This week sees the release of worldwide manufacturing and services PMI data which will give an insight into global growth, inflation, and labour market trends in key economies for the first month of the third quarter. June's PMIs and their early July flash readings have hinted at a deteriorating economic environment, showing business activity falling in the US and Eurozone as the cost of living crisis and tighter monetary policies hit demand. Elsewhere, China's Caixin PMI will be watched with particular interest to assess the ongoing impact of its zero COVID policy after June's encouraging rebound.

After last week's Fed 75 basis point hike, US markets will be eagerly awaiting non-farm payroll numbers which will help guide the future path of the Fed. The market is currently expecting a slowing in the pace of job gains with the latest figure expected to come in around the 260k mark (down from 372k). Meanwhile, the unemployment rate, is predicted to hold steady at 3.6%, while monthly earnings growth is also likely to hold at 0.3%.

Central bank meetings will meanwhile flow thick and fast this week, with Reserve Bank of Australia the first to make their rate decision with a 50 basis point hike now expected. Meanwhile, July flash S&P Global / CIPS UK PMI data pointed to a slowdown in growth and even a contraction in manufacturing output. The Bank of England is nevertheless projected to also hike their rate by 50 basis points.

The Reserve Bank of India (RBI) will meet for its quarterly monetary policy meeting on Thursday where it looks set to follow the general global trend of tightening monetary policy. Inflation rates have remained elevated which the RBI will look to control by hiking their rate by 35 basis points.

Brazil's selic rate decision will be another interesting central bank meeting to follow. In our baseline focus, we anticipate that GDP will decline in Q3 and Q4 (QoQ). Risks to policy continuity, coupled with high inflation, tight monetary policies, and a weaker external environment have increased the likelihood of recession.

Bank of England to hike rates to highest since 2008

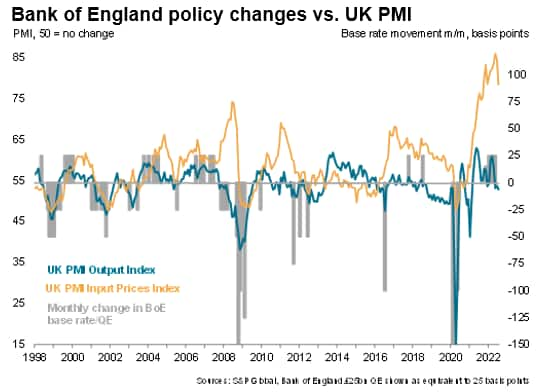

Among the various central bank policy meetings in the coming week, the most important will be the gathering of the Bank of England's Monetary Policy Committee. Concerned over the rapid rise of consumer price inflation to a four-decade high of 9.4%, and emboldened by increasingly aggressive policy stances at the FOMC and ECB, the BoE is set to hike interest rates by another 50 basis points. The rise would be the largest since 1995 and means the MPC will have tightened policy for a sixth successive meeting to take Bank Rate to 1.75%, its highest since late 2008.

With a 50bp August rate hike already priced in, the focus shifts to the future policy path. Our forecasters here at S&P Global Market Intelligence expect further 25 bp hikes in September, November, and December, as well as in February 2023, taking the policy rate to a peak of 2.75%, reflecting the anticipated stickiness of elevated inflation in the UK. Although PMI data have indicated a tentative peaking in price pressures, household energy prices are expected to rise sharply into the winter, keeping inflation uncomfortably above the bank's 2% target and adding to fears of a wage-price spiral.

However, this projected rate path is contingent on the UK experiencing only a mild recession. GDP is expected to contract slightly in Q2 and Q3 2022 before marginal growth returns from late 2022, thanks to the government's support package for households. The PMI data, including additional colour in the coming week, will be an important gauge of how likely that growth projection looks.

Key diary events

Worldwide Manufacturing PMIs (Jun)

South Korea Balance of Trade (Jul)

Indonesia Inflation (Jul)

Germany Retail Sales (Jun)

United Kingdom Nationwide Housing Prices (Jul)

Italy Unemployment Rate (Jun)

Hong Kong SAR GDP (Q2)

Euro Area Unemployment (Jun)

US ISM Manufacturing PMI (Jul), Construction Spending (Jun)

Tuesday 2 August

South Korea Inflation Rate (Jul)

Australia RBA Interest Rate Decision

Spain Unemployment Change (Jul)

Switzerland Consumer Confidence (Q3)

Hong Kong SAR Retail Sales (Jun)

Spain Consumer Confidence (Jul)

India Balance of Trade (Jul)

Canada Manufacturing PMI (Jul)

New Zealand Unemployment Rate (Q2)

Wednesday 3 August

Worldwide Services PMI** (Jul)

Australia Retail Sales (Jun)

Germany Balance of Trade (Jun)

Switzerland Inflation Rate (Jul)

Italy Retail Sales (Jun)

Euro Area Retail Sales (Jun)

US MBA Mortgage Applications (Jul)

Brazil Industrial Production (Jul), Interest Rate Decision

United States ISM non-Manufacturing PMI (Jul)

Thursday 4 August

Australia Balance of Trade (Jun)

India RBI Interest Rate Decision

Netherlands Inflation Rate (Jul)

United Kingdom Interest Rate decision

Canada Balance of Trade (Jun)

Czech Republic CNB Interest Rate Decision

United States Balance of Trade (Jun), Jobless Claims (Jul)

Friday 5 August

Japan Household Spending (Jun), Coincident Index (Jun)

Philippines Inflation Rate (Jul)

Australia RBA Statement on Monetary Policy

Indonesia GDP Growth Rate (Q2)

Singapore Retail Sales (Jun)

Germany Industrial Production (Jun)

United Kingdom Halifax House Price Index (Jul)

France Balance of Trade (Jun), Industrial Production (Jun)

Italy Industrial Production (Jun)

China Current Account (Q2)

Canada Unemployment Rate (Jul), Ivey PMI (Jul)

United States Non-farm Payrolls (Jul), Unemployment Rate (Jul), Consumer Credit (Jun)

What to watch

Manufacturing and Services PMIs

This week sees the release of S&P Global's manufacturing and services PMIs which will be watched with particular interest given the movement towards tightening central bank policies, surging inflation, and growing macroeconomic uncertainty. Flash PMIs pointed to a slowdown of growth in the UK, Australia, and Japan while the US and Eurozone registered outright contractions. There will be a particular focus on mainland China on Monday where the S&P Global/Caixin PMI will give a first economic insight into performance at the start of Q3.

Americas: US Construction spending, ISM Surveys, Balance of Trade. Canada Ivey PMI and unemployment

Last week saw some key events and releases for the US, namely the Fed FOMC meeting and GDP data, which pointed to a second quarter contraction and subsequently a technical recession. This week, US non-farm data is in focus, in addition to US construction spending, PMIs, ISM surveys, and balance of trade data.

Elsewhere, Canada's Manufacturing PMI will be released on Tuesday and will reveal the sector's performance amid the Bank of Canada's hopes of a soft landing. Employment has also been a topical subject in Canada with latest figures - released Friday - set to shed light on the jobs front.

Europe: Industrial production data for Germany, France, and Italy. Eurozone Retail sales and UK house prices

Industrial production figures for Germany, France, and Italy will be released on Friday, following the S&P Global Manufacturing PMIs. Growth is likely to have slowed across the three nations in June, with latest Flash PMIs hinting at a broader eurozone deterioration in July. Retail sales figures for the end of the second quarter will shed light on spending trends for the Eurozone as a whole, in the heat of surging inflation and growing uncertainty.

The UK, meanwhile, has the BoE meeting which will no doubt steal the focus. One eye will be kept on the Halifax House Price Index for signs of the property market cooling.

Asia-Pacific: Indonesia and Hong Kong SAR Q2 GDP

GDP data for Indonesia and Hong Kong SAR are set to dominate APAC releases in the coming week. Our forecasts point to a 3.8% rate of growth (slowing from 5.01% YoY) in Indonesia. More concerningly, in Hong Kong SAR, our estimates predict a second consecutive contraction at -0.84% (although slowing from Q1 decline of 4%)

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."