Potential for a new high in the FTSE 100. The FTSE 100, a key indicator of the UK's largest companies, has been a point of concern for investors lately. The primary culprit? Its lack of exposure to the booming tech sector.

Across the pond, the S&P 500 in the US has been on a tear, fueled by the strong performance of tech giants. These innovative companies have been major drivers of growth, propelling the American index to new highs. In contrast, the FTSE 100, heavily weighted towards traditional sectors like mining, oil, and banks, hasn't kept pace.

The FTSE's woes are compounded by anxieties surrounding the global economic slowdown. Concerns about a potential recession are dampening investor enthusiasm for cyclical sectors like mining and oil. These industries typically thrive in periods of strong economic growth, and with fears of a downturn looming, investors are hesitant to jump in.

Furthermore, the prospect of persistently high interest rates throws another wrench into the mix. Central banks are raising rates to combat inflation, which can stifle economic activity and further hinder the performance of these interest-rate sensitive sectors.

While the FTSE 100 offers a healthy dose of stability with its established companies, its lack of diversification, particularly in the red-hot tech arena, is hindering its growth potential. Investors seeking exposure to the current market darlings may find themselves looking elsewhere until the economic outlook brightens and traditional sectors regain their luster.

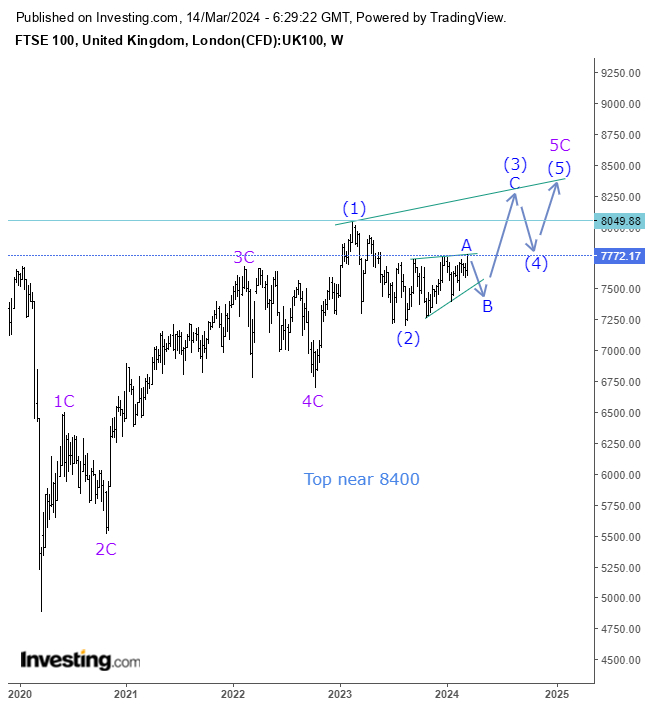

For that reason the FTSE will continue to underperform the S&P 500. Despite this, Elliott wave analysis suggests the FTSE 100 will make a new all-time high. I believe the rally from the low in 2020 is an impulse wave [1C,2C,3C,4C,5C] with an extension in wave 5C. This extension is probably an ending diagonal [(1),(2),(3),(4),(5)] which is a common terminal pattern, terminal because the pattern takes the form of a rising wedge between two converging trendlines. A slowing economy would act as a drag on the advance, this explains why the waves are overlapping in the final move up. This means we are near the top. On the chart you can see we are currently is wave (3), this wave will make a new all-time high. At the end of the five-wave sequence the FTSE 100 could top near 8400.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Potential for a new high in the FTSE 100

Published 17/03/2024, 07:40

Updated 17/03/2024, 07:38

Potential for a new high in the FTSE 100

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.