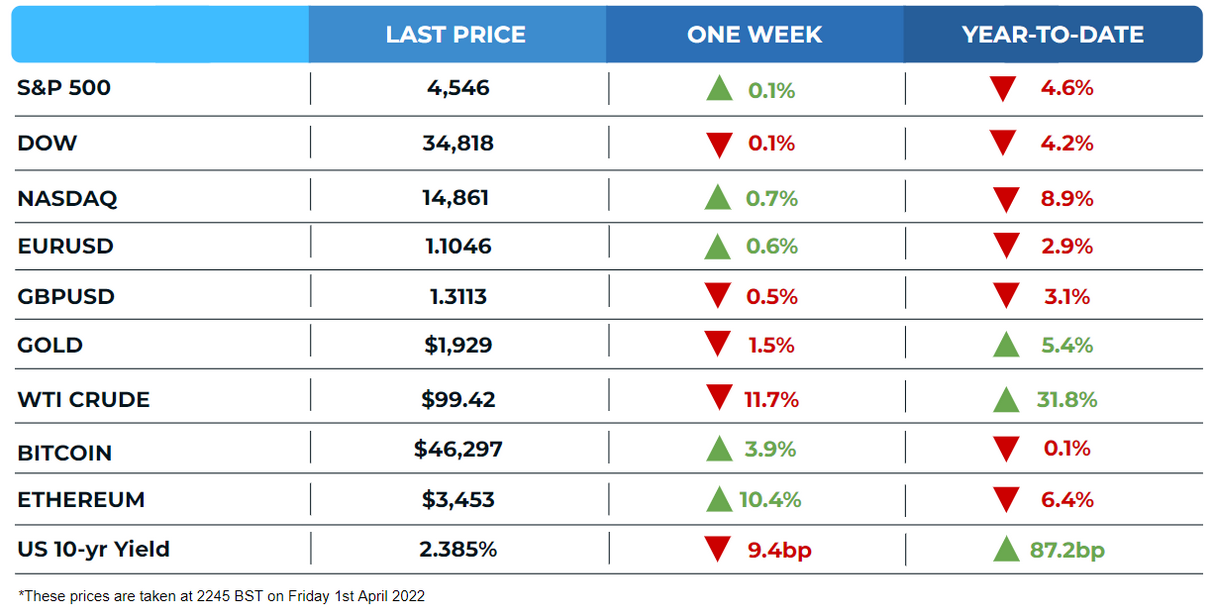

MARKETS

Markets: WTI crude closed back below $100/bbl following the move from the US to release roughly a million barrels of oil a day from its reserves for six months beginning in May. Meanwhile, for equities and fixed income, it was a game of two halves as progress of a Ukraine ceasefire was met by data supporting the narrative for further rate rises prompting the yield curve to briefly invert for the first time since 2019.

Crypto: Bitcoin traded through the key level of $45,500 this week allowing the price to briefly trade north of $48,000 and erase all of its YTD losses. While Ether outperformed, up by more than 10% and finished higher for a second consecutive month. The recent uptick comes as Ethereum's latest upgrade, which is expected to lower the blockchain’s carbon footprint, is expected in the coming months.

DEALS PAY THE BILLS

M&A and Private Equity

Nielsen (NYSE:NLSN), a media measurement firm has been acquired by Elliot Investment Management and Brookfield Asset Management Inc (LON:0KEH) in a $16bn takeover.

NPD Group, a market info provider is in talks to acquire Information Resources for $5bn.

HP (NYSE:HPQ), the multi-national information technology company has agreed to buy remote gear maker Poly for $3.3bn, all-cash.

RBC (NYSE:RY), the Canadian bank is in talks to buy UK-based wealth manager, Brewin Dolphin (LON:BRW) for $2.1bn.

Venture Capital and IPO

Helium, a blockchain provider that powers decentralised wireless networks has raised $200m at a $1.2bn valuation led by a16z and Tiger Global.

Blockchain.com has raised a new Series D round valuing it at $14bn, it was led by Lightspeed Venture Partners.

Mohalla Tech, an Indian startup is looking to raise a Series H at a $5bn led by Temasek. They created ShareChat and Moj.

Porsche, the German automaker could be valued at $100bn when it IPOs later this year. They have hired Goldmans, BofA and J.P. Morgan to advise on the listing.

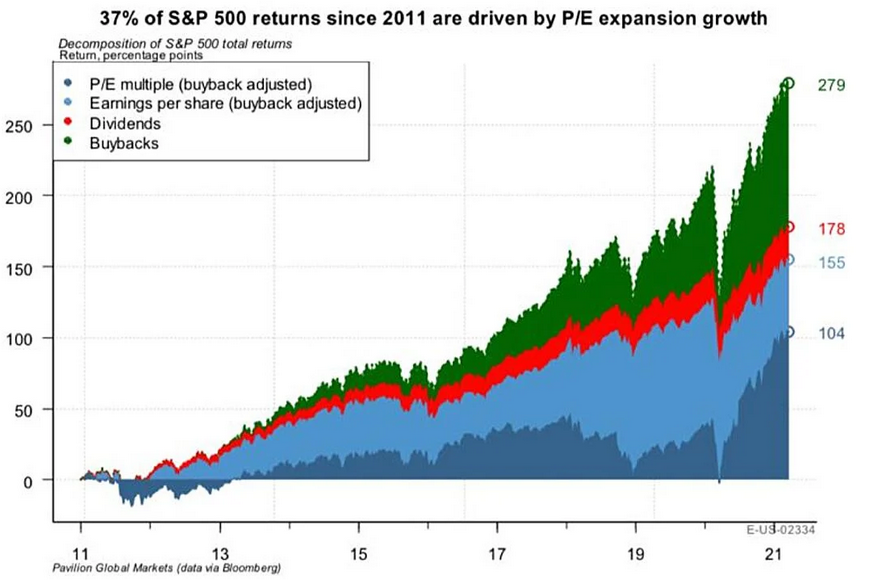

CHART OF THE WEEK

When you realise nearly 40% of S&P 500 stock market returns since 2011 have been driven by stock BUYBACKS. Financial engineering at its finest. Nobody’s going to know…

MARKET MAKER ON THE GO

MEME OF THE WEEK