It’s been a wild ride for Bitcoin investors. The world’s most famous cryptocurrency has had a rollercoaster start to 2021, where all-time highs were repeatedly broken throughout January and February before May and June saw severe corrections that have hurt the pockets of its many new adopters. With cryptocurrency markets experiencing sharp volatility that hasn’t been seen in over a year, could the only true winner be Robinhood and its upcoming IPO?

Volatility is nothing new in the world of cryptocurrency, but the sustained collapse in Bitcoin’s value over the course of Q2 2021 has left even the most hardened of holders gritting their teeth.

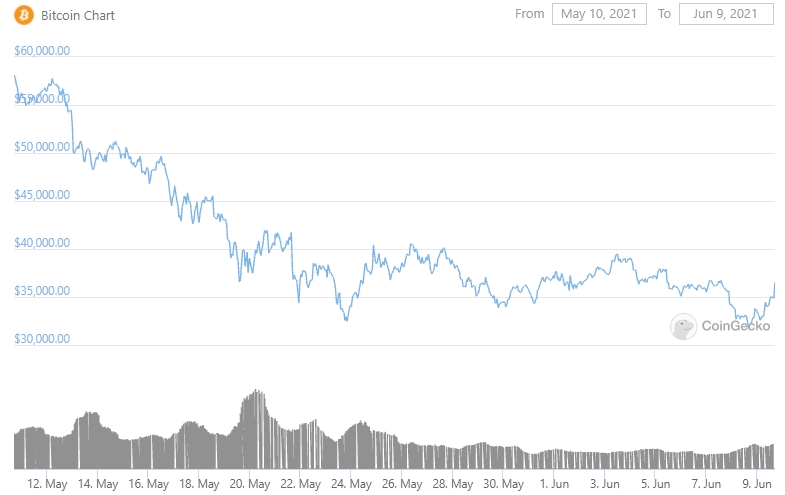

(Image: CoinGecko)

Bitcoin’s collapse has seen 37.3% shed from the cryptocurrency’s value in the space of 30 days, with other assets finding themselves caught up in the midst of similarly deep downturns.

Although cryptocurrency markets are famously volatile, this tumbling of value represents the biggest dip that many investors will have experienced since buying into crypto for the first time.

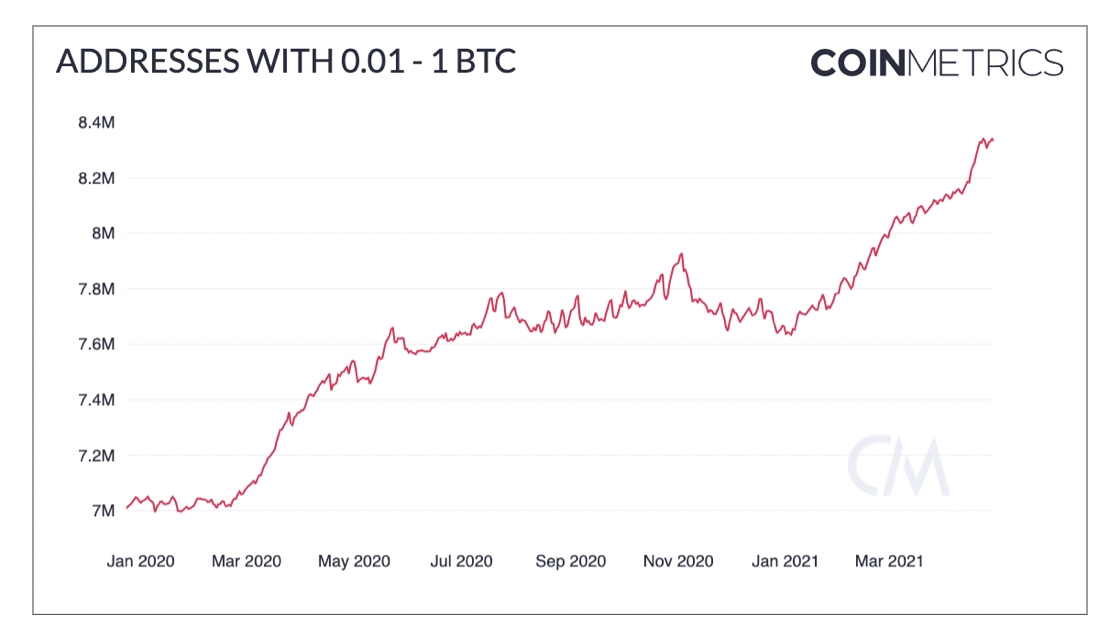

(Image: CoinDesk)

As the data above shows, the number of small to medium (~$300 to $30,000 investment size) Bitcoin holders grew from around 7 million to almost 8.5 million since the beginning of 2020 - with many new adopters arriving in 2021, as BTC chased all-time highs before suffering its corrections.

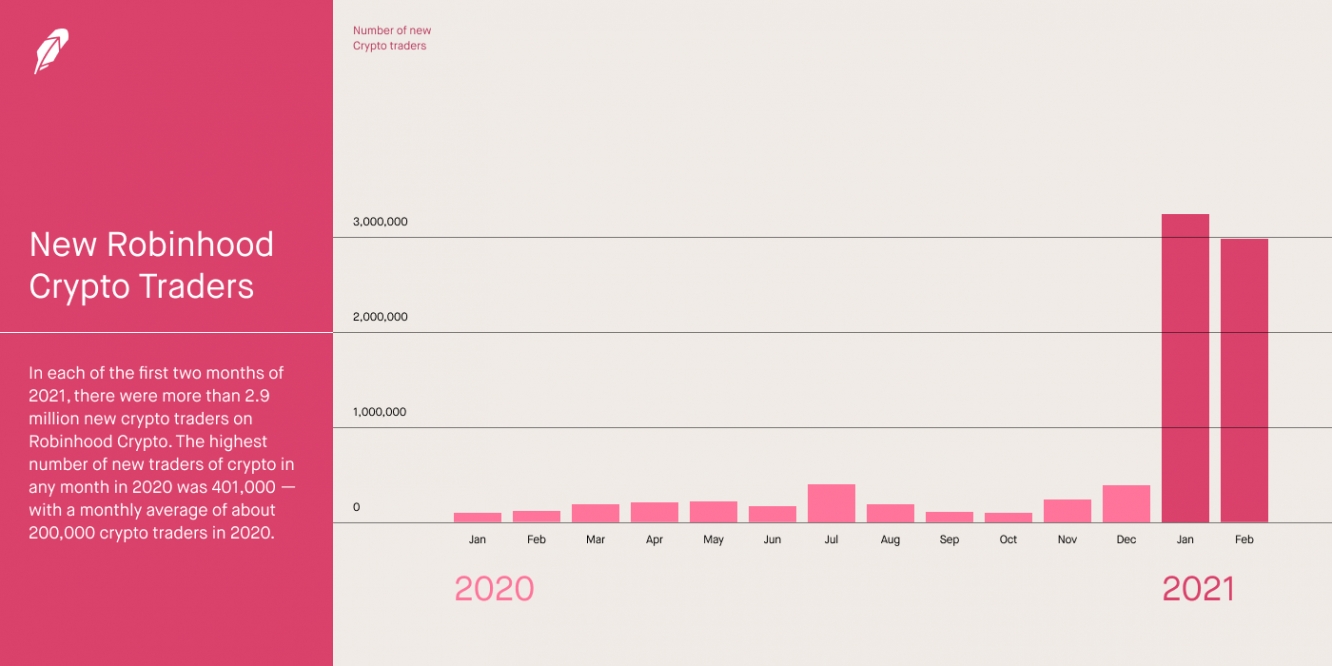

(Image: Robinhood)

As retail investment app, Robinhood’s own data shows, new crypto traders arriving on the platform soared into the millions in 2021, showing that the appetite for cryptocurrency investments were at an unprecedented level at the beginning of the year.

So, what happens now that a new market of traders have found themselves exposed to an extremely testing financial climate? One potential trend to emerge from Bitcoin’s downturn may come as great news for Robinhood itself, as the investing platform gears up for a much anticipated IPO.

Strength in Diversified Markets

Despite the challenging cryptocurrency market, Robinhood, which trades seven crypto assets on its platform, is gearing up for a July IPO.

The online brokerage that primarily deals in stock trading filed for a confidential initial public offering on the 23rd March 2021. In opting for a confidential filing, Robinhood’s IPO terms will only need to be made public some 15 days before the IPO takes place. This can be advantageous for companies because it gives a greater sense of control over its IPO dates, while enabling it to change terms on the fly without coming under public scrutiny.

Robinhood has rarely steered clear of controversy in 2021, and the app found itself at the centre of the GameStop (NYSE:GME) short squeeze that rocked Wall Street in January while drawing criticism from some of the investment world’s most iconic figures for its commission-free investments. However, after its most recent funding round in February 2021, Robinhood has been left with a reported value of $40 billion - making the platform host to one of the hottest IPOs of the year.

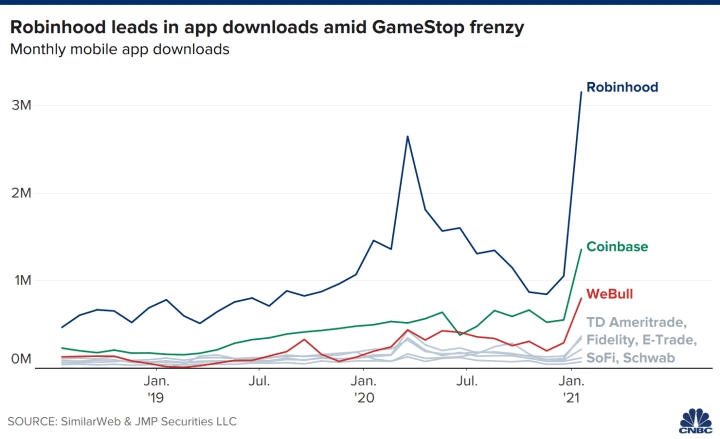

(Image: CNBC)

As the data shows, Robinhood has experienced a significant level of growth since the beginning of the COVID-19 pandemic, with the app appearing to welcome a new market of retail investors looking to try their hands at the buying and selling of stocks. However, in going public, there’s little doubt that Robinhood will be wholly intent on sidestepping the mishaps experienced by another exchange that also enjoyed a spell of recent growth: Coinbase (NASDAQ:COIN).

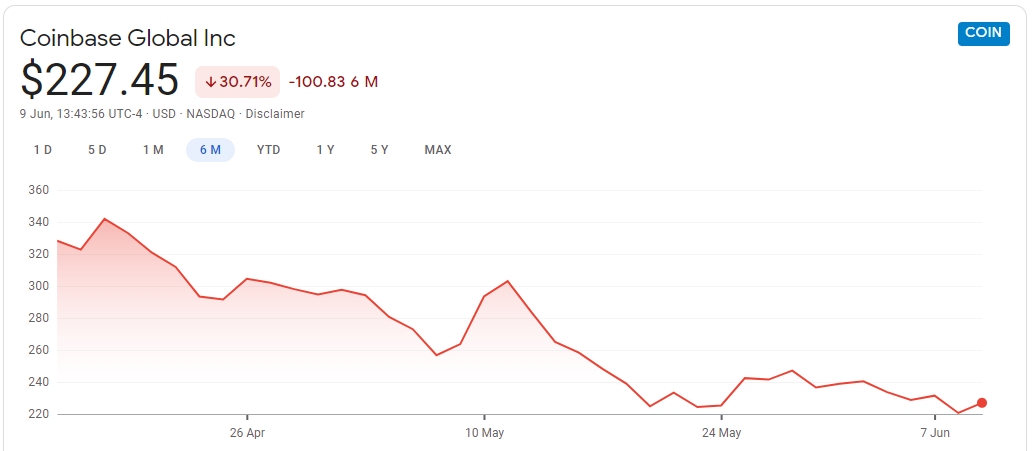

Coinbase is a solely cryptocurrency-based investment platform that took the bold step of going public in April 2021. The move represented the most significant step the cryptocurrency ecosystem has taken towards mainstream adoption. Although Coinbase entered the market with a $99.6 billion valuation and an immediate 52% pop upon its debut, the negative cryptocurrency landscape quickly turned things sour for the company.

As Coinbase’s stock performance shows, the boost to share prices were short lived, and Bitcoin’s troubling performance across May has caused shares to tumble from the exchange. Sadly, in an environment that’s heavily controlled by the performance of Bitcoin, even publicly traded assets can’t steer clear of crypto’s famous volatility.

So what can help to prevent Robinhood from suffering the same fate upon its upcoming market debut? Robinhood’s market advantage is that it’s evolved into the go-to app for the convenient buying and selling of stocks for retail investors who are eager to invest their spare change.

(Image: Business of Apps)

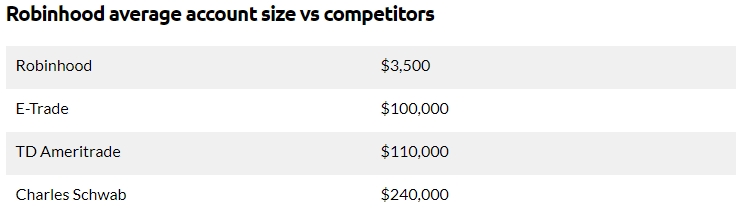

As the chart above shows, Robinhood stands alone as the place to go for investors with smaller accounts wanting to trade both traditional stocks and shares as well as cryptocurrencies. While the platform has seven tradable assets in the crypto ecosystem, it also has over 5,000 traditional stocks and shares that investors can buy.

Robinhood’s IPO is already highly sought after, and online brokerages like Freedom Finance Europe have already acted fast in creating a portal to leverage the purchase of the platform’s initial public offering. However, it’s important to note that Freedom’s purchasing process requires a minimum financial threshold of $2,000 to be met alongside a stringent application process.

Other more traditional brokerages like TD Ameritrade and Fidelity are also expected to offer Robinhood’s IPO, but the financial thresholds associated with these companies typically range into the $100,000s.

Perhaps Robinhood’s greatest asset can be found in its ability to put individual investors directly in touch with enticing stocks without any associated commission fees. The company’s recent announcement of its IPO Access feature is set to be the latest in a revolutionary line of convenient financial services for retail investors, and Robinhood plans to make its own initial public offering available for investors to buy into - without the need of a minimum account balance.

In democratising IPOs, as well as other financial assets that operate both inside and outside of the crypto ecosystem, Robinhood’s greatest failsafe against Bitcoin’s downturn is its strength in diversity. It’s this dedication to innovation that may well help the online brokerage to avoid suffering from the difficult start to public life that Coinbase finds itself in.