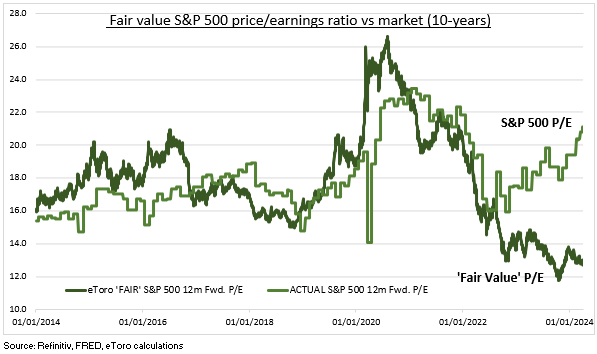

HEADWINDS: US valuation risks are rising again. The S&P 500 price/earnings ratio is now well above long term averages. And rising 10-yr bond yields widened the gap to our fair value P/E to a record 40% (see chart). Stocks have become less sensitive to rising yields over the past year, but there will still be a tipping point. US GDP growth ‘exceptionalism’ and concerns on higher-for-longer interest rates are pressuring up yields. Alongside a return of the catch-all ‘term premium’ of broader uncertainties from fiscal sustainability to election outcomes. This makes a Q1 earnings season recovery crucial, and supports our rotation to cheaper ‘insurance’ assets.

FAIR-VALUE: We use 10-yr US bond yields, corporate profitability, and long-term GDP growth estimates to estimate a ‘fair value’ S&P 500 (SPY (NYSE:SPY)) P/E ratio. It has a good long-term track record but this has broken down recently. The current 13x is low and a record 40% under the S&P 500 consensus 21x. It’s the biggest gap of the decade. And reflects the top-heavy market with ‘magnificent-seven’ concentration at records. And investor expectations for better earnings growth and potentially economic growth ahead. A 0.5% higher 10-yr bond yield cuts our P/E by 7%. A return to the long-term GDP outlook a decade ago (2.6% vs 1.8%) raises it 10%.

DOUBLE-FOCUS: It also reminds on the relative markets risk and reward. Tech sectors are the largest in US, already highly profitable, with already high valuations. They are well-supported, but the upside is now from elsewhere. We see an increasing rotation continuing to cheaper sectors, like financials (XLF) and to real estate (IYR). And to regions, like Europe (FEZ) and emerging markets (EEM). They have the most room for valuations to rise. They are also an ‘insurance’ to eventual valuation pressures if bond yields rise. And they have the double benefit of the most earnings upside to our base case of an economic soft landing and lower interest rates.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US valuation risks are rising

Published 05/04/2024, 08:09

Updated 09/02/2024, 07:53

US valuation risks are rising

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.