US: Business surveys expected to show a further contraction in manufacturing activity

We now have the best part of two months until the next Federal Reserve meeting, with the market seemingly content in the view that we are at or very close to the end of the Fed’s tightening cycle and that recession can be avoided as inflation gradually returns to its 2% target. We remain sceptical, but the upcoming data isn’t likely to shake the market mindset.

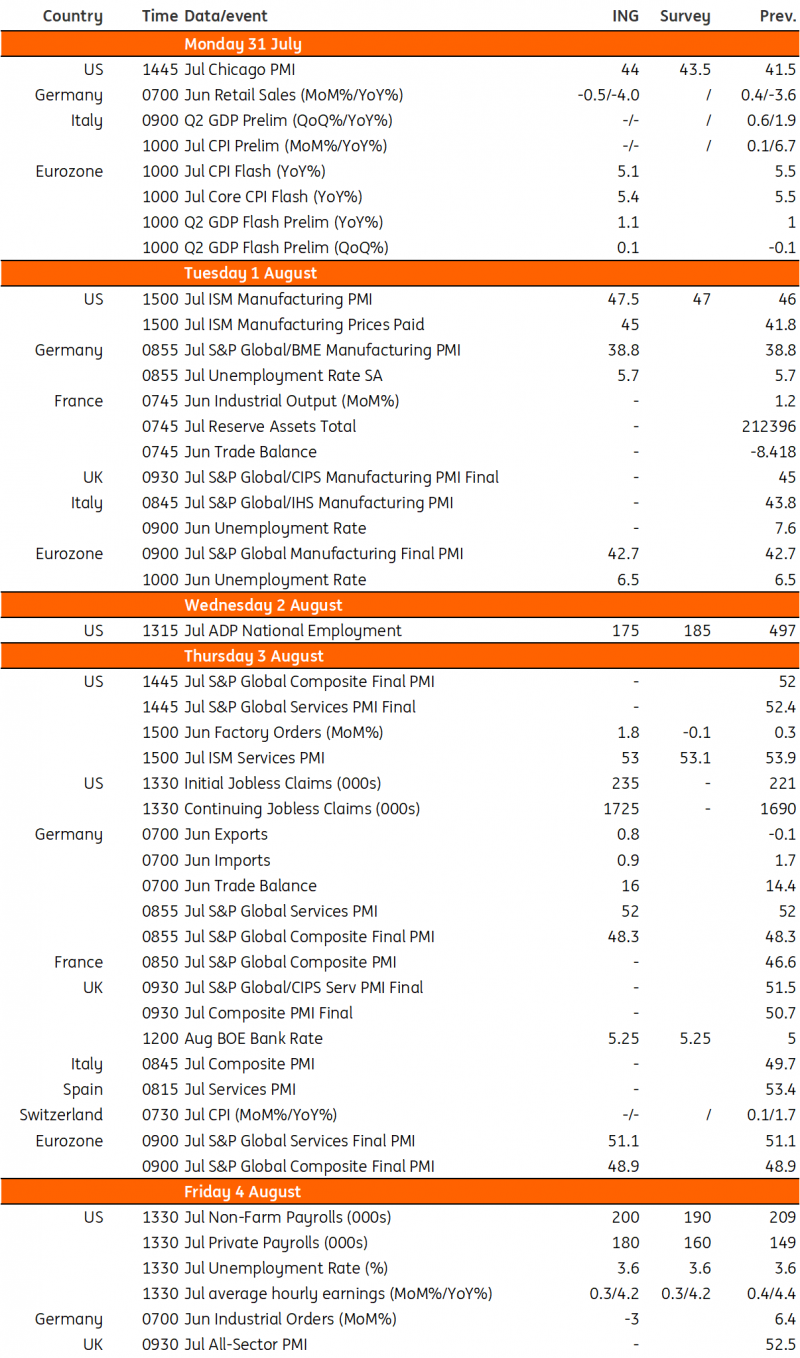

The July jobs report will be the focus with a figure of around 200k expected and unemployment staying low at 3.6%. Meanwhile, the ISM business surveys are going to show a further contraction in manufacturing activity, but the service sector should continue to see growth.

We will be closely watching the Federal Reserve’s Senior Loan Officer Opinion Survey given it is such a key leading indicator. It shows that banks have significantly scaled back their appetite to lend and this has been corroborated by weekly lending data, suggesting loan repayments are now outstripping new lending, prompting a decline in the outstanding stock of lending in the economy. Given the importance of credit to the American economy’s falling lending, it is a huge concern that means we continue to see downside risk for economic activity from the fourth quarter onward. If that is the case, it will help to intensify the disinflationary trend happening in the economy.

UK: Bank of England poised for smaller rate hike after better inflation news

Welcome news on UK inflation has taken a fair amount of pressure off the Bank of England to repeat the 50 basis point rate hike it implemented in June. Services inflation, a key metric for the Bank, dipped back in June’s data, against BoE expectations for it to remain unchanged. That was complimented by better news in other areas, including food. Admittedly this improved story on inflation was tempered by a recent upside surprise to pay growth, but that too was offset by further signs of cooling in the jobs market and an ongoing return of workers. This latter point was acknowledged in a recent press conference by Governor Andrew Bailey.

In short, there’s just enough in the latest data flow for the Bank to be comfortable reverting back to a 25bp hike in August. While you could reasonably argue that the latest inflation number is just one data point, you could have made a similar argument about the previous month’s data, which the Bank said had contained “significant news”. We shouldn’t rule out a 50bp hike though, especially if the committee concludes they think they’ll hike again in September. Governor Bailey explained at the ECB’s recent Sintra conference that this logic partly drove the Bank to enact a 50bp hike last month.

Eurozone: GDP and inflation data releases on the agenda next week

Even though the ECB only met on Thursday, next week already starts with some of the most important data points ahead of the September meeting. GDP and inflation are on the agenda. The first country estimates have been decent, although German GDP stagnating was worse than expected. Overall, GDP is trending very close to zero growth at the moment and the question is whether a small positive growth figure can be reached.

For inflation, French data provide some relief, but for the ECB only a strong drop would be seen as dovish evidence ahead of September. Further along in the week, unemployment data will be released. This is also important, as a cooling labour market would make ECB concerns about inflation persistence smaller, but there is little sign of that so far.

Key events in developed markets next week

First published on Think.ing.com.