Flash estimates released this morning showed inflation rising as expected in December in the Eurozone. Headline CPI rose 0.4% in December, up to 2.4% on a yearly basis, up from 2.2% in November, which had contracted 0.3% from the previous month. Meanwhile, core inflation, which excludes volatile prices like food and energy, rose 0.5% in December, but the year-over-year figure remained unchanged at 2.7%.

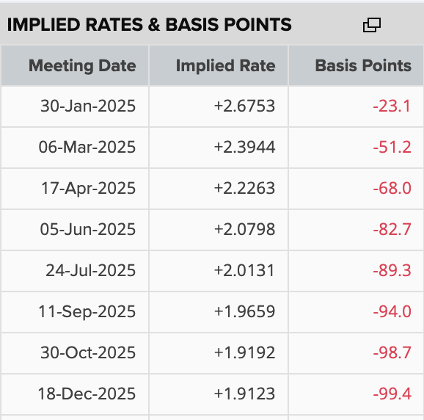

The data proves to be quite insignificant in today’s trading as the figures have come in pretty much in line with expectations, therefore lacking any surprises. It also fails to give any new information on the direction of the Eurozone economy, suggesting that rate cuts from the European Central Bank (ECB) are expected to continue over the coming months. Market pricing currently shows a 92% chance of another 25 bps cut on January 30 with -94 bps expected by September.

Source: refinitiv

The dovish bias expected from the ECB has left the euro struggling to find its footing. The predictability of the central bank’s expected path has meant EUR/USD remains at the mercy of the US dollar and its momentum. The new year started off a bit rocky as the dollar continued the bullish bias on confirmation of Trump’s presidency which will commence in less than two weeks.

However, EUR/USD has started off the week strong, breaking back above 1.04. On Monday, the Washington Post published a story saying that the Trump team was “exploring tariff plans that would be applied to every country but only cover critical imports,” which it said would “pare back” what had been announced during the campaign. The dollar dropped sharply. A few hours later, Trump’s riply appeared on social media: “The story in the Washington Post, quoting so-called anonymous sources, which don’t exist, incorrectly states that my tariff policy will be pared back. That is wrong.” The dollar bounced back, but the momentum was weak.

The pair now faces increased resistance between 1.0425 and 1.0455 before attempting to move towards 1.05.

EUR/USD daily chart

Past performance is not a reliable indicator of future results.

Capital Com is an execution-only service provider. The material provided in this article is for information purposes only and should not be understood as investment advice. Any opinion that may be provided on this page does not constitute a recommendation by Capital Com or its agents. We do not make any representations or warranty on the accuracy or completeness of the information that is provided on this page. If you rely on the information on this page, then you do so entirely at your own risk.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI