Since the last hawkish move by the Federal Reserve on Jun 13-14, Gold Futures witnessed a sell-off after facing stiff resistance at $1,970 and continued to slide to hit a low at $1,900 on June 29, 2023.

Some odds and hopes for a reversal were in support of the bulls at this low, resulting in a pullback, but once again, futures are facing stiff resistance at $1,939.58.

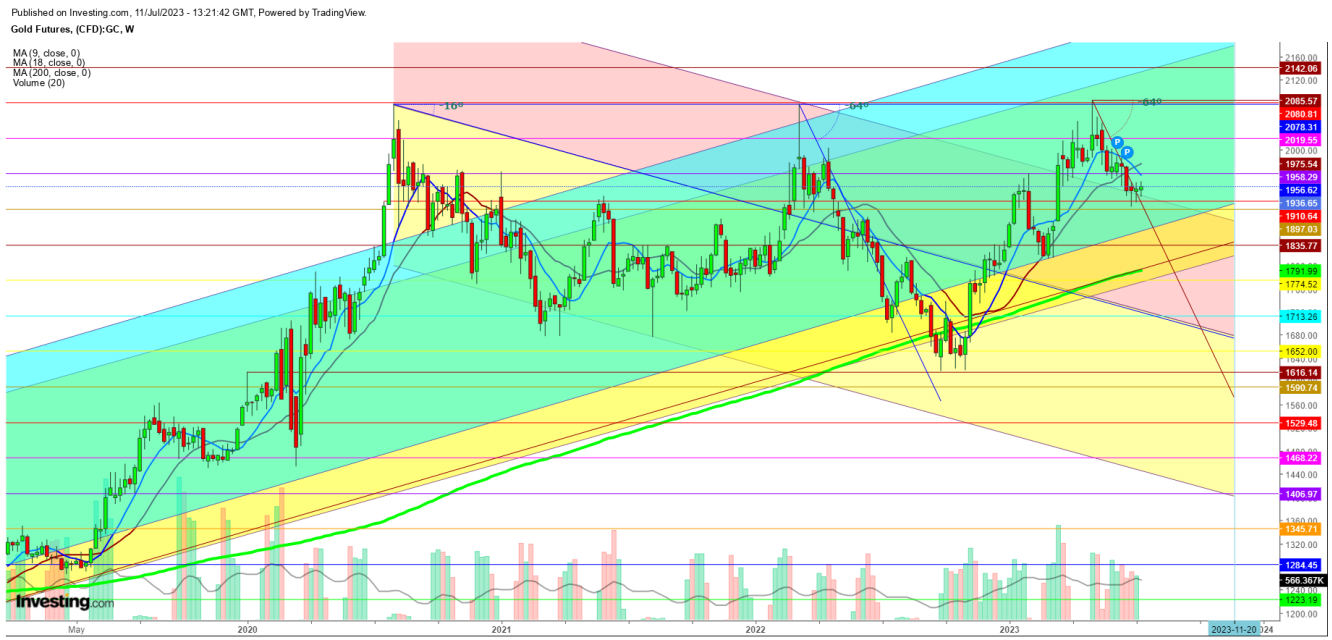

In the weekly chart, gold futures are trying to hold above the immediate support at $1,918 and the second support at $1,902, but constantly facing stiff resistance above $1,958 for the last two weeks - which suggests a selling spree is likely to start soon as the 9 DMA crosses 18 DMA with a down move, resulting in the formation of a bearish crossover.

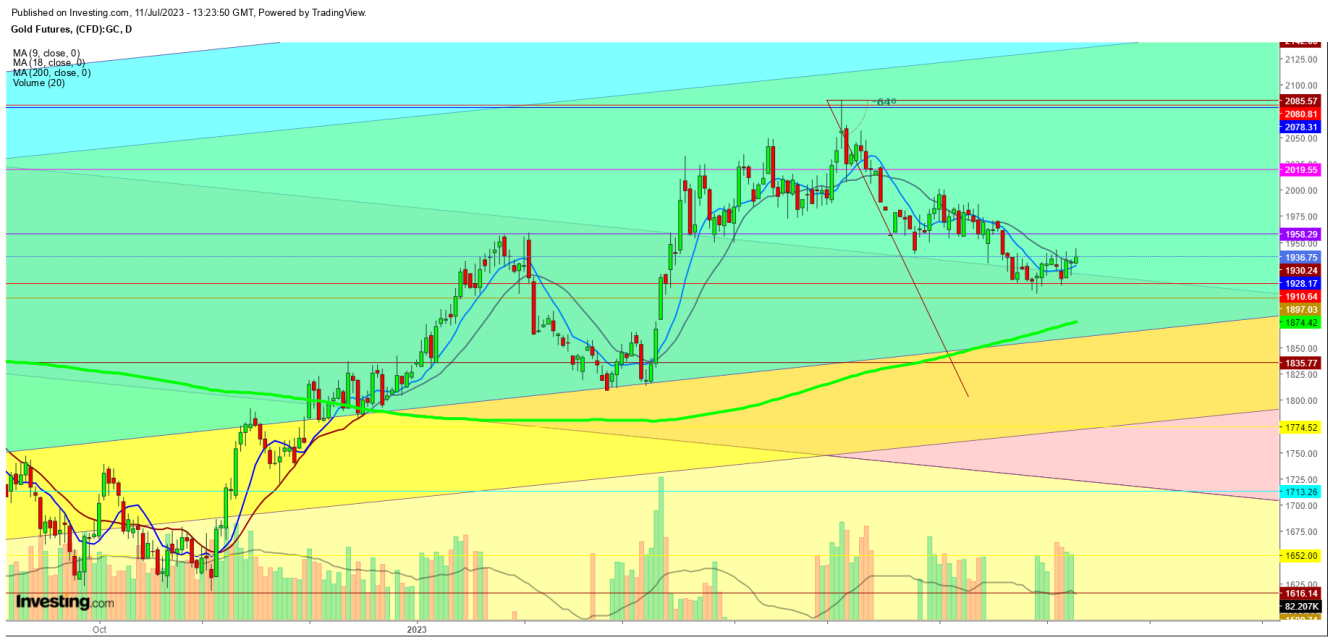

In the daily chart, futures are showing some strength in expectation of positive steps by the Federal Reserve in its upcoming meeting this month.

Futures could remain a little volatile for some more time before a breakdown starts below $1,939. On the other hand, a bullish crossover could complete its formation if futures sustain above $1,948 during this week, which could result in some bouncing moves.

Finally, I conclude if a sudden selling spree pushes the price up to the 200 DMA in the daily chart, which is at $1,874, it will provide an opportunity to go long. On the other hand, any upward swing above $1,962 will attract bears to come forward. Gold futures are likely to wobble in a narrow range up to the Federal Reserve meeting on July 25-26, 2023.

Disclaimer: The author of this analysis does not have any position in Gold futures. All the readers are advised to take any position at their own risk.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI