The Cable continues to show constructive price action as the dollar continues to weaken on reduced haven flows. Similar price action has been observable on the other major pairs with the EUR/USD breaking higher and USD/CAD lower etc.

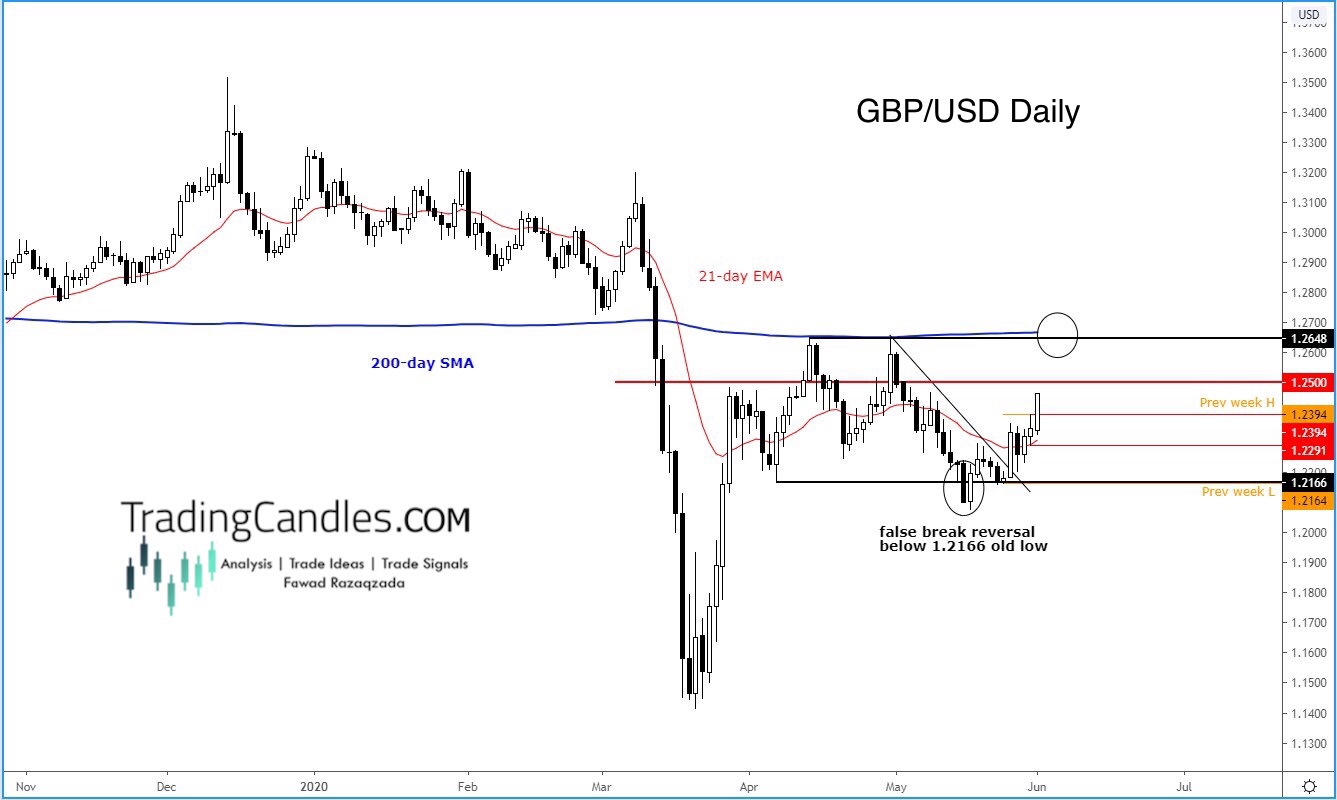

Have a look at this chart of the cable:

The GBP/USD has now broken it bearish trend line, which was derived from connecting the highs in March and April. This is clearly a bullish development as it shows the sellers are losing control of the trend.

The GBP/USD had previously created a false breakout below its prior low around 1.2166 in mid-May. That has proven to be the key reversal formation as price has pushed higher since then.

From here it looks like the candle is heading to the liquidity resting above 1.2650, the prior double top high and where the 200-day comes into play.

We have actually been posting bullish trade signals on the GBP/USD and other dollar crosses including the EUR/USD and gold over the past couple of weeks.

This, for example, is the before and after of our GBP/USD setup: