Going into Friday’s Us jobs data it seemed like the immediate path of interest rates would be decided, but it wasn’t. The outcome showed a resilient labour market in the US, with growing employment, but a little bit slower than anticipated, while the unemployment rate ticked down. Meanwhile, the stronger-than-expected wage growth likely saw some jitters arise as wage inflation continues to be a concern.

The outcome of the data was a lack of clarity on what will happen at the September 18 FOMC meeting. The economy is showing signs of deceleration but there is no clear indication as to whether 25 or 50 basis points would be the appropriate decision for the first rate cut from the Federal Reserve. Will the CPI data later this week give more insight?

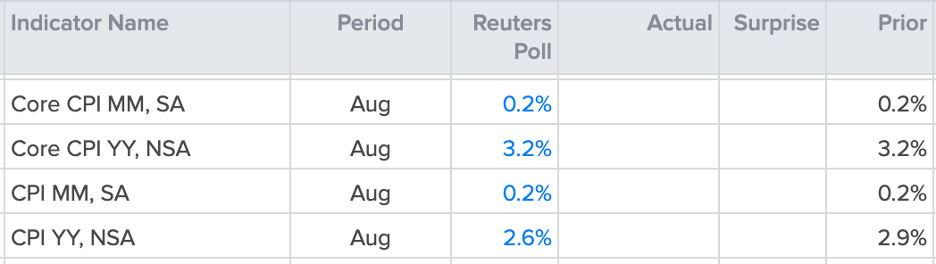

So far, the view on how much to cut depends on one’s view of the economy. So far, the data has been pretty ambiguous, so it can be read either way. Forecasts for the August inflation report suggest a significant drop in headline CPI, from 2.9% to 2.6%, which would be the lowest reading since March 2021. The disinflation process has stalled in recent months but if forecasts are right, the August drop could see expectations lean closer to a 50 basis point cut throughout this week, possibly giving risk assets another leg higher.

US CPI expectations

Source: refintiv

That said, focus may remain on the core CPI data, which has been sticky for some time. A lack of progress in less volatile prices could see the risk-positive momentum stall this week as traders may determine that the reading is not soft enough to convince the Federal Reserve to cut 50 basis points next week.

The momentum so far this week has started pretty solid for equities in Asia and Europe, with US equities seeing some further resistance with a stronger dollar and rising yields. Commodities have also started the week on the front foot, but gold is struggling to find upside support as the precious metal seems to be lacking direction ahead of the CPI data on Wednesday. Both a recession and lower rates would benefit gold so it is likely that buyers are taking it easy before committing to the commodity, with focus on how the data plays out over the coming days.

XAU/USD daily chart

Past performance is not a reliable indicator of future results.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.01% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

The information provided is not to be considered investment advice or investment research. Capital.com will not be liable for any losses from the use of the information provided.'

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Market Analysis: as NFP failed to do so, will US CPI determine rate cut size?

Published 09/09/2024, 12:51

Market Analysis: as NFP failed to do so, will US CPI determine rate cut size?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.