Sentiment has been given an extra boost in Asia today, on reports that US and China are set to resume trade talks in October. Sentiment had already been lifted by stronger China Service PMI yesterday, along with news Hong Kong’s PM was to withdraw the extradition treaty officially. But it was today’s trade-war breakthrough which made a notable mark on asset prices.

What helps the report carry more weight is the phone call made to agree to the talks has been confirmed by both US and Chinese spokesman. This may seem like an obvious requirement, but it should be remembered that President Trump took some flak for claiming trade talks were going well, over a phone call China claim never existed. But only after the markets rallied and quickly reversed course once China denied the call.

So with index futures trading higher and USD under pressure, markets may have hit an inflection point. At least over the near-term.

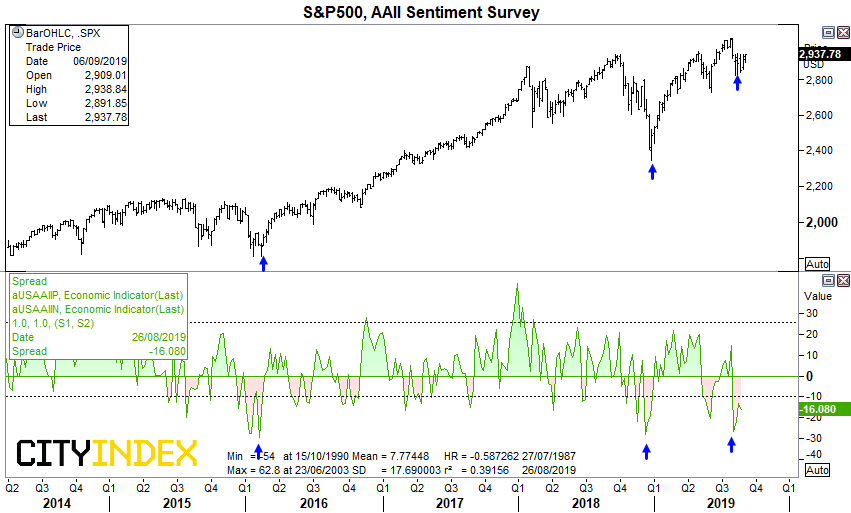

For today’s video, we look at key levels on the S&P500 E-mini’s, SPX sentiment and DAX.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."