After a strong close on Wall Street, European stocks are looking to play catch up, although grim coronavirus statistics and growing fears over a second wave will keep risk sentiment in check.

Fears of lockdown restrictions being re-imposed or economies being reopened at a slower pace have weighed on sentiment across the week resulting in choppy trading and a constant struggle between the bulls and the bears. Whilst the FTSE closed the previous session in positive territory and aims for another jump higher on the open, the index is on track for a 2% loss across the week. Meanwhile the S&P is on track for a flat weekly move despite being up as much as 1.8% and down by as much as 2.4% at different points across the week.

In the US several states posted the highest one day increase in daily coronavirus infections whilst Texas has slammed on the brakes on its reopening plan, reversing course after just one month of reopening, as new cases hit a record 5996. Texas has been operating a more aggressive reopening plan, easing restrictions at as a faster rate that New York, which is still seeing improving stats.

US recorded its highest number of daily cases, with an increase of 42,000 infections. Concerns are rising that the fragile economic recovery could be knocked off track, however hope that stimulus could offset this is keeping the markets range bound.

US data in the previous session showed just how fragile the economic recovery is. Whilst durable goods soared, jobless claims showed that the improvement in the labour market is slowing.

With little on the European economic calendar to grab traders’ attention, a relatively quiet session is expected. In the afternoon, US Personal consumption expenditure and consumer confidence data could provide fresh impetus.

Oil extends gains, but remains cautious

After steep falls mid-week, oil continued its recovery, extending gains amid hopes of continued fuel demand recovery. Satellite traffic data from China, US and Europe is showing growing levels, boosting optimism surrounding fuel demand. Gains will remain capped as concerns surrounding oversupply linger following EIA inventory data showing a much bigger than expected inventory build, supporting a similar find from API data earlier in the week.

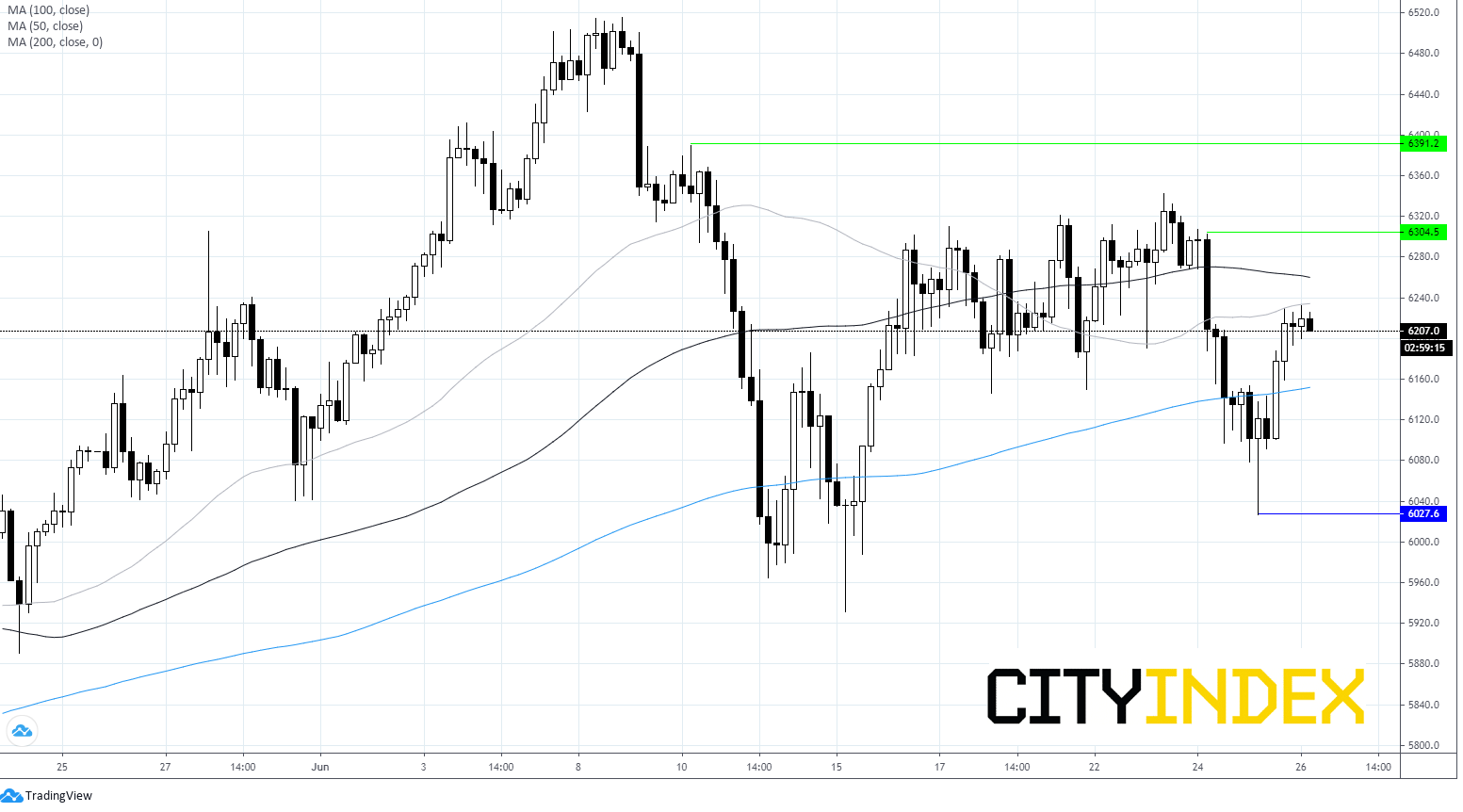

FTSE Chart

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."