressed that were able to turn themselves around," said Meyer Shields, who covers AIG shares at Keefer, Bruyette & Woods. "I think it is fair to say that there are people out there who could do this job."

The incoming CEO will be AIG's sixth in 12 years and will be tasked with carrying out the insurer's plan to continue shedding assets and reducing risk exposure some nine years after receiving a $182 billion government bailout during the 2008 financial crisis.

Although Hancock resisted calls to break up AIG, he did complete or announce 17 deals to shrink the company by $13 billion worth of assets in total. AIG’s overall balance sheet was $498 billion at year-end, less than half its size at the end of 2007.

Shrinking the balance sheet is important for AIG, which is currently labelled a systemically important financial institution, or SIFI, by the U.S. government. Icahn’s breakup calls were intended to rid AIG of that designation, which forces it to hold more capital and undergo tougher regulatory supervision.

Icahn has a 4.7 percent stake in the company. Samuel Merksamer, who represents Icahn on AIG's board and several others, exited the activist investor's firm in December. Merksamer, however, continues to serve as Ichan's representative.

Hedge fund billionaire John Paulson also holds AIG shares and a board seat, though he has been shedding some of the stake.

Directors were frustrated by AIG's stunning fourth-quarter loss, which was the result of under-reserving, and the second surprise charge in a row, people familiar with the matter said. Hancock announced his decision to resign at a regular board meeting on Wednesday.