Gold prices set for weekly gains on dovish Fed outlook; silver near record high

Many retail investors focus primarily on equities, while bonds often end up in the shadows. But with recent sharp rises in global government yields, bonds are trying to tell us something important—even for equity-focused retail investors.

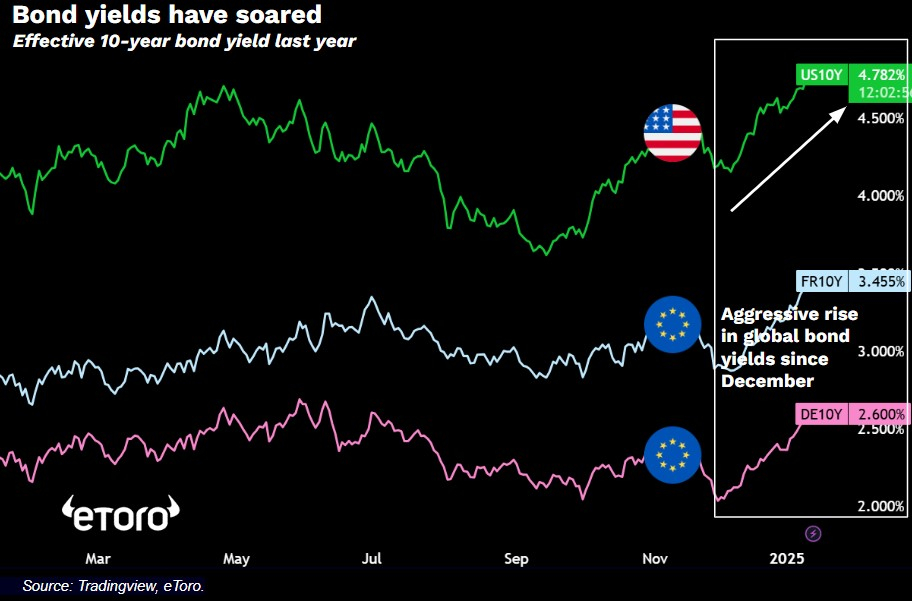

The US 10-year Treasury yield is once again pointing towards 5%. Since bottoming out at 3.6% in September last year, it has risen significantly, especially since early December, and has now hit 4.7%. A similar trend is evident in Europe, where yields on UK 10-year, French, and German government bonds have seen dramatic increases since December.

This is happening simultaneously with the central banks' short-term key interest rates, pointing downwards. So why are government yields rising so fast? There is no clear answer, but a combination of several factors has created a sell-off of government bonds, causing bond yields to rise.

Firstly, the US economy continues to surprise on the upside. Most recently with Friday's jobs report, which showed 256,000 new jobs and a drop in unemployment to 4.1%. Secondly, inflation is more resilient than hoped, and harder to get below the 2% target. This, along with the strong economy, is helping to postpone expectations for the Fed to cut interest rates. After the strong jobs report, the market is now only pricing in a single cut in 2025. Third, growing budget deficits and rising debt levels are creating increased credit risk and uncertainty for bond investors.

Higher bond yields and falling bond prices do not only affect bond investors. The correlation between bonds and equities is close, and the 10-year US Treasury bond acts as a benchmark for other financial assets and typically sets the standard for a theoretical risk-free return.

Typically, investors demand a higher return—a risk premium—on riskier stocks than on government bonds, which are generally considered among the safest investments (though perhaps less so as government debt builds up).

With bond yields approaching 5%, the risk premium on US stocks is narrowing. The S&P 500 index trades at an overall Price/Earnings multiple of 22x, meaning the index delivers $ 4.5 in earnings for every $ 100 invested (1/22) — an earnings yield of 4.5%. This makes the typical risk premium for holding stocks over bonds lower than it has been for a long time.

We can expect that sooner or later either equities or bonds will have to give in to rebalance the risk premium. Further increases in bond yields could put pressure on the stock market, but also make bond returns even more attractive to retail investors. US Treasuries are now within reach of delivering an expected annual return in dollar terms of almost 5% over the next ten years.