Forecasts of recession seem to be flowing from all corners these days. Still, this week’s initial estimate of economic activity for the first quarter (Apr. 27) is expected to show that growth prevails.

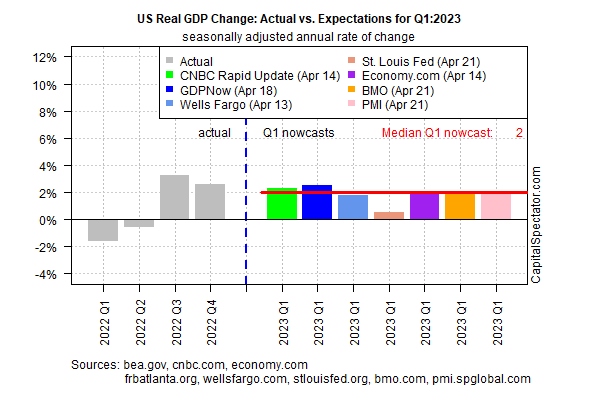

The median estimate for Q1 output held steady at a 2.0% rise, based on a set of nowcasts compiled by CapitalSpectator.com. The nowcast is unchanged from our previous update on Apr. 17. Meanwhile, today’s revision marks a modest slowdown from Q4’s 2.6% increase.

One of the components in the chart above switched to modestly positive estimates from negative in the previous estimates. As a result, all seven inputs are nowcasting growth for Q1.

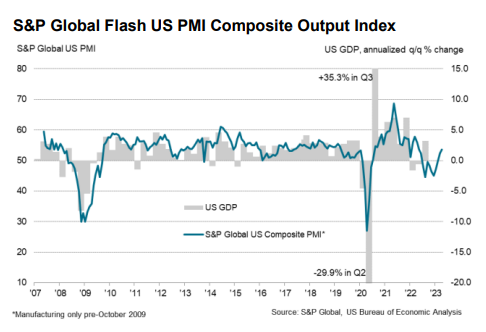

The survey-based Composite PMI, a GDP proxy, has recently strengthened, offering support for thinking that recession risk may be lower than some forecasts suggest. Chris Williamson, chief business economist at S&P Global Market Intelligence, said,

“The latest survey adds to signs that business activity has regained growth momentum after contracting over the seven months to January. The latest reading [for April] is indicative of GDP growing at an annualized rate of just over 2%.”

The economic expansion looks set to survive in the official Q1 data, but recession forecasts persist. A new survey of economists at companies and trade groups finds that “panelists are nearly evenly split on the probability that the U.S. economy will enter a recession in the next 12 months,” according to the National Association of Business Economics.

The poll shows that 44% of economists indicate a higher-than-50% probability of a downturn, while 53% suggest a lower-than-50% probability. Although today’s median nowcast for Q1 points to relatively high odds that output will stay positive, a substantial downside miss in Thursday’s data would signal that recession fears are more credible than today’s outlook implies.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.