Read our guide on how to interpret the weekly COT report

As of Tuesday 17th December:

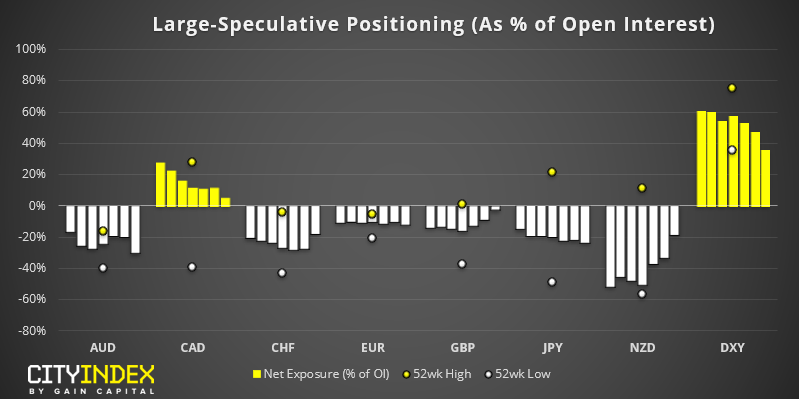

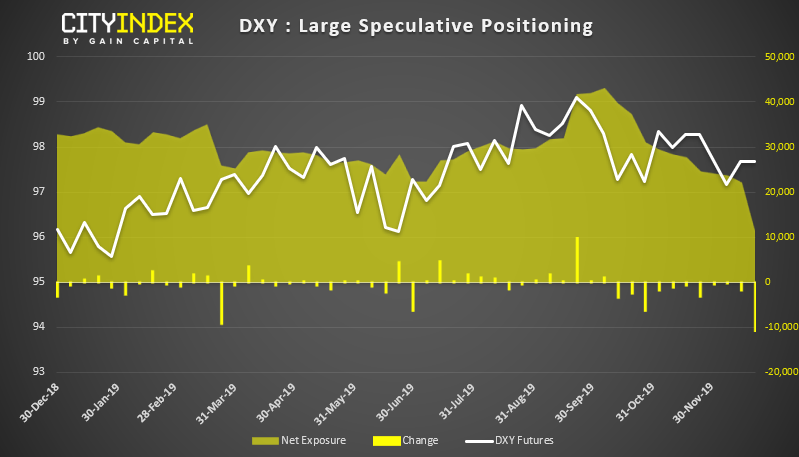

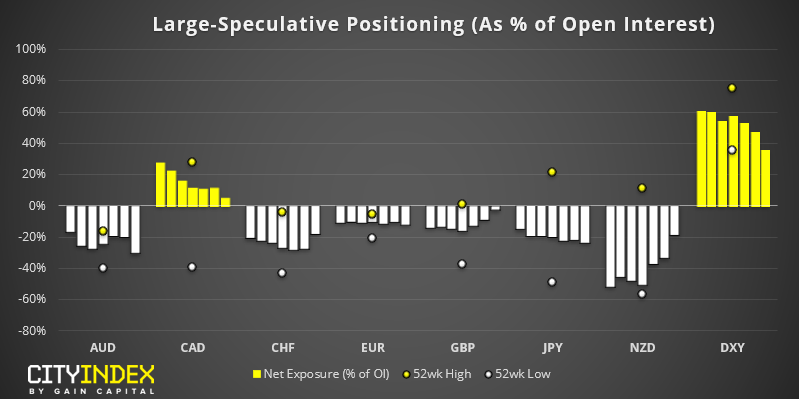

DXY: Bullish exposure fell to its lowest level in 18-months. Falling by -10.6k contracts, it was its largest weekly fall in 2.5 years. Gross longs are their lowest level since April 2018 and gross shorts have risen to a 3-month high. However, whilst this leaves room for further downside as we head into the new year, the monthly chart is on track for a bullish hammer which would be confirmed with a break above 98.38.

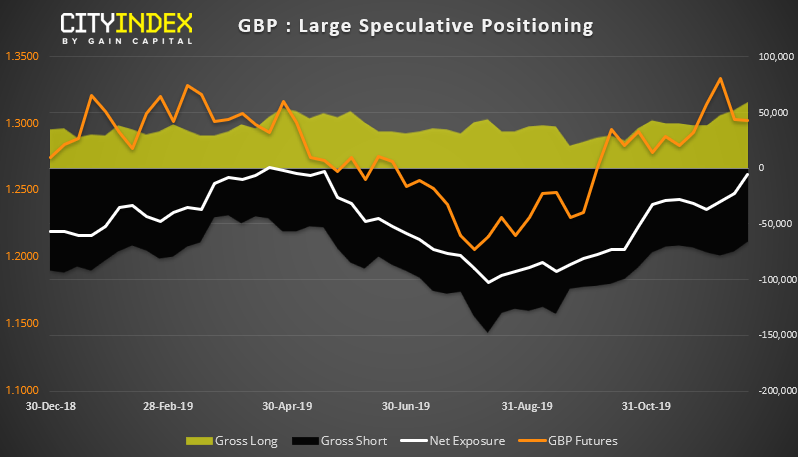

GBP: We were half expecting to see GBP traders flip to net-long exposure after Johnsons election victory. Yet with doubts still lingering over Brexit, it was not to be. And given GBP has retraced all of its election gains, its likely to remain net-short until we see a major breakthrough and confirmation that a hard Brexit will be avoided. For now, 1.30 appears to be a sticky level heading into 2020.

NZD: Bears have continued to capitulate, yet bulls remain cautiously on the side. We expect this to change as we head into 2020 as economic data overwhelmingly points towards a hold, and traders still don’t appear to be positioned for this outcome.

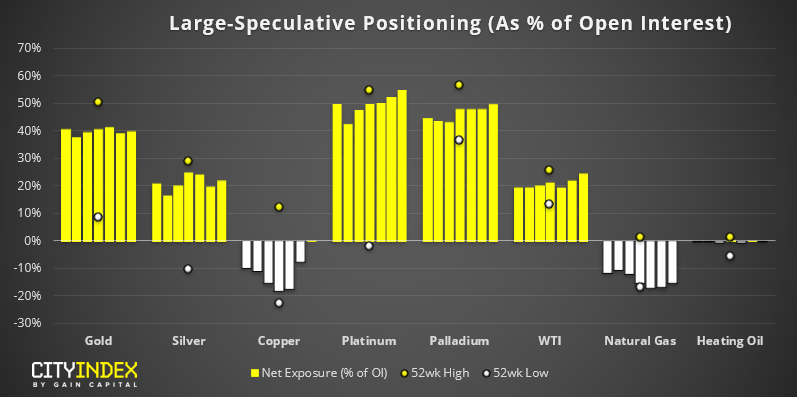

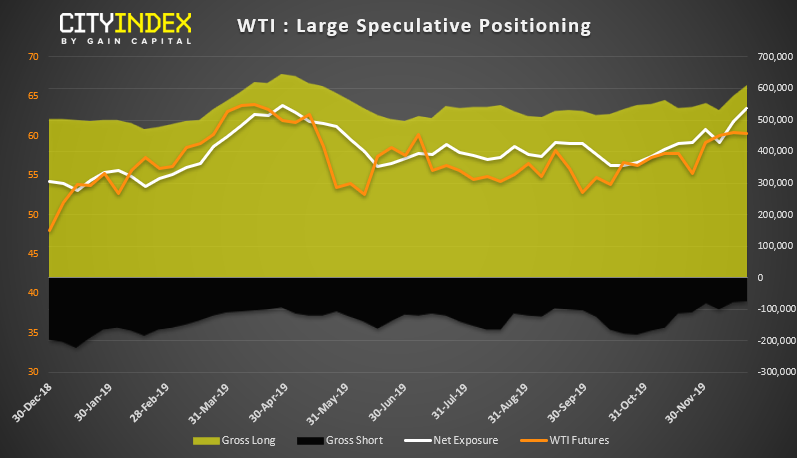

As of Tuesday 17th December:

WTI: Oil is back above $60 and net-long exposure is at its highest level since April. Technically it remains within a bullish channel, although a two-bar reversal on Friday warns of a retracement from the highs. As we head into the new year, we remain bullish above 58.70 – 59.00.

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.