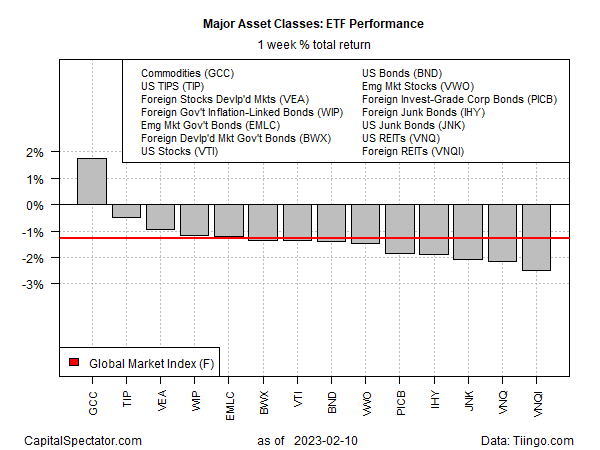

This year’s rebound in global markets hit some turbulence last week, with the exception of commodities, based on a set of ETFs through Friday’s close (Feb. 10).

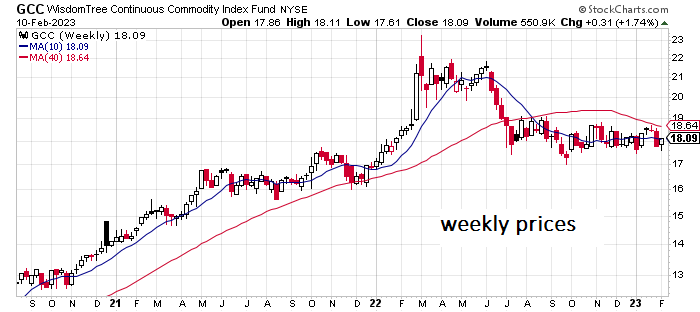

WisdomTree Enhanced Commodity Strategy Fund (GCC) rose 1.7% last week, posting the only gain for the major asset classes. The advance highlights the potential diversification benefits of commodities, but GCC continues to trade in a tight range. Last week’s increase, as a result, looks like noise in a flat market.

The rest of the field fell as markets digest the year-to-date rallies amid mixed data for the economic outlook. The biggest decline for the major asset classes last week: real estate shares ex-U.S. (VNQI), which closed lower for a second week with a 2.5% loss.

The Global Market Index (GMI.F) also lost ground, slipping 1.3% — the first weekly decline in the past three. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

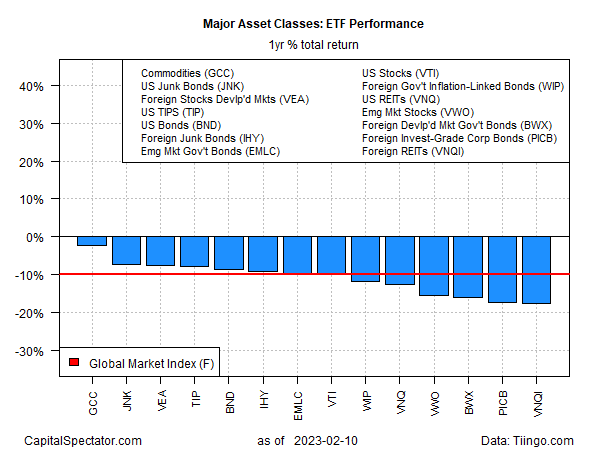

For the one-year trend, all the major asset classes are posting losses. The red ink varies from a mild 2.2% decline for commodities (GCC) to a steep 17.8% slide for real estate ex-U.S. (VNQI).

GMI.F is also posting a one-year loss of 10.0%.

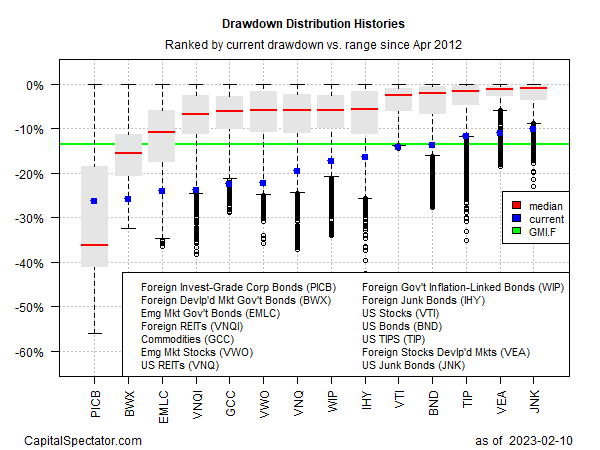

All the major asset classes are also suffering relatively deep drawdowns. The softest peak-to-trough decline at the moment is found in U.S. junk bonds (JNK), which ended last week at 10.3% below its previous peak.

Meanwhile, corporate bonds ex-U.S. (PICB) are posting the deepest drawdown: -26.3%.

GMI.F’s drawdown: -13.6%.