- Utilities notched a new high last week as the broad market retreated

- Offers impressive relative strength and low volatility but long-term investors should take caution

- Sector trades at rich valuation and relatively low dividend yield

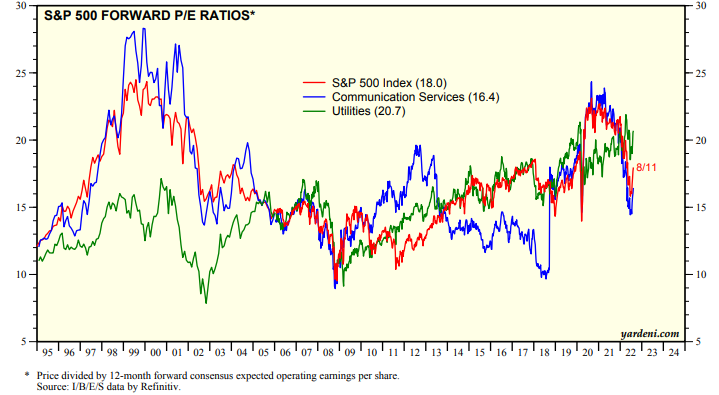

The boring old Utilities sector has been on fire recently. It trades at a very rich price-to-earnings ratio. These trends have been ongoing for much of 2022 in the face of higher interest rates and a volatile stock market. According to Yardeni Research, the Utilities sector sports a forward P/E of 20.7—which is just slightly cheaper than the high-growth Technology sector as of August 17, for perspective.

S&P 500 Forward P/E Ratios: Utilities at A Premium to the S&P 500

Source: Yardeni Research

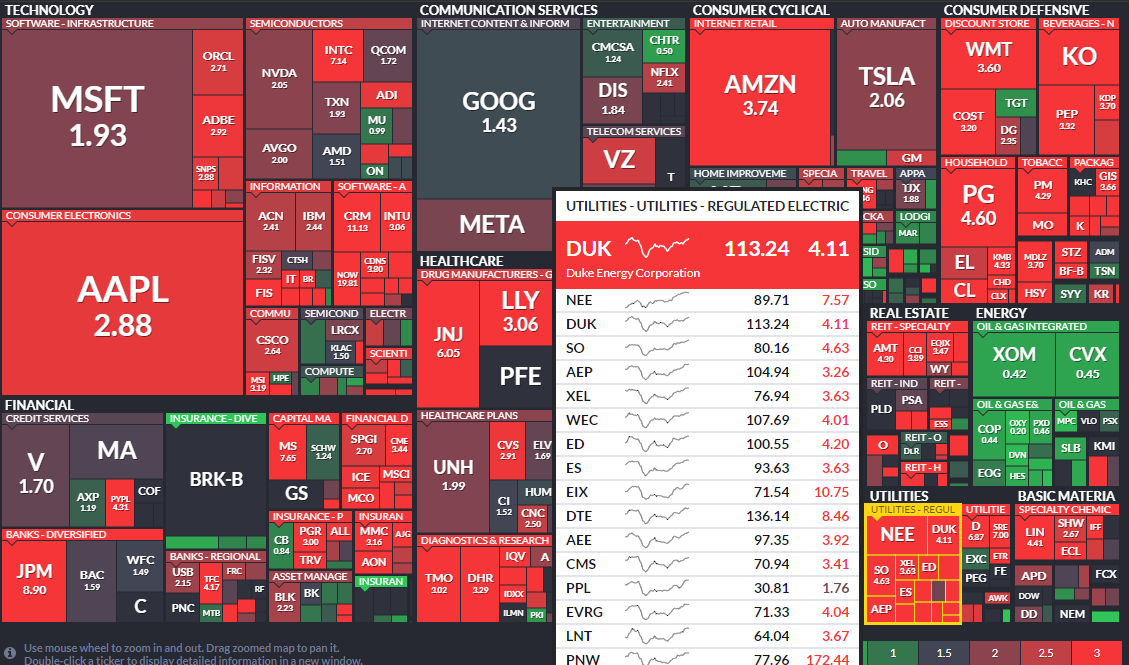

Moreover, the niche’s expected earnings growth rate is not high (as you would imagine, given Utilities’ stable operating characteristics). Resulting PEG ratios, a useful valuation measure that compares an earnings multiple to the forecast earnings growth rate, across the sector are at nosebleed levels.

S&P 500 PEG Ratio Heat Map: Utilities’ Nosebleed Valuations

Source: Finviz

In the face of a pricey valuation, the Utilities ETF went out at a fresh all-time high last week. Making the move even more impressive was that the broad market suffered a more than 1% decline during the options expiration week, so relative strength was high on XLU. Thus far in 2022, the S&P 500 SPDR ETF Trust (NYSE:SPY) has returned a negative 10.5% while XLU is up a somewhat stunning 10.2% including dividends. Even since the June 16 low in stocks, Utilities are beating SPY by more than 300 basis points.

Utilities Sector ETF: Fresh All-Time Highs

Source: Investing.com

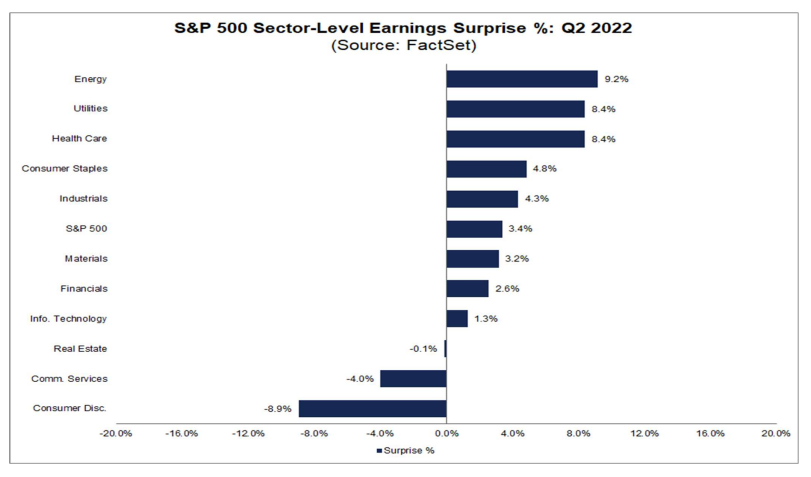

Perhaps investors took a shine to just how well these companies, which make up just 3% of the S&P 500 index, according to iShares, performed during the second quarter. FactSet reports that the Utilities sector featured the second-largest positive aggregate earnings surprise (the difference between actual and estimated profits). NRG Energy (NYSE:NRG), Entergy (NYSE:ETR), and Southern Company (NYSE:SO) had the biggest EPS surprises. Moreover, the steady eddy sector had the biggest positive revenue surprise among all 11 areas of the market.

S&P Q2 Earnings Surprises: Energy, Utilities, Health Care Top the List

Source: FactSet

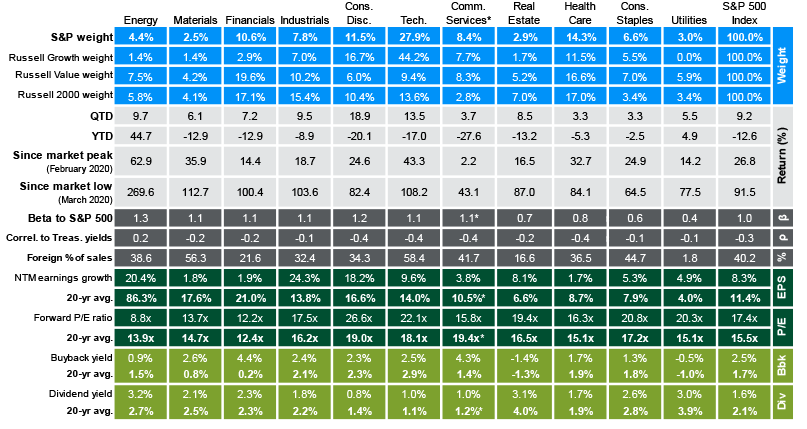

Another stealthy reason Utilities have outperformed lately could be the new 1% tax on stock buybacks. Power generation and transmission & distribution companies generally don’t repurchase many shares. According to J.P. Morgan Asset Management, the Utilities sector has a net negative buyback yield. All other sectors, excluding Real Estate, have a positive repurchase yield. More commonly known among investors is Utilities’ high dividend yield, which stood at 3.0% as of July 31.

Returns and Valuations by Sector

Source: J.P. Morgan Asset Management

I take a cautious stance on Utilities going forward. As a technical analyst, I completely respect its strong absolute and relative performances over the last few weeks (and all this year). Could there be more upside? Yes. In fact, there probably will be given that it’s the only sector making all-time highs. Longer term, though, sluggish growth could hinder returns. With a forward P/E ratio above 20 and a dividend yield that is about 25% below its 25-year average, Utilities appear expensive to me.

The Bottom Line

There are some positive characteristics of the Utilities sector right now. XLU has price momentum and a handful of industries that might benefit from new legislation aimed at beefing up the power grid. But a high valuation and historically low dividend yield make me cautious long term. While the sector feels safe amid a volatile market, don’t hide out long in this space.

Disclaimer: Mike Zaccardi does not hold any positions in the securities mentioned in this article.