Bitcoin is a hot topic lately. It’s been in the news a lot, and not for good reasons. In fact, it’s currently down 72% from its all-time high of $69,000 in November.

Investments that are more volatile are viewed by the general public as risky. Conventional wisdom tells us things like “the trend is your friend” and “don’t try to catch a falling knife”. These are true — so the contrarian take for bitcoin is not because of these or refuting them, but in fact regardless of them.

It seems like the worst time to buy bitcoin. And if you believe that, you probably shouldn’t.

However, if you are a contrarian, hear me out.

Here are five reasons why accumulating at least 5% of your savings in bitcoin is needful.

Bitcoin Reason #1 — Growth Beats Volatility

The first reason you should buy bitcoin is that historically it has appreciated over time, a lot faster than older assets like gold, real estate, stocks or bonds. Past performance does not guarantee future results, however in market analysis we operate off of numbers of the past. Growth over a longer time frame removes volatility as a risk.

Let’s look at a comparison outside of bitcoin.

Some assets are more volatile than other assets.

For example, stocks are more volatile than bonds. This is a short-term risk. However, over longer periods of time, this risk becomes less. In fact stocks simply outperform bonds by a massive margin long-term.

Inflation is a risk that is usually ignored by investors, though its hard to ignore it right now. It eats away at all assets. Historically, in the US, inflation has been around 3% annually. Over the past 12 months, it has been 9.1%. In emerging markets like Nigeria, South Africa, India and Brazil, inflation has been historically a lot higher.

Over a 10–20 year time frame holding assets that return less than 3% annually is actually a far greater risk than volatility.

In November 2013, bitcoin exploded over 550% in a single month from a little over $200 to $1,100. What followed was a lengthy bear market for over 3 years, dropping back to around $200 before eventually rising again. That sounds really volatile, but that time period, which covers more than ⅓ of this graph, is hardly noticeable.

Since that time, bitcoin has seen two major bull markets, and in its second of two major bull markets. If someone invested near the top at $1,100 and held their investment a little more than 8 years to today, that is an 1800% growth. That’s factoring in the 70% drop from all-time high last November.

Let’s compare it to the S&P 500. The S&P 500 has grown about 223% from November 2013 to July 2022. That’s is a historic bull market — well over 20% growth per year for the index which performs an average of about 10% per year long-term.

Bitcoin is a lot more volatile short-term, and it has outperformed the S&P 500 by a factor of over 8 to 1 in that same time frame.

Math is on the side of bitcoin long-term.

“It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self fulfilling prophecy.”

— Satoshi Nakamoto

Bitcoin Reason #2 — Good Monetary Policy

Bitcoin is a digital asset with predictable and decentralized monetary policy. There will only be 21 million bitcoin ever created through a process known as mining. In fact, per Decrypt, 3.7 million bitcoins have been lost and can never be recovered. So that’s actually a hard cap of 17.3 million bitcoin that can ever be in circulation.

Central banks print national fiat currencies. Their monetary policies are at the whim of politics and popularity. They can be changed by the same politician or central banker, or a different one that replaces them, based on popular sentiment. Doing what everyone wants is not the same as good monetary policy. People generally would like handouts but not the inflation that comes later to pay for it.

The easiest way to get “more money” is to print more if you are a government or a central bank. All money is backed by the production of the economy built by people and the machines built by people. So when more money is printed, valuable goods and services, people’s hard work is devalued. This is known as inflation.

The strongest of all fiat currencies, the US Dollar, has lost 96% of its value since the creation of the Federal Reserve in 1913 and 90% of its value since 1950.

Bitcoin Reason #3 — Decentralized

There is no CEO, Board of Directors, or Founder of Bitcoin that can manipulate. No government regulator, no Venture Capitalist and no bank to externally pull the rug out from under it. Even its creator, Satoshi Nakomoto disappeared after his last post on December 12, 2010. Their identity is a mystery, so by design it is difficult for one individual to manipulate it.

Bitcoin is created through a process known as proof-of-work mining.

The bitcoin network is further supported by “nodes” computers around the world that do their part to administer, secure and support the network. Any person or government can mine bitcoin or run a node. No one government or billionaire can take over the network.

Per bitnodes.io there are 15,327 reachable bitcoin nodes connected to the network. They are from 97 countries, and 8,414 have an unknown location.

It is possible to attack a single government or central bank. It is far more difficult to attack 15,327 computers in 97 countries and more than half in unknown locations!

Bitcoin Reason #4 — Hedge Against Unrest

While some have called bitcoin a hedge against various things, its current volatility in its young history may argue against this point.

I consider Bitcoin more of a hedge or insurance policy against disaster. The past year has only highlighted this further.

Bitcoin can be stored on a hardware or digital wallet. You can custody your own bitcoin and in this case it can’t be seized or stopped by any government. It cannot be held by a bank that fails, or seized from you at a broder if you are escaping your nation.

In the past year, extraordinary instances of hyperinflation, civil unrest, riots, strikes, banking collapses, government overreach into personal finances and other messes have occurred across the world. Some examples include

- China

- Canada

- Holland

- Albania

- Turkey

- Lebanon

- Sri Lanka

- Afghanistan

The list goes on and on.

As crypto industry executive Akil Patterson and I recently co-tweeted on Twitter (NYSE:TWTR):

Bitcoin Reason #5 — Bitcoin is Growing

Bitcoin use continues to grow, and even more so in the developing world. El Salvador and Central African Republic have adopted bitcoin as legal tender as a means to build their own financial independence. Their experiment is being watched by the world.

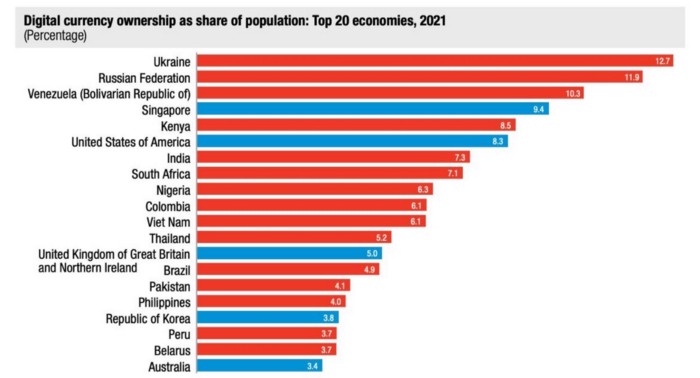

Here is a nation-by-nation breakdown of uses. Note that nations at war, nations with massive inflation and developing nations are significant on the list.

Another way to view bitcoin is the value of the payment network. Mati Greenspan, CEO/Founder of Quantum Economics recently commented on Twitter about the massive growth of bitcoin as a payment network. In fact, currently bitcoin moves over 10X the USD value that it did in December 2017, when it reached a peak around $20,000, slightly less than its value today.

Bitcoin’s use and fundamentals are stronger than ever. You might want to accumulate some before the rest of the world figures that out.