FX Brief:

- Lack of economic data, market-moving headlines or, pretty much anything made for a quiet session in Asia. Traders will now be focussed on next week’s Fed meetings, so we may well find trading ranges to be below average and in a ‘wait and see’ holding pattern.

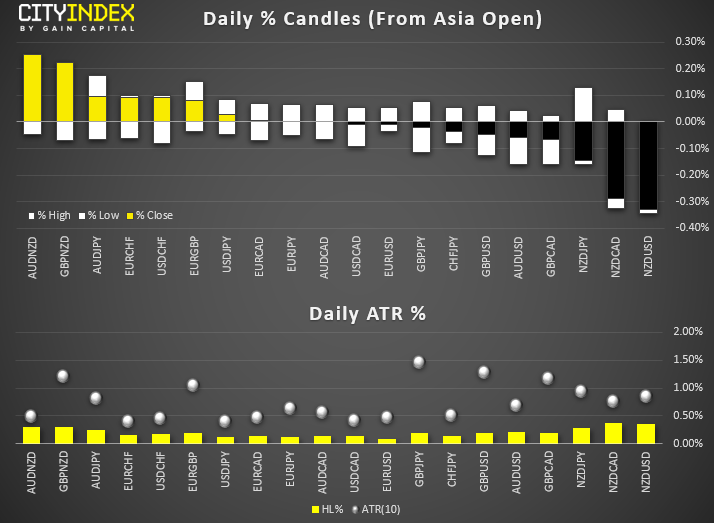

- Brexit uncertainty weighed slightly on risk, seeing NZD and AUD weaken with NZD currently the weakest currency and largest mover of the session. NZD/JPY has broken yesterday’s low to suggest a reversal could be underway and ZD/USD has touched a 5-day low.

- As you’d expect, FX majors trade in narrow ranges and, across the 20 FX pairs we track, the daily ranges have averaged just 30% of their ATR. Still, this leaves potential meat on the bone should any headlines see volatility stir throughout the European or US session.

Equity Brief:

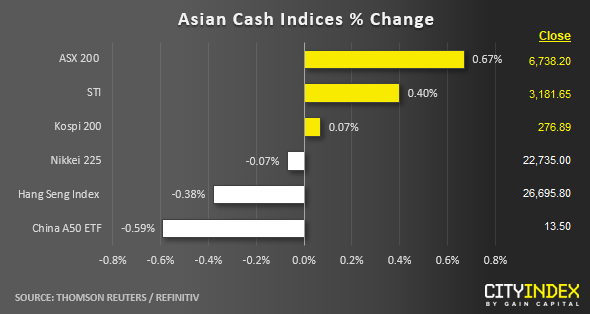

- Key Asian stock markets are trading in a mix fashion as at today’s Asia mid-session. Dismal earnings result from U.S. bellwether technology/consumer discretionary stock, Amazon and the latest Brexit fiasco where U.K PM Boris Johnson is now seeking parliament approval for a snap election on 12 Dec have sucked out some “bullish optimism” from the markets.

- Singapore’s Straits Times Index has continued to surge with a gain of 0.45% and its now on sight for a weekly gain of 2.3%, the best performance since Jun 2019 led by a stellar rally of 7% seen in Singapore Exchange where the local bourse has reported the biggest quarterly net profit increase in 12 years; $114.2 million in Q1 ending Sep 2019, up 25.5% y/y.

- Also, Singapore property market has continued to show signs of resilient despite a global economic slowdown. Private residential prices have increased to 1.3% in the past 3 months ended Sep 2019, up from the preliminary estimate of 0.9% gain.

- Australia’s ASX 200 is the best performer so far today with a gain of 0.67% led by the healthcare sector which has rallied by 2.66%.

Up Next

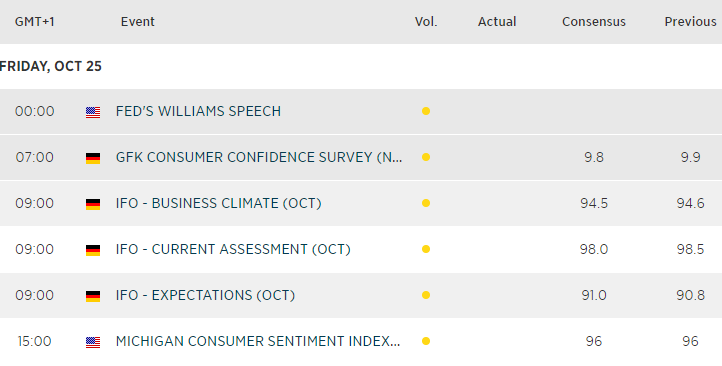

- A quiet session overall for economic data. German IFO warrants a look though, as the business sentiment indicator showed minor signs of a revival with its first rise in 6-month (from multi-year, pessimistic lows….). EUR/USD closed below 1.1100 yet it remains a key level going forward, so if the rebound continues we could expect Euro to break back above this level. If extend its retracement lower if sentiment sours once more.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."