For years, the XRP community has been following the legal battle between Ripple and the US Securities and Exchange Commission (SEC) with great tension. When the case reached a preliminary decision earlier this year, market sentiment rose briefly – only to falter again soon after, as the SEC's appeal brought new uncertainties.

However, with Donald Trump's victory in the US presidential elections, the XRP community's hopes have been rekindled: many expect the conflict with the SEC to come to an end soon.

Trump's crypto-friendly policies could benefit Ripple

Trump's crypto-friendly attitude is seen as a possible advantage for Ripple. It is speculated that Trump could replace SEC Chairman Gary Gensler, who has played a crucial role in the proceedings against Ripple, in early 2025. A new, crypto-friendly SEC chair could ease the pressure on Ripple and strengthen the XRP exchange rate.

Lawyer Fred Rispoli commented on the social media portal X that Trump's election victory could significantly speed up the process and that an agreement could be reached as early as spring 2025.

Ripple CEO confirms meeting with Trump

Ripple CEO Brad Garlinghouse seems to have confirmed that he recently met with President-elect Donald Trump. These speculations arose after Garlinghouse liked a post on X by crypto advocate Zach Rector that hinted at such a meeting.

Ripple could become the strongest cryptocurrency in the coming years

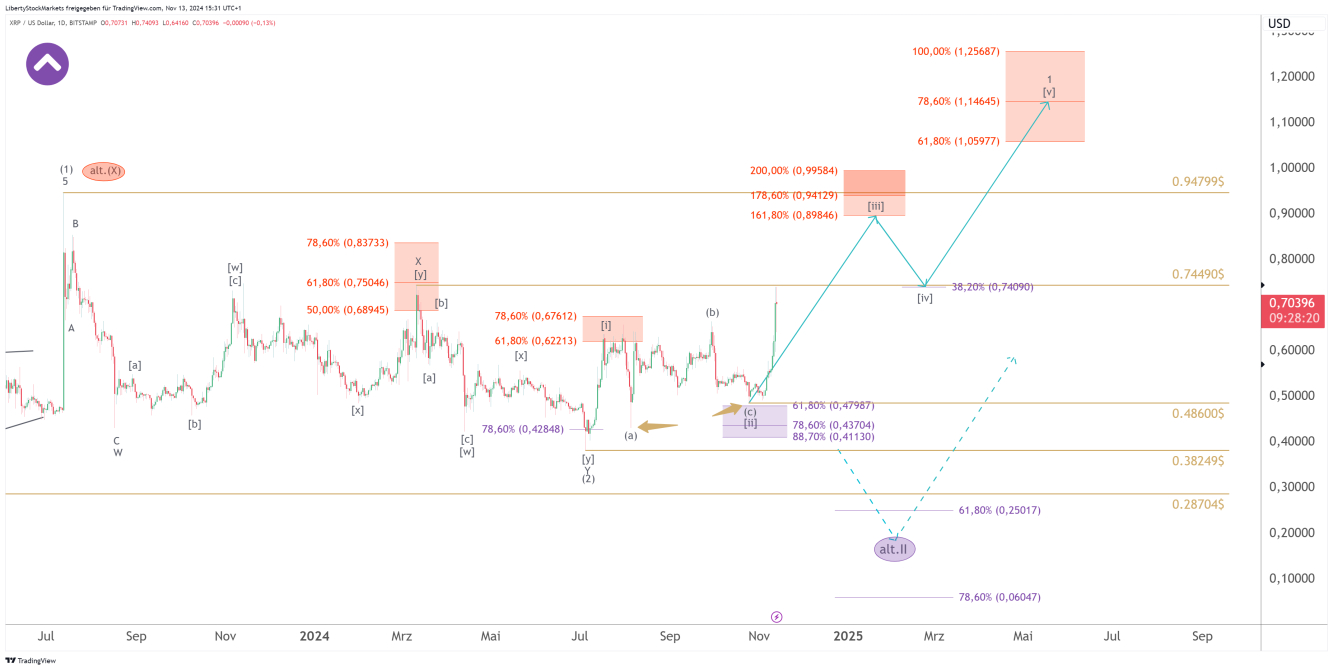

The reasons listed above and also those below this analysis are likely to have a major impact on Ripple's price. This is also reflected in the chart.

After being stuck in a corrective formation since around 2018, it is now becoming apparent that a sustainable upward breakthrough could succeed. We saw this in the chart early on:

The basis for a very strong increase is formed by the structure of the red box at $0.62213 to $0.67612 and the two lows at the purple box at $0.47987 to $0.41130, with the decisive low at $0.48600. Since then, the price has been clearly on the rise. If Ripple manages to overcome $0.74490, we believe the coin will switch to full bull mode with a long-term potential of over 400%.

And that is precisely why we prefer Ripple. And because the coin is starting a little later compared to others like Bitcoin, Ethereum, Solana and even Dogecoin, there is still a very good chance of getting in.

Ripple is gaining political influence

Garlinghouse's reaction has drawn attention to Ripple's growing political importance in American crypto politics. Some suspect that Ripple could even rise to political committees under Trump's leadership. Such a move would give Ripple and the entire crypto industry a stronger political voice.

Charles Hoskinson, founder of Cardano, is also showing interest in Ripple and seeking to close the gap. Although he has had conflicts with the XRP community in the past, he recently issued a public apology, which many see as a sign of Ripple's growing political influence – especially in light of the upcoming launch of RLUSD, Ripple's stablecoin.

However, not everyone in the XRP community welcomes Hoskinson's apology. Some suspect that Hoskinson's political rise has inspired him to improve his relationship with Ripple and the XRP community. One comment read: ‘Garlinghouse will probably soon be sitting on the crypto committee with other industry leaders, and Hoskinson knows this – he therefore wants to reconcile with Ripple.’

Others criticised Hoskinson's approach to Ripple as ‘uncomfortable’ and ‘embarrassing’, once again highlighting the tensions between the Cardano and Ripple communities.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.