Hawkish Powell Weighing on Stocks

US equity markets are expected to open in the red on Thursday, as traders await the second appearance of the week from new Federal Reserve Chair Jerome Powell and a selection of economic data.

Powell’s testimony in front of the House Financial Services Committee on Tuesday was very bullish on the economy and led many to believe that a fourth rate hike is on the table this year. While this isn’t a million miles from what markets are pricing in, it did trigger another negative response from markets with US indices falling around two and a half percent since and positioned for further losses today.

It would appear markets are bracing for more hawkish commentary from Powell today when he appears before the Senate Banking Committee, once again discussing the semi-annual monetary policy report. Given everything that he said on Tuesday, it seems pretty clear that economic forecasts will be revised higher this month and the pace of tightening will likely therefore pick up, which may make today’s less eventful as he reiterates many of the views already expressed. That said, should he wish to back pedal on anything or clarify points that have been misinterpreted, it may attract some attention.

US Inflation Data Eyed

What may be of more interest today is the US economic data that’s being released. Yesterday’s GDP data showed the economy growing at a decent pace in the fourth quarter and with momentum very much building and tax reform providing additional stimulus, this will likely pick up in the quarters ahead. This makes the inflation data all the more interesting, especially as the labour market slack has already been largely diminished which should put more upward pressure on prices.

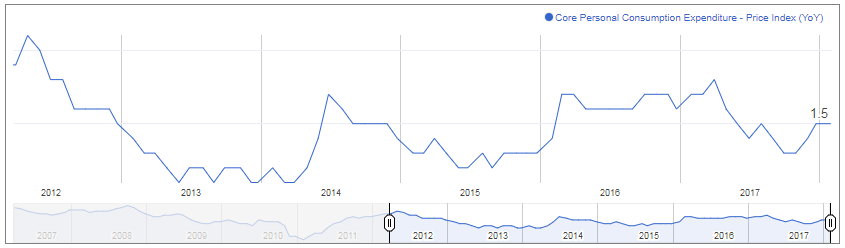

The core PCE price index is the Fed’s preferred measure of inflation and has been gradually ticking up again in the last few months. At 1.5%, it is still below the Fed’s 2% target but close enough that any surprise beat will likely trigger a reaction in the markets, particularly following such a hawkish testimony from the new Fed Chairman. Personal income and spending figures will also be of interest, along with the two manufacturing PMI surveys.

Sterling at Six Week Low as Transition Talks Frustrate

We’ve already had a large number of PMI readings from across Europe this morning but, despite the numbers being broadly positive, they have failed to lift the mood in markets. The UK manufacturing PMI ticked slightly lower from a month ago, although this was largely shrugged as it remains quite elevated, with the sector having been boosted by a weaker pound over the last 18 months.

The pound is trading at six week lows against the dollar this morning, having come off its highs as Brexit discussions come back into focus, with both sides in talks over the transition period. A deal on the transition was initially intended to be completed this month, allowing for other discussions to take place over the course of the rest of the year but with both sides seemingly far apart on their expectations – to the surprise of no one – this could run over which is making traders uneasy and weighing on the pound.

Disclaimer: This article is for general information purposes only. It is not investment advice, an inducement to trade, or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. Ensure you fully understand all of the risks involved and seek independent advice if necessary. Losses can exceed investment.