Love Hemp (AQUIS:LIFE) has established a leading presence in the UK CBD market and is looking to replicate this achievement globally. Key to its success will be product development, the introduction of new sales channels, both online and offline, and securing global distribution agreements. The company will continue brand development via large-scale marketing campaigns and leveraging agreements with the Ultimate Fighting Championship (UFC) and high-profile ambassadors such as British boxer Anthony Joshua.

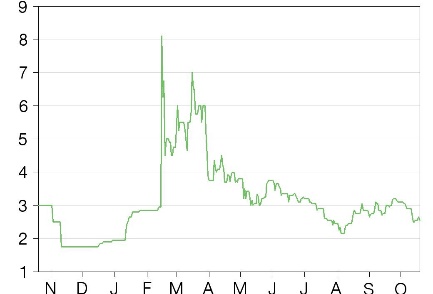

Share price graph

Global expansion plans

While continuing to enhance its leading UK presence, Love Hemp is focused on the global CBD market, which Grand View Research values at US$2.8bn in 2020 and forecasts a CAGR of 21.1% in 2021–28e. Its partnership with UFC provides an ideal platform to penetrate the US market, given the 55 million UFC fans in the US alone (625 million worldwide), with a licensed range of UFC products in the pipeline. The distribution deal with eCargo Holdings announced in September 2021 is a first step into Asia in anticipation of easing regulations. High-profile brand ambassadors such as Anthony Joshua continue to raise awareness of Love Hemp as a wellness product.

An Amazon (NASDAQ:AMZN) vendor

Amazon UK invited Love Hemp to join its vendor platform and the company received initial orders in September 2021. Love Hemp expects the product range on the platform to grow as the authorisation process with Amazon continues and a dedicated virtual store is planned.

Strong FY21 growth despite lockdown

In the July 2021 trading update, Love Hemp reported a 60% increase in revenue to £4.3m for FY21, with the number of consumer accounts more than doubling to almost 37,000 and a 244% jump in units sold to 188,865. Online sales accounted for approximately 60% of revenues in FY21, with the remainder via major UK retailers such as Holland & Barrett, Boots and Alliance Healthcare. The balance sheet has been strengthened via a c £5m reduction in debt, including the conversion of convertible debt to equity.

Milestones

Love Hemp raised over £10m in equity financing in FY21, including initial investment from institutional investors. Use of funds include the establishment of new production facilities (complete) and fulfilling the international growth strategy. Given the size of the international opportunity, Love Hemp expects revenues to at least double in FY22 from £4.3m in FY21. It is on track to list on the London Stock Exchange in the coming months, a move that can be expected to widen the pool of potential investors and enhance liquidity.

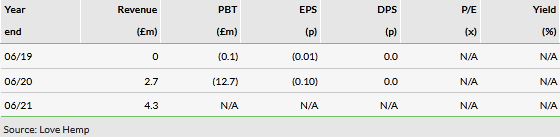

Historical financials

For more, read the PDF below: