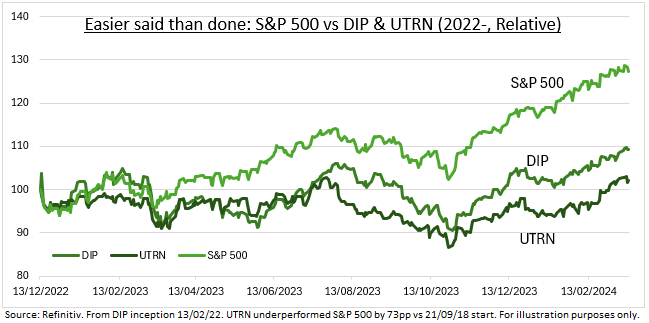

TURNAROUNDS: Charlie Munger of Berkshire Hathaway (NYSE:BRKa) (BRK.b) once said turning around a struggling business was ten-times harder than people think. Yet it is one of the most popular investment strategies for retail investors. Given their craving for a perceived deal and their longer-term investment outlook. There are many potential turnarounds front and centre today. From Paypal (PYPL) to Cisco (NASDAQ:CSCO), and Intel (NASDAQ:INTC) to Boeing (NYSE:BA), to name just a few. Yet the data tends to back up Munger. With stocks falling for a good reason, and turnarounds tough to quickly execute. ETFs following a stock turnaround strategy have done poorly (see chart). More interestingly, the equivalent in the corporate bond market has performed much better.

BUYING DIP: We look at two stock ETFs that have ‘buy the dip’ turnaround strategies. They are both tiny, relatively new, and US and short term focused. And performed poorly. BTD Capital Fund (DIP) uses AI to highlight short-term opportunities. Its largest positions are Universal Health (UHS), Newmont Mining (NYSE:NEM), Crown Castle (NYSE:CCI). Whilst the Vesper US Large Cap Short Term Reversal Strategy ETF (UTRN) looks for rebounds among the worst performers the prior week. Its largest holdings are Lennar (NYSE:LEN), Akamai (AKAM), DR Horton (DHI). Retail investor strategies may be longer term and less systematic, but this performance is a warning.

FALLEN ANGELS: We also looked at the ‘fallen angels’ strategy in corporate bonds. Buying the bonds of companies downgraded from investment grade to junk. The two largest ETFs tracking this are larger, longer standing, and both outperformed the high yield index (JNK). The VanEck Fallen Angel High Yield Bond ETF (ANGL) by 33%, since 2012, and iShares Fallen Angels ETF (FALN) by 16%, since 2016. The theory is that as a downgraded bond transitions from investment grade to high yield, there is a natural ownership switch. From those averse to default risk to those more accustomed to it. This transition creates credit mispricing and opportunity.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Turnarounds are difficult

Published 19/03/2024, 08:12

Updated 09/02/2024, 07:53

Turnarounds are difficult

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.