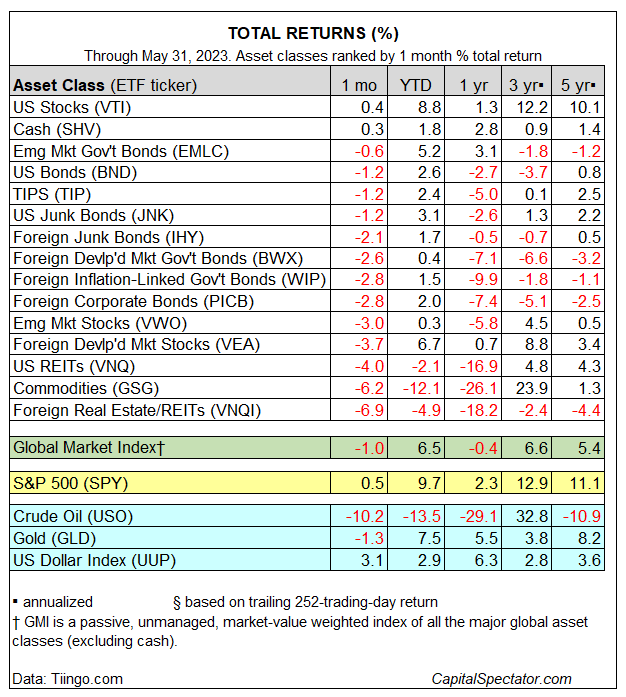

Most of the major asset classes fell in May. The upside exceptions: U.S. stocks and cash. Otherwise, red ink prevailed last month, based on a set of proxy ETFs representing the world’s primary markets.

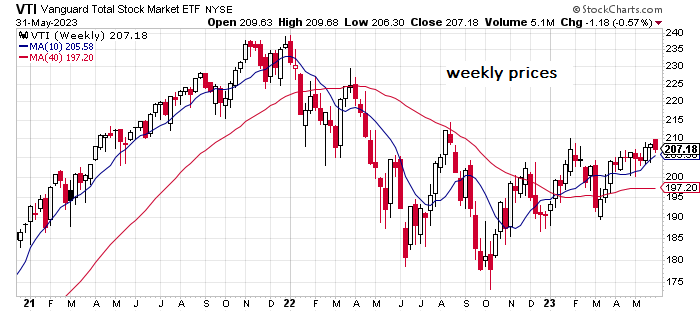

Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) edged up 0.4% in May, marking the fund’s third straight monthly gain. VTI is also posting the strongest year-to-date rise for the major asset classes, advancing nearly 9% so far in 2023.

Most markets around the world are sitting on gains for the year. One of the handfuls of exceptions: foreign real estate/REITs via Vanguard Global ex-U.S. Real Estate Index Fund ETF (NASDAQ:VNQI). The ETF suffered the biggest loss in May among the major asset classes and is down 4.9% for the year.

The Global Market Index (GMI) fell last month, losing 1.0%. The decline is the first monthly setback for the index since February. This unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights and represents a competitive benchmark for multi-asset-class portfolios. Despite last month’s loss, GMI is holding on to a solid 6.5% year-to-date rise.

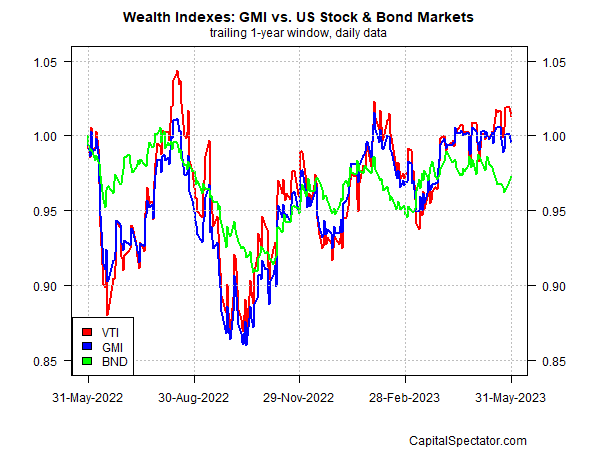

Reviewing GMI’s performance in context with U.S. stocks (VTI) and U.S. bonds (BND) over the past year continues to reflect a relatively narrow range of performances. GMI’s one-year performance is a fractional 0.4% decline vs. a 1.3% rise for VTI and a 2.7% drop for BND.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI