Assuming we don’t see a repeat of January 2019’s yen flash-crash, we’re looking for these pairs to extend their bullish trends.

It was one year tomorrow that JPY pairs exhibited extreme volatility in a low liquidity environment. Given that Japanese exchanges will remain closed until Monday, liquidity is expected to remain low for the remainder of the week during Asian hours which could leave JPY pairs vulnerable to another flash-crash. But hopefully, prices will continue to coil and wait for volumes to return, before extending their trends.

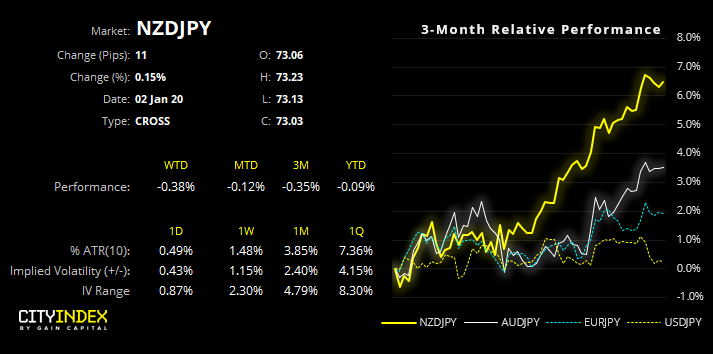

NZD/JPY: The trend remains firmly bullish and prices have found support above the 10-day eMA. It could be argued that it requires a deeper pullback but, until price action presents us with one, we’re to assume the trend will remain in place. With prices coiling up in a potential bull-flag formation, we’re looking for this to break higher.

However, take note that gap resistance between 73.47-73.62 has so far been respected, so we’d prefer to see a break above this resistance zone before assuming trend continuation.

AUD/JPY: Whilst its advance has not kept up at the same pace of NZD/JPY, AUD/JPY is trading within a bullish channel and now coiling up near the highs. With it holding above the 10 and 20-day eMA’s, we’re also looking for this to break higher.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."