This post was written exclusively for Investing.com

- Gold broke out to the upside in dollars in June 2019

- Many currencies made new record lows against gold in 2019

- Last week the Swiss franc reached a new low

- King dollar is next

London is the international hub of gold and silver bullion trading. Central banks around the globe hold gold as an integral part of their foreign exchange reserves, and the Bank of England acts as a custodian for many nations. Ironically, the United Kingdom decided to sell half of its gold reserves at the turn of this century. The UK sold around 300 metric tons of the yellow metal via a transparent auction from 1991 through 2001. In 1999, the price of gold hit a low of $252.50 per ounce. In 2001, the low was at $255.

Gold has not traded below $300 since 2002, under $500 since 2005, or south of $1,000 since 2009. The UK, the nation that holds a significant percentage of the world’s gold, sold half its national treasure at a price that was under 20% of the current market price.

The latest leg in the bull market for gold that began at just over $250 per ounce started in June 2019, and gold is appreciating in all currencies. Years of central bank stimulus have caused an across-the-board devaluation of all foreign exchange instruments against the precious metal. The most recent fiat currency to fall to a new low against gold was the Swiss franc, which leaves only one, the U.S. dollar still to slip.

Gold broke out to the upside in dollars in June 2019

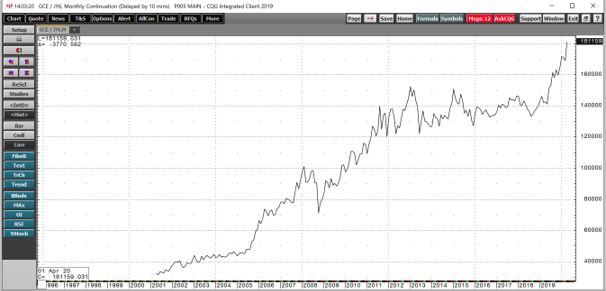

The U.S. Federal Reserve told markets to expect interest rates to decline in June 2019, which caused COMEX gold futures to break out to the upside from a $331.30 trading range that had been in place since 2014.

Source all charts: CQG

The quarterly chart above highlights that the next leg of the bull market that began around the start of this century commenced last June, when gold rose above technical resistance at $1377.50 per ounce. Both price momentum and relative strength indicators were rising in overbought territory.

However, the metric spent eight years, from 2004 through 2012, in oversold conditions. As of the end of last week, gold posted gains even over the past consecutive quarters. From 2008 through 2011, the yellow metal rose in twelve straight quarters.

The technical target on the upside stands at the 2011 all-time high of $1920.70, but in most other currencies, gold has already reached new record levels since the second half of last year.

Many currencies made new record lows against gold in 2019

Gold has reached all-time highs in almost all other currency terms over the past months.

The chart of gold in euros shows that it surpassed the record level from 2012 at 1376.88 euros in August 2019 and was trading at almost the 1550 level on April 17.

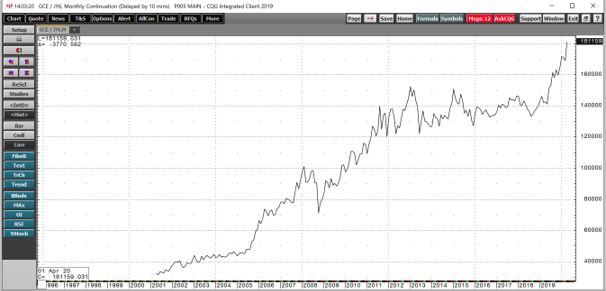

Gold in yen rose above its 2013 record high of 152,457 yen in July 2019 and was at 181,159 yen late last week.

In British pounds, the precious metal moved higher than its 2011 high of 1123.96 pounds in July 2019, as was at almost 1350 pounds per ounce on April 17. Gold has moved to new record levels in Australian and Canadian dollars, Chinese yuan, Russian rubles, and nearly all other currencies.

Until recently, only the prices of gold in U.S. dollar and Swiss franc were below the all-time high, but that changed last week.

Last week the Swiss franc reached a new low—King Dollar is next

The previous record peak in gold in Swiss francs came in 2012 at 1662.51 per ounce.

The monthly chart illustrates the long-term price action in gold in Swiss franc terms.

The daily chart shows that on April 13, gold in Swiss franc rose to just over 1700 per ounce for the first time, a new record high for the yellow metal in the Swiss currency.

Gold has a long history as money and central banks around the world validate the precious metal’s role as a currency when they hold it as part of their reserves. Perhaps the most bullish sign for gold is that it has broken to new highs against virtually all of the fiat currencies in the world.

Last week, the Swiss franc became another currency that fell to a new low against gold. It may not be long before the world’s reserve currency, the U.S. dollar gives way and the price of gold in USD terms rises to a new record level above the 2011 high at $1920.70 per ounce.