What is moving the markets these days? What are the main drivers of currency pairs?

First, the vaccination pace. The second, the recovery speed. And finally, investors are concerned about how soon the central banks will tighten the policy (increase rates or/and cut asset purchases).

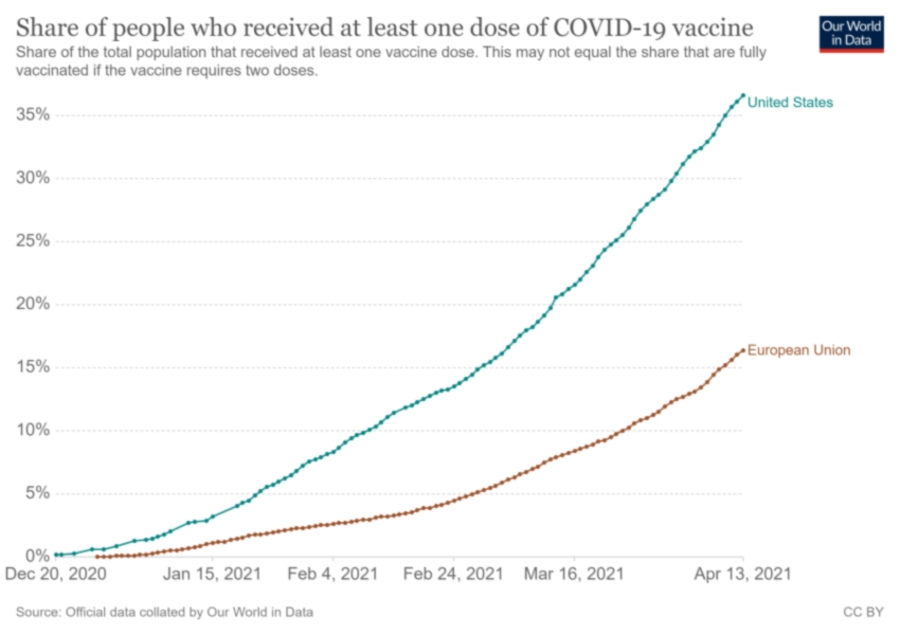

Let’s analyse the most traded pair – EUR/USD. At the first sight, the US is doing better than the Euro Area. The percentage of vaccinated people is much higher in the US than in the EU. Elsewhere, after problems with AstraZeneca’s (LON:AZN) vaccine, Johnson & Johnson (NYSE:JNJ) stopped sending its vaccine to the EU as well because of the possible negative side effects.

While the US does not depend on J&J, Europe may suffer a delay of 3-4 months to obtain its goal to vaccinate 70% of the population. As a result, it may significantly worsen the situation in Eurozone and press the euro down.

However, EU Retail sales came out much better than expected this Monday: 3.0% vs the forecast of 1.3%. It’s just the beginning of further growth – more to come in the months ahead! Elsewhere, according to Barclays, European people acquired savings at 600 billion euros ($714 billion) during long lockdowns. But when they feel free to go out without any restrictions, they will tend to spend them more. So, consumer spending will grow and help the economy to recover.

Forecasts

ING foresees the tentative recovery for Europe. The bank points that the USD has started losing its steam and the breakout of EUR/USD above 1.2000 is very likely! According to ING’s model, EUR/USD is undervalued by almost 2%. Indeed, if you look at the chart below, you’ll notice that the RSI indicator is well below 70.00 level, so it’s not overbought.

US retail sales today

Today US retail sales will come out at 15:30 MT and will have a great impact on EUR/USD. The general rule is that if US retail sales are better than expected, the USD will surge; if worse – the USD will fall. However, some analysts believe that if retail sales come out better than the forecasts, it may fuel the ongoing risk-on sentiment and press down the USD, which will push EUR/USD higher. Anyway, follow the results and keep an eye on the charts.

Tech analysis

EUR/USD has failed to cross the resistance of 1.1990-1.2000 so far. However, if it does, the way up to the 100-day moving average of 1.2050 will be open.

On the flip side, if it breaks below the 50-day moving average of 1.1960, the way down to the 200-day moving average of 1.1890 will be clear.