- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Silver: Is It Ready To Step Out Of Gold's Shadow?

Having lurked under the imposing cover of Big Brother gold for what seemed like an eternity, silver emerged from gold's shadows and into the limelight in July as prices of both precious metals hit astounding heights.

But it proved to be a brief escape.

Stymied in September by a risk-on mood across markets that also boosted arch-rival dollar—which became a haven of choice despite the gaping U.S. fiscal deficit and other economic ills from COVID-19—gold tumbled, and so did silver.

However, with the dollar getting crushed over the past week and the two metals taking off again on speculation that another coronavirus stimulus might see the light of day before the Nov. 3 U.S. election, the question is: Can silver forge its own path, independent of gold?

Yes, but not right away.

At Wednesday’s early highs in Asian trading, silver for December delivery on New York’s COMEX got to a near two-week peak at $25.28 per ounce.

Most analysts think silver needs to get well beyond $25.50 to break new ground and stand on its own.

Industrial Demand A Prerequisite

Metals tracker Christopher Lewis wrote in a blog on FX Empire:

”Given enough time, you also have to question whether or not we are going to see industrial demand as well, which is a major influence on what happens next with silver.”

And that’s the key for making silver independent: industrial usage.

What happened in the July-August stretch was an aberration in the world of silver.

As gold futures hit record highs of nearly $2,090 an ounce, futures of silver saw a 55% jump—outperforming the hike in gold by six-to-one.

Adding to the sudden spotlight on silver was the easing of COVID-19 restrictions in the U.S. and elsewhere which kick-started the economic recovery.

The nascent economic recovery in those two months gave the illusion that industrial demand for silver—used in jewelry, cutlery and coin-minting—was taking off.

September’s price crunch in precious metals, new spikes in coronavirus cases in the U.S., Europe and Asia and a resulting slowdown in economic recovery shows silver nowhere near a revolution in industrial demand—let alone standing on its own, without the cover of Big Brother gold.

50-Day EMA Is Key

So, where is silver's current trajectory headed?

Silver watcher Vladimir Zernov said in a separate post on FX Empire:

“From a big picture point of view, silver needs to settle above the 50-day EMA in order to continue its upside move. If silver fails to move above this resistance level, the risks of a sell-off will increase.”

The 50-Day EMA, or Exponential Moving Average, for silver futures is $24.774.

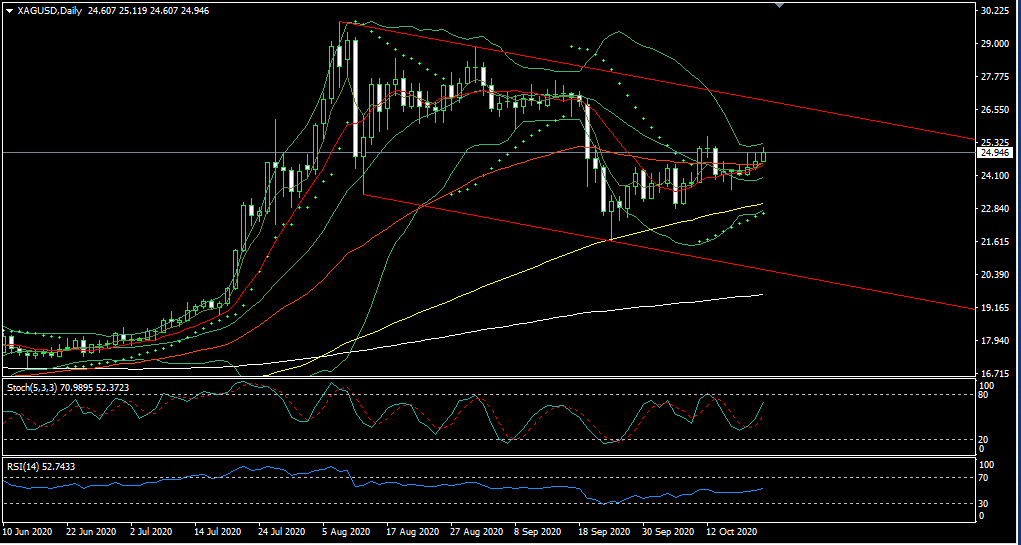

Chart Courtesy of Sunil Kumar Dixit

Independent analyst Sunil Kumar Dixit also points to the importance of keeping above the 50-Day EMA.

But he also says it’s more crucial to track gold’s movements to determine how far silver could go.

In an email to Investing.com, Dixit said:

“Gold has been holding above the psychological handle of $1900 and also broke above previous resistance of $1,920, which signals buyers will come at value areas to target it upwards for $1,927-$1,935. Further news on stimulus may boost the rally to $1,955-$1,968.”

“Silver has been holding above crucial support of $24 and broke above $25 which signals further strength towards $26 and 26.90 Here it is important to hold above 50 Day EMA 24.50.”

Investing.com has a “Strong Sell” on spot gold’s 5-, 10- and 15-minute, and the one- and 5-hourly charts. The only “Buy” signals are on the weekly and monthly charts.

Investing.com also has a “Buy” signal on spot silver’s 15- and 30-minute charts as well as the hourly- and 5-hour indicators and the daily, weekly and monthly counts.

The deepest downside or support is at $13.04 while the highest resistance or bullish level is $35.03

Jeffrey Halley, Sydney-based analyst at New York’s OANDA, said if the dollar continues to wilt, there was no reason for the precious metals rally not to continue.

“Should stimulus negotiations reach an impasse, the ensuing sell-off in equity markets will test gold's resolve. Recent selloffs by equity markets have also seen gold prices crushed as well.”

“We have yet to see evidence that gold can stand on its own two feet as a haven asset in that scenario in recent times.”

That tells how well silver is positioned.

Disclaimer: Barani Krishnan does not own or hold a position in the commodities or securities he writes about.

Related Articles

Natural gas prices have slipped lower to start the week as the market remains uncertain about the balance of supply and demand, making it hard to predict future price...

Gold faces pressure as US bond yields rise and the dollar strengthens. China’s stimulus efforts could offer potential support for the precious metal. Key support levels near...

Crude oil is trading with marginal losses this morning after settling higher at the end of last week. Concerns over waning demand in China have largely overshadowed the threats of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.