This article was written exclusively for Investing.com

- Peak season for demand begins in the spring

- Gasoline prices have recovered and are heading for the 2018 high

- Gasoline refining spread moves higher as the fuel outperforms crude oil

- Three reasons why gasoline can continue to rise

- UGA: risk position gasoline ETF

It's no secret that climate change is causing the world to move away from fossil fuel consumption. In the US, the Biden administration is shifting energy policy from hydrocarbons to alternative power sources. On his first day in office, the President canceled the Keystone XL pipeline project that delivers petroleum from Canadian oil sands in Alberta, Canada, to Steele City, Nebraska, and beyond.

Meanwhile, the majority of automobiles and other modes of transportation rely on gasoline and other fuels. While that may change in the coming decades, the foreseeable future will require gasoline and distillates to power cars, trucks, planes, and boats.

With the end of the pandemic in sight, as vaccines go into arms in the US and worldwide, energy demand is likely to rise over the coming months despite the shift in energy policy. The US had become the world’s leading oil-producing country, but those days appear to be over in 2021.

At the latest OPEC+ meeting, the Saudi oil minister told a reporter that “drill-baby-drill,” the previous US policy, is dead. With oil’s pricing power back in the Middle East and Russia’s hands, prices are likely to rise. Moreover, the end of the coronavirus will usher in a resurgence of energy demand. The price of gasoline been rising as we head into the time of year when people put more mileage on their cars. The United States Gasoline Fund (NYSE:UGA) is an ETF product that tracks the price of fuel.

Peak season for demand begins in the spring

During the winter months in the United States, drivers tend to put less mileage on their cars because of dangerous road conditions in many parts of the country. As the snow and ice melts and the warm winds of spring begin to blow across the US, odometers begin clicking at a faster rate, and gasoline demand rises. The peak driving season lasts from the spring through the fall each year and reaches its height in the summer months during the vacation season.

The 2020 driving season was a bust. The global pandemic caused people to work from home, lose jobs, and social distancing limited trips outside of their residences.

As vaccines are creating herd immunity to COVID-19, the prospects for 2021 are looking far brighter. The gasoline price has been moving higher since early November when it hit bottom as the market reflected the winter seasonality.

Source: CQG

As the daily chart shows, gasoline futures for April delivery rose from a low of $1.1184 per gallon on Nov. 2 to the latest high of $2.1599 on Mar. 8, a rise of over 93.1%. Seasonality and optimism over the end of the coronavirus have sent the fuel higher at the beginning of the 2021 spring season.

Gasoline prices have recovered and are heading for the 2018 high

In early March 2020, gasoline prices were below $1 per gallon and heading for a low of 37.60 cents in late March, the lowest price since 1999.

Source: CQG

The monthly chart highlights that gasoline moved above the April 2019, $2.1559 technical resistance level last week. From there, the next upside target stands at the May 2018, $2.2855 peak. In June 2014, gasoline traded at $3.1520 per gallon. The all-time high came in July 2008 at $3.6310 per gallon wholesale.

Drivers are paying a lot more for gasoline in March 2021 than last year at the same time. Moreover, the price trend tells us that filling our tanks will be a lot more expensive over the 2021 driving season in the coming months.

Gasoline refining spread moves higher as the fuel outperforms crude oil

The gasoline crack spread reflects the premium or margin for processing a barrel of crude oil into a barrel of gasoline. In early November, seasonal weakness drove the gasoline crack spread to a low of $6.43 per barrel, where it found a bottom.

Source: CQG

The weekly chart shows that the gasoline processing spread rose to its latest high of $24.79 per barrel last week and settled at the peak, which was the highest level since May 2018. The mid-2018 high was only nine cents above last week’s high. The next upside target stands at the August 2017 $27.79 high.

When the gasoline crack spread moves higher, it means gasoline demand is rising, sending a bullish signal to the oil market. At the start of the 2021 driving season, we could see the rally continue.

Three reasons why gasoline can continue to rise

Three factors point to even higher gasoline prices in the US over the coming weeks and months.

- As the US and world achieve herd immunity to COVID-19, people will return to work and travel. As they put more mileage on their cars, gasoline demand will rise over the coming months.

- US energy policy under the Biden administration will favor alternative sources that do not accelerate climate change. The President canceled the XL pipeline project that carries petroleum from oil sands in Alberta, Canada, to Nebraska, and beyond to Cushing, Oklahoma, the delivery point for NYMEX crude oil. Increased regulations leading to less production in the US are coming even as the demand is dramatically rising.

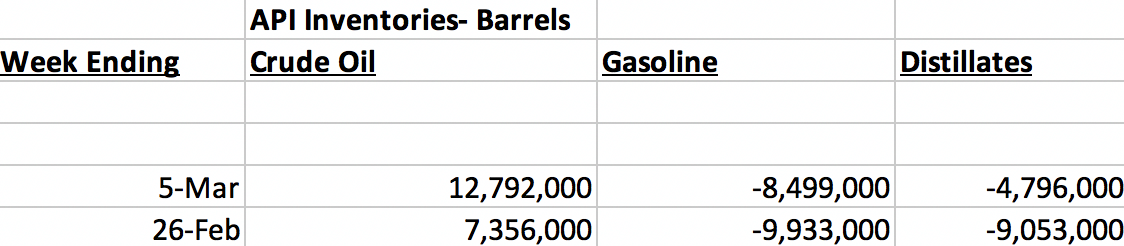

- The most recent data from the American Petroleum Institute and Energy Information Administration pointed to rising oil stockpiles but even greater declines in gasoline and distillate stocks. Over the past two weeks, the declines were substantial:

Source: API

While crude oil inventories rose by 20.148 million barrels as of Feb. 25 and Mar. 5, gasoline stocks declined 18.432 million, and distillates were 13.849 million barrels lower. Product stockpiles dropped by a combined 32.281 million barrels.

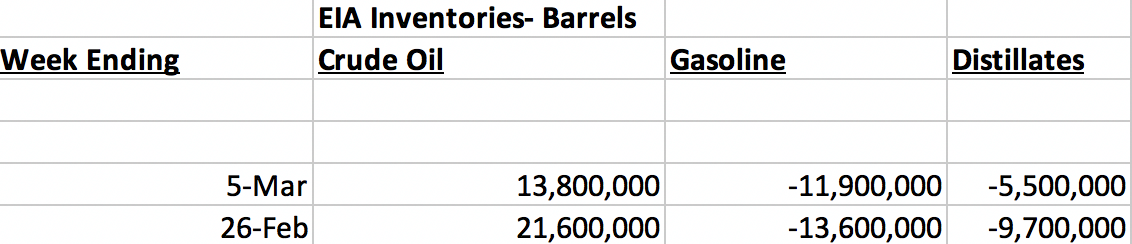

Source: EIA

The EIA confirmed the more substantial decline in product stocks as crude oil inventories rose by 35.4 million barrels, with product stocks dropping 40.7 million.

The inventory data is a compelling sign that the demand for energy is robust going into the 2021 driving season.

UGA: risk position gasoline ETF

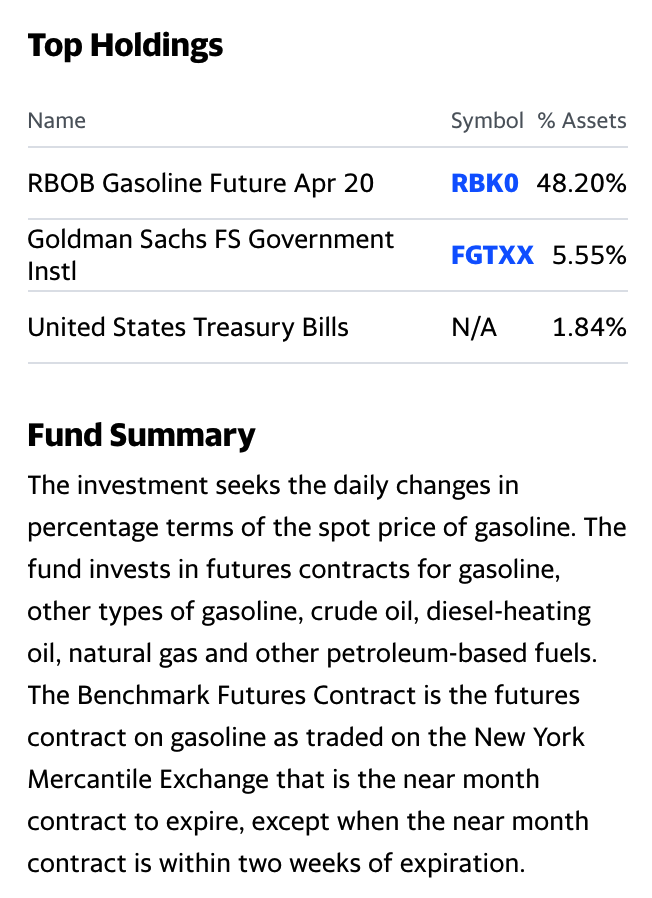

The most direct route for a risk position in the gasoline market is via the futures and futures options that trade on the CME’s NYMEX division. For those looking to participate in the rising gasoline market without venturing into the futures arena, the United States Gasoline Fund (UGA) provides an alternative.

The top holdings and fund summary for UGA include:

Source: Yahoo Finance

UGA has net assets of $107.93 million, trades an average of 80,400 shares each day, and charges a 0.75% expense ratio. April gasoline futures rose from $1.1184 on Nov. 2 to a high of $2.1599 on Mar. 12, or 93.12%.

Source: Barchart

The chart illustrates the rise in UGA from $17.23 to $34.68 per share or 101.28% over the same period. UGA did an excellent job replicating the price action in the April NYMEX gasoline futures market.

Gasoline prices are driving higher as the peak demand season for 2021 approaches. The price is approaching a three-year high in early 2021. The last time gasoline traded at a wholesale price of over $3 per gallon was in 2014.

The trend is your best friend in markets, and technically, gasoline remains in a bull market. Fundamentals are lining up with the technical indicators, which could mean gasoline has a lot further to run on the upside over the coming weeks and months.