US stocks decline

Yesterday, Monday 5 December, the US stock market fell.

Major indices such as S&P 500 and Nasdaq closed in negative after the recent positive days.

The reason behind the decline is that investors are worried that Fed will not slow down the interest rate hikes, following the strong data released by the Institute for Supply Management, yesterday.

The report, regarding the economic activity in the service sector, has shown an expansion of 56.5 while the forecast was 53.3.

Since the data is higher than expected, the Federal Reserve's monetary policy is not efficiently working at the moment, because the economy is still growing instead of slowing down.

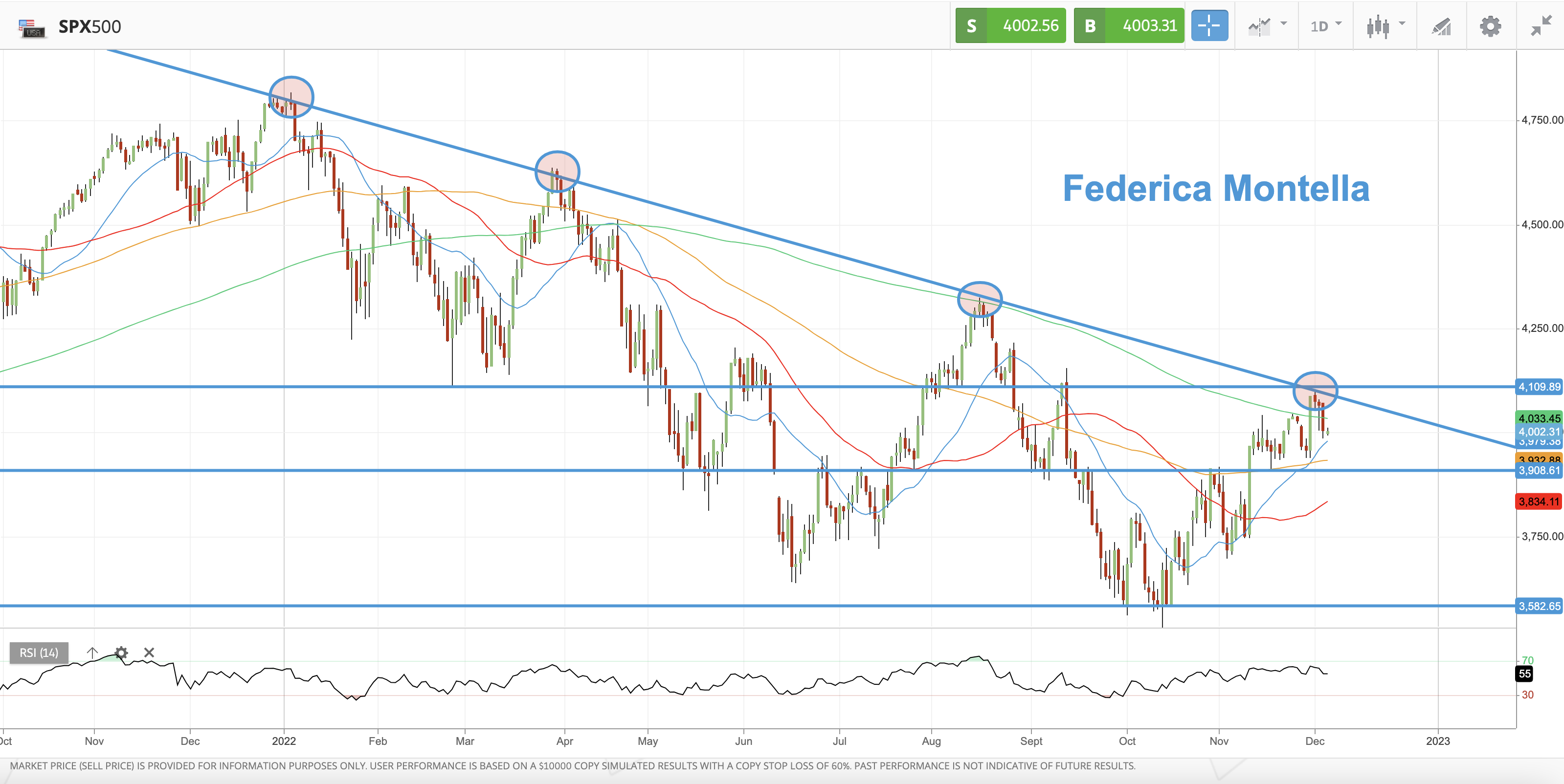

S&P 500 Technical Analysis - Daily Chart

The S&P 500 price has been rejected at the bear market trendline, for the fourth time, on 1 December (see red circles on the chart).

The index price fell below the 200-day MA (green moving average) yesterday after it was able to hold it for 3 days.

Those are bearish signals.

The fake breakout above the 200-day MA key level was likely generated by shorts covering by investors who panicked and closed their positions.

The next support levels for bullish investors are the 21-day MA (blue moving average) at around 3980 and then the horizontal support line at around 3900.

The only option to change the current scenario to a new bullish trend would be for the price to move back above the 200-day MA and then the trendline at around 4100.

The RSI moved lower to 55, indicating a bullish trend.

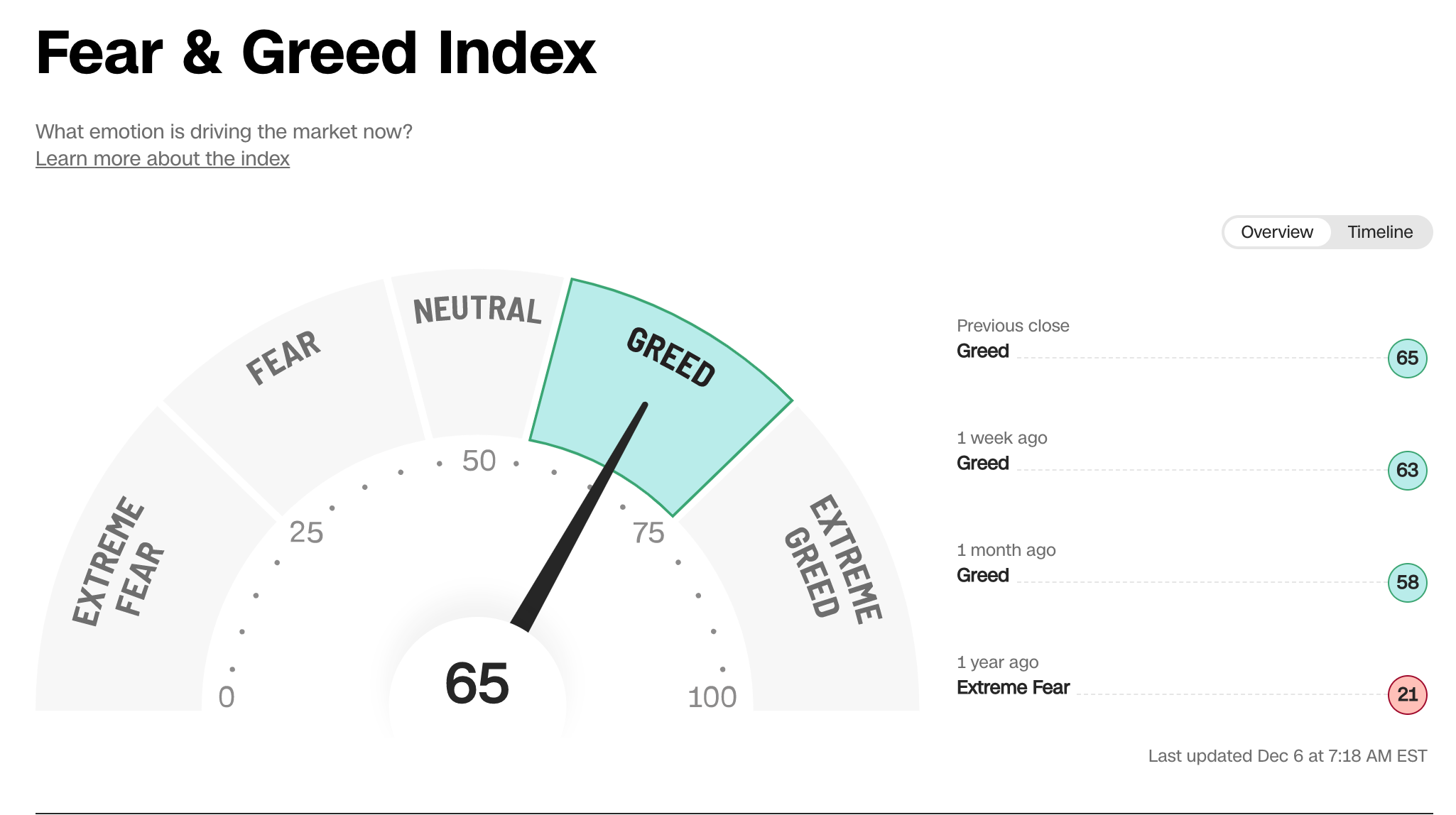

Sentiment Indicator - Fear & Greed Index

The market sentiment is at 65 in the "Greed" mode which is the same exact level registered yesterday.

FedWatch Tool - FED rates probabilities

79.4% of investors are expecting the FED to increase the interest rates by 0.50% in the next meeting.

The remaining 20.6% are expecting a 0.75% rate increase.

The data show us that the number of investors expecting an increase of 0.50% is the same as the last few days.

No other options are considered at this stage.

The next FED meeting is on 14 December 2022.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Strong economic data means stock decline

Published 06/12/2022, 13:47

Updated 28/07/2023, 11:55

Strong economic data means stock decline

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

yes

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.