By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

- Should You Buy Dollars at these Levels?

- NZD: How to Trade the RBNZ Rate Decision

- CAD Soars on Higher Oil Prices

- AUD Sinks on Flat Job Advertisement Growth

- GBP/USD V Shaped Recovery

Should You Buy Dollars at these Levels?

With no U.S. economic reports released Tuesday, there was very little consistency in the performance of the dollar. But if you are thinking about buying dollars here, we believe that current levels represent an attractive opportunity to initiate new long positions with orders to add slightly lower. To be more specific, the two-day decline in USD/JPY stopped just short of the 123.75 support level. Buying here with orders to scale-in around 122.50 could be a good strategy. If you are looking to trade euros, we prefer selling EUR/USD on the 1.13 handle. We had been looking for consolidation and profit taking in the dollar at the beginning of the week but with less than 48 hours to go before the release of U.S. retail sales, it is time for short-term traders to start thinking about getting back into long dollar positions. The dollar’s long-term uptrend has not changed but in the short term, this latest pullback gives us the opportunity to buy the dollar at lower levels. U.S. retail sales are expected to rebound strongly after stagnating in May. We already know that auto sales were hot last month and while expectations are high, the improvement in the labor market and rise in average hourly earnings means that U.S. consumers will be coming back after taking a breather in April. Given recent reports, the Federal Reserve will most likely prepare the market for September tightening. We expect the dollar to trade higher leading up to the June monetary policy announcement and then extend its gains in the days that follow. Yellen has made it clear that she does not need to see a major increase in core prices as long as labor-market slack is declining, making them confident that their inflation target will be reached. At the same time, we don’t see a Greek debt deal for at least 2 more weeks and during that time, the country’s creditors could flex their muscle and say that they would be willing to kick Greece out of the Eurozone if they do not accept reforms. When push comes to shove, we believe that an eleventh-hour deal will be reached but this can translate into more near-term pain for EUR/USD.

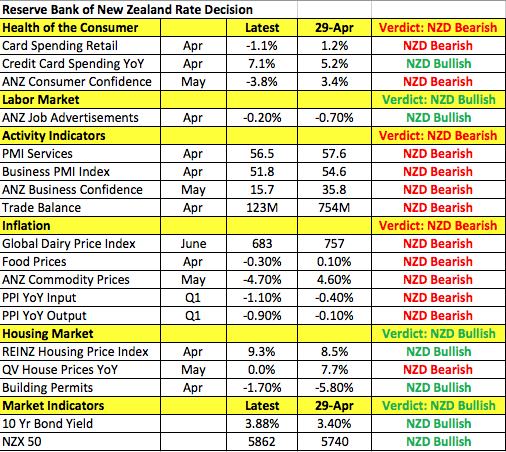

NZD: How to Trade the RBNZ Rate Decision

One of the most important event risks for currencies this week is Wednesday’s Reserve Bank of New Zealand monetary policy announcement. The decision will be a close one but we believe that the RBNZ will cut interest rates. Back in April when they last met, the central bank warned that it could lower interest rates if demand weakens and inflationary pressures continue to fall. They also described the NZ dollar as unjustifiably and unsustainably high, sending the currency sharply lower. Since then, the economy has weakened further with consumer spending and confidence deteriorating, manufacturing and service-sector activity slowing and price pressures declining. Based on these readings alone, the central bank should cut interest rates but according to the table below, the housing market is still holding up well and most importantly, the New Zealand dollar has fallen sharply since the last monetary policy meeting, reducing the pressure to ease. Should the Reserve Bank cut interest rates, NZD/USD will break 70 cents. If they leave rates on hold, we could see a knee-jerk rally, though a dovish tone should limit the bounce in the pair. Meanwhile, the best-performing currency Tuesday was the Canadian dollar. No economic data was released from Canada but oil prices jumped over 3%, taking the price of crude above $60 a barrel. The Australian dollar, on the other hand, declined despite stronger business confidence and a rise in home loans as AUD traders chose to take their cue from the lack of increase in job advertisements.

EUR Should be Trading Lower

Euro ended the day unchanged against the U.S. dollar after rising as high as 1.1345 in the early European trading session and falling as low as 1.1214 at the NY open. The main news flow continues to be Greece and the conflicting headlines have put the currency pair on a rollercoaster ride. Tsipras’ proposal has been received and is under review. According to EU officials, the plan is not credible and there are still differences with Greece on what has to happen by the end of the month. Germany’s Schaeuble continues to express his dissatisfaction by saying that his views differ from Varoufakis, which implies that they are willing to let Greece leave the Eurozone if their reforms are insufficient. We doubt that it will go that far, but given the risk and the unlikelihood of a deal in the next 2 weeks, euro should be trading lower. As such we are looking for another test of 1.1050 before the end of the month. Meanwhile, the weaker euro and Quantitative Easing continues to lend support to the economy. Labor costs are on the rise along with capital expenditures in the first quarter. Wednesday’s French industrial production report will show further evidence of this with a continued recovery in the Eurozone’s second largest economy.

GBP/USD V Shaped Recovery

Sterling ended the day only slightly higher against the greenback but its modest change masked a strong intraday recovery in the currency. During the North American trading session sterling jumped more than 100 pips on no specific catalyst. Tuesday morning’s U.K. trade data was better than expected but the report was released during the European session and the reaction was limited. The country’s trade deficit narrowed to GBP8.56 billion from GBP10.12 billion on the back of stronger exports and lower imports. The 10-year Gilt and US Treasury yield spread also moved in favor of GBP/USD but these 2 things alone do not explain the sudden turnaround in the currency. Nonetheless, sterling remains in play over the next 24 hours with industrial production scheduled for release along with speeches from Bank of England Governor Carney and Chancellor Osborne.