This article was written exclusively for Investing.com

Stocks have pushed higher and higher, even with the prospects of the Fed tapering its asset purchases of bonds. It does not matter when the taper begins because it will happen and it could have a significant impact on stock prices. The anticipation of that event has helped strengthen the dollar, pushed yields, including on the 10-year Treasury note, higher, and even started to push equity markets in parts of the world lower.

The US markets have been on a different course, rising to record high after record high, ignoring the Fed's messages of tightening policy. Despite the equity market's denial, financial conditions have started to tighten. Typically, this has resulted in a lot of volatility, making this period particularly risky.

Financial Conditions Are Starting To Tighten

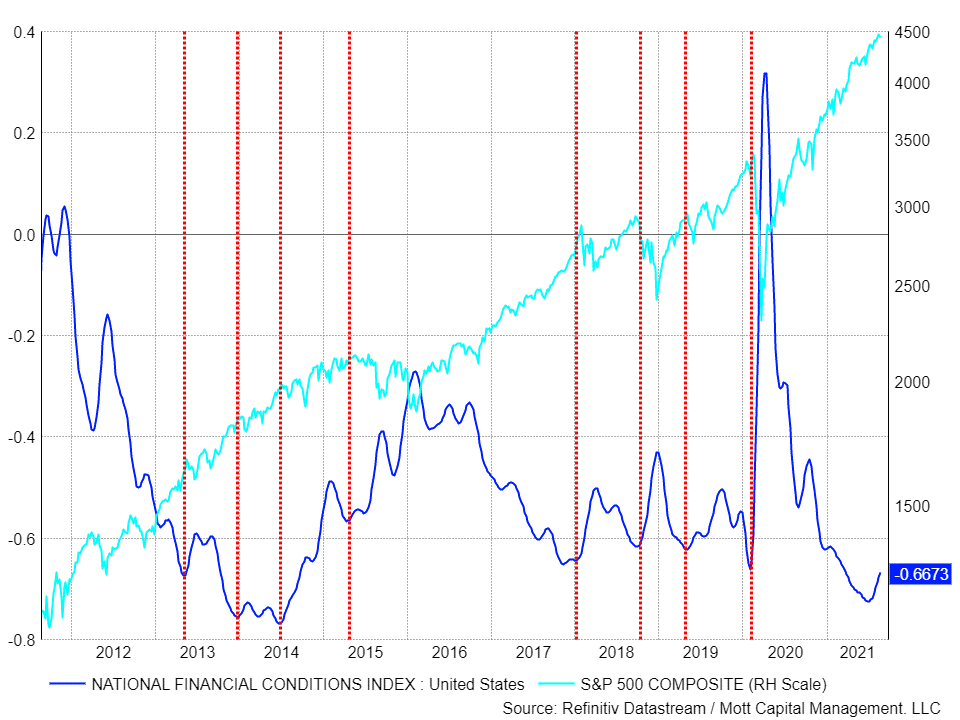

The Chicago Fed National Financial Conditions Index has a strong correlation between the risk-on-and-off moods of the S&P 500 over the years. Easing financial conditions have helped boost equity prices, while tighter conditions have led to turbulence or very sharp pullbacks. After the pandemic began, monetary policy became very accomatative, allowing for conditions to become very easy, helping to push the S&P 500 to record highs. But conditions bottomed in late June and have since reversed and are rising, climbing to -0.67 as of Aug. 25 from -0.72 on July 2.

A Dislike For Tighter Conditions

While this tightening is minor—and conditions are, on a relative basis, easy—it does not take much tightening for the disruption in the equity market to occur. From January 2018 until April 2018, conditions tightened from roughly -0.65 to -0.50, and the S&P 500 fell by approximately 11%. The same thing happened in September 2018 with conditions tightening from -0.61 to -0.44 in December, resulting in a drop of almost 20% in the index.

In 2013 and 2014, when the Fed ended its bond-buying program, financial conditions tightened dramatically, rising from roughly -0.75 in June 2014 to -0.27 in February of 2016. The occurrence resulted in the S&P 500 virtually going nowhere over that time, but actually, It fell by more than 5%, while also witnessing three declines of about 10%.

Leverage Is Getting Tighter

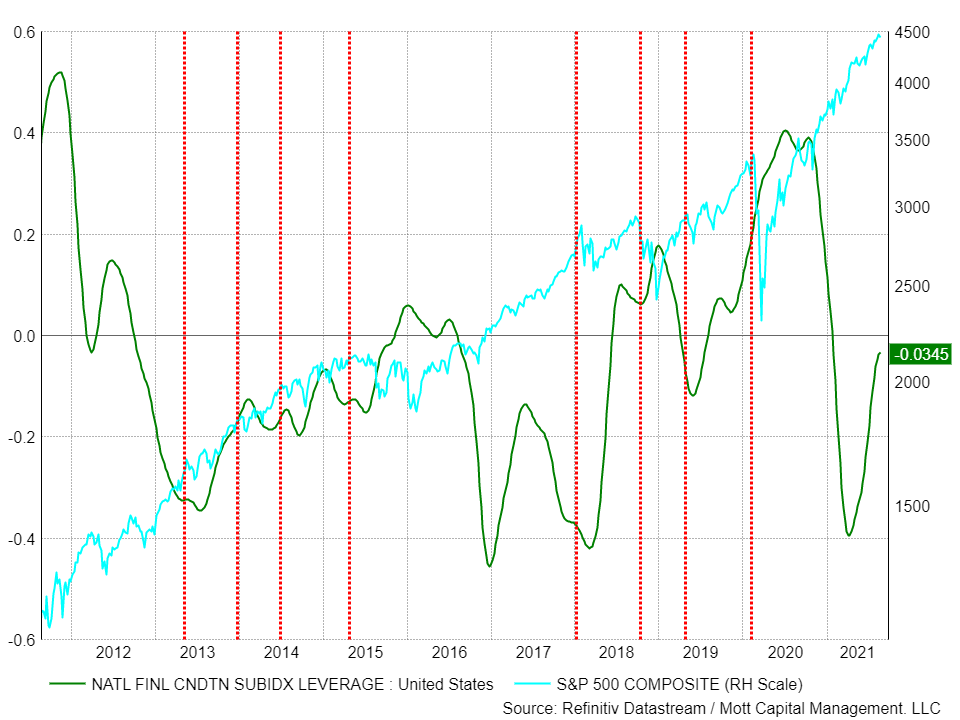

A subindex within the broader financial conditions index specifically looks at leverage; that indicator shows significant tightening has already occurred. The index is approaching the neutral territory and is nearing zero. It could also be why we have seen margin debt levels are beginning to fall, as borrowing on margin to buy stocks may not be as readily available, taking away a significant liquidity source for the equity market.

It isn't to say that history is about to repeat itself, it could, but one thing this data tells us is that tighter financial conditions are something the equity market does not like. If conditions tighten further from here, it is likely to disrupt the stock market's rally. Just how much volatility we see will depend on how tight those conditions get, but it could be considerable given the market's epic melt-up.